Watchlist for 5/12/22 & Recap

Manage Risks & Trading Plan Disclosure

These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter. Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan. For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone). Always make sure you have a day trade available in case you need to exit and reposition. It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

5/12/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

VRM

VRM hit high of day (HOD) $1.68 premarket and high of day $1.58 intraday before fading and hitting low of day (LOD) $1.27, triggering SSR for tomorrow 5/12/22, finding support at $1.30 levels, and closing at $1.34. If there is another pullback, watch for the dip zone to be at $1.23-$1.30. Short Interest is 30.79% of float as of 4/15/22. Based on 12 analysts, there is a high PT of $51, low PT of $2, and average PT of $8.71.

AMC

AMC hit high of day $12.16 premarket followed by a huge fade into a low of day $9.91, triggering SSR for tomorrow. This is significant because it’s taken 2 months for AMC to trigger SSR after a ton of manipulation. I’ve monitored AMC for 2 years, tracking its intraday moves. AMC was able to reclaim $10 levels again, closing at $10.37, so tomorrow we shall see how it moves under SSR. In the past, both GME and AMC have done extremely well once SSR gets triggered. If there is another pullback, watch for the dip zone to be at $9.73-$10.09 levels. Short Interest is 19.61% of float. Based on analysts, there is a high PT of $35.10, low PT of $1, and average PT of $9.95.

INDO

INDO had news today, “Indonesia Energy Discovers Oil at Kruh 27, the First of Two Back-to-Back New Wells at Kruh Block in 2022.” The significance is:

“Each of these new wells are expected to average production of over 100 barrels of oil per day over the first year of production, and each well will cost approximately $1.5 million to drill and complete. Based on the terms of IEC’s contract with the Indonesian government and an oil price of $90.00/barrel (which is 20% below yesterday’s closing price for Brent crude), each well is expected to generate $2.4 million in net revenue in its first twelve months, which would be enough to recover the cost of drilling the wells in only the first year of production.

The Kruh Block is located on Sumatra Island where IEC is already producing oil from 5 existing wells.” Read full press release here.

INDO hit high of day $15.28 and faded into low of day $13.30 after hours. Dip zone is $13.25-$13.74 levels. I’m personally holding this one as my main oil stock because it has the setup to squeeze back into the $20-$30s once crude oil runs back above $110 levels.

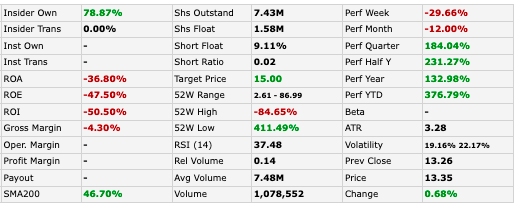

Insiders own 78.87%, which is extremely significant when choosing stocks to go long or swing long in. If they were going to drop an offering, they would’ve done it in March when it peaked in the $80s. This tells me they have been generating more than enough money, so I will continue to buy at these levels. It’s one of the strongest oil play out of all small caps. Shorts expected offerings to get dropped since March, but since it hasn’t happened, it’s unlikely to happen now. This is a sign that the company doesn’t need to drop offerings because they have more than enough cash flow. Based on their news over the last 6 months, since they’ve been drilling, it makes a lot of sense why offerings aren’t needed. When it comes to oil, it’s all about supply v demand. Right now, gas and oil prices are skyrocketing. Just because market makers are keeping this down doesn’t change the fact that once the games are over, this will shoot up. Short Interest is reported as 9.11% of float, but I believe it’s much higher. Based on analysts, there is a PT of $15.

RBLX

Roblox reported earnings yesterday on 5/10/22 after hours, and held a conference call to review the earnings. You may view the press release here. After that call, the market responded positively, hitting high of day $28.37. If there is another pullback, watch for the dip zone to be at $21-$23 levels. Short Interest is 6.22% of float. Based on 21 analysts, there is a high PT of $103, low PT of $28, and average PT of $53.33.

5/11/22 Setups Pre- and Post- Reviews

I’ll be posting pre- and post- charts to see if our plan worked. I’ll show the percent changes from the dip zones so that you can see how there are plenty of gains to be made even in the small moves. It’s up to you when you take your profits. These will be used as archives so I can refer back to the chart year over year. This will also be used as learning tools to see where we went wrong so we can figure out the best way to maximize profits and manage risks. If none of these have moved yet, watch for the move to come in the coming weeks.

VRM

VRM hit high of day (HOD) $1.93 after the market open, triggered SSR for today and Wednesday 5/11, faded to low of day (LOD) $1.23, and started moving uoward into the close, closing at $1.43, and hitting $1.72 after hours (AH). If there is another pullback, watch for the dip zone to be at $1.28-$1.54 levels. Short Interest is 30.79% of float as of 4/15/22. Based on 12 analysts, there is a high PT of $51, low PT of $2, and average PT of $8.71.

VRM hit high of day (HOD) $1.68 premarket and then hit the bottom of my dip zone ($1.28-$1.54) at $1.30 (✓) premarket, followed by a $0.13 (10%) bounce to $1.43. It hit my dip zone again during the morning flush at $1.31 (✓) , followed by a $0.27 (20.61%) climb, hitting intraday high of day $1.58 before fading and hitting low of day (LOD) $1.27 (✓) , triggering SSR for tomorrow 5/12/22, followed by a $0.13 (10%) move back up to $1.40. VRM found support at $1.30 levels, and closing at $1.34. This is setting up for the next leg back up & will be a multi-day/week swing.

CYN

CYN hit a low of day (LOD) $3.74 premarket and high of day (HOD) $5.78 after hours (AH). If there is a pullback, look for the first dip zone to be in the $$4.86-$5.20 levels. Due to the volatility, if it breaks that dip zone, watch for the next one at $4.53-$4.67 levels. Short Interest is 1.53% of float as of 4/15/22. Based on an Analyst, there is a PT of $13. Earnings will be reported on 5/11 after hours.

CYN hit high of day (HOD) $5.46 premarket, but was losing volume, which is normal on earnings day. As I mentioned, earnings were being reported after hours and most people do not like holding into earnings unless they are 100% confident in the results. CYN was able to make a small move, hitting just $0.06 below the first dip zone ($4.86-$5.20) at $4.80 (✓) premarket, followed by a $0.21 (4.38%) bounce to $5.01 premarket. After the initial morning spike at the open, there was a major sell off heading into earnings. That, plus, a red market, did no favors for CYN.

RDBX

RDBX hit a low of day (LOD) $5.16 and high of day (HOD) $5.99, closing at $5.60. If there is a pullback, look for the dip zone to be in the $5.25-$5.46 levels. Short Interest is 11.31% of float as of 4/15/22. Based on 4 Analysts, there is a high PT of $10, low PT of $3, with an average PT of $5.25.

RDBX had an exciting morning. PR dropped early premarket “Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company” and there was immense panic. View the press release here. This obviously broke well below my dip zone, but once the market opened, and people decided to read the news, there was a massive halt up, reclaiming my dip zone ($5.25-$5.46) at $5.25 (✓), and halted up again making a $0.87 (16.57%) move to high of day (HOD) $6.12.

BTTX

BTTX hit a high of day (HOD) $2.43 intraday and low of day (LOD) $1.90. If there is a pullback, look for the dip zone to be in the $1.88-2.05 levels. Short Interest is 0.67% of float as of 4/15/22. Based on 4 Analysts, high PT is $21, low PT is $15, average PT is set at $17.67.

BTTX hit my dip zone ($1.88-$2.05) at $2.05 (✓) premarket, making a $0.28 (13.66%) move to high of day (HOD) $2.33 after the open, followed by a big fade, hitting low of day $1.82, triggering SSR for tomorrow, and closing at $1.87.

BBIG

BBIG hit high of day (HOD) $3.01, and a low of day of $2.68. BBIG moved back to $2.88 levels after hours (AH). If there is another pullback, watch for the dip zone to be at $2.70-$2.80 levels. Short Interest is 14.95% of float as of 4/15/22. It is definitely higher now going into 5/18. I’m swinging and will be holding at the closing date for my Cryptide shares that will be distributed to Vinco shareholders on 5/27. Some have asked how high this can go, I’ve been in every big run as I’ve mentioned previously. If we can reclaim $4, then $5.50, then $7.50, above $12 will be possible. We have to form higher lows so we can get there.

BBIG was a swing from the previous day 5/10/22 at the dip zone $2.68, making a small $0.14 (5.22%) move overnight, and it hit my dip zone ($2.70-2.80) at $2.75 (✓) moving up another $0.07 (2.55%) to high of day (HOD) $2.82 premarket. With the overall market being red, and a loss in volume, BBIG just faded lower throughout the day, triggering SSR for tomorrow, but continuing to break support levels. It will need to reclaim $2.75 levels for a move back up.

SKYH

SKYH hit low of day (LOD) $7.40 premarket and high of day (HOD) $10.63 after hours. If there is a pullback, watch for the first dip zone at $9.56-$9.74. If it breaks below, watch for the second dip zone at $8.50-$8.78 levels. Short Interest is 0.96% of float as of 4/15/22.

SKYH hit just $0.07 below my dip zone ($9.56-9.74) at $9.49 (✓) moving up $1.16 (12.22%) to high of day (HOD) $10.65 intraday after the market open. After hitting highs, it knifed down to low of day $8.42, triggering SSR for tomorrow.

Others to Watch/Trending

- AFI

- SOFI

- ISPO

- RIVN

- BMBL

- AMD

- SBFM

- FCEL

- PIK

- BOLT

- GME

- GFAI

Oil Stocks to Watch for a Reversal

If trading oil, make sure you’re monitoring crude oil prices. Only load up on red days. If you chase the day it runs, you’re already too late. Your chances of losing money is much higher since it’s more volatile. Unless you’re a strong day trader, I would not try scalping an oil play. There are better setups elsewhere.

- INDO – 9.11% SI as of 4/14/22

- HUSA – 5.25% SI as of 4/14/22

- ENSV – 4.18% SI as of 4/14/22

- CEI – 8.57% SI as of 4/14/22

- USWS – 10.71% SI as of 4/15/22

- MXC – 3.34% SI as of 4/14/22

- MARPS – 1.48% SI as of 4/15/22

- IMPP – unknown SI

Earnings

5/12/22

- CPG

- AFRM

- JOBY

- VERU

- ACB

- TPR

- BKKT

- HIMX

- FIGS

- BAM

- SIX

- INDI

- USFD

- MSI

- CYBR

- IMMR

- DAVA

5/13/22

- HIPO

- MUX

- HNST

- HUMA

- BFRI

- SDPI

- LFMD

- PLXP

- IMV

- NYC

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.