Watchlist 7/1/22

Hi everyone,

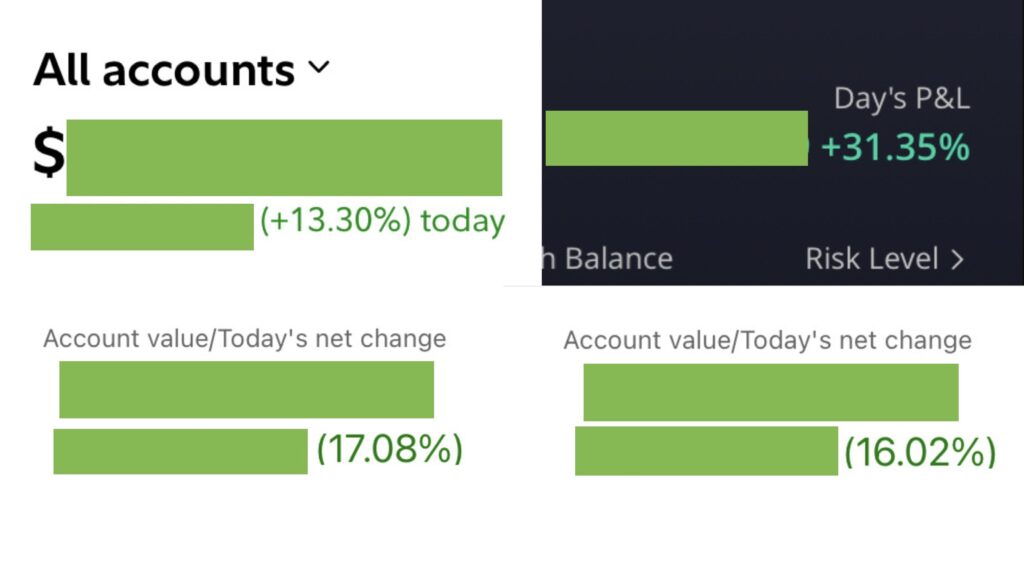

Hope you all had a great Thursday. Trading hasn’t been this fun since 2 1/2 weeks ago before everything happened. Now that I don’t follow anyone, my feed is clear of all drama, politics, gossip, bickering, and retweet/follow me or “i’ll go private/get me to 50k/100k followers/etc.” As a result, our group banked hard today and I was so excited to see everyone winning the last few days. I’m sorry so many were red while I was screening as fast as possible to approve requests, however, I have to do this the right way to ensure every one of you feel safe. We’re a small group, but boy are we powerful; the proof was in the pudding in the 4 main stocks that we focused on today. Watching us buy the big dips was like art, and I am so proud of what we accomplished today as a team. Your confidence grew and we’re slowly rebuilding those accounts. Thank you for putting your trust in me. As a tribe, we have one goal, and we focus on reaching that goal by drowning out the noise, focusing on buying pullbacks, and banking hard.

I’ve added 280, with 130 actively trading. Everyone who has been added needs to check in and read the pinned thread and like it so I know you’re present. After 7 days, I will be removing whoever is inactive to make room for new members. I’m assuming some are bots, bears, or trolls who snuck their way in if they can’t follow simple instructions. Anyway, I couldn’t ask for anything better than this small community that I worked so hard to create. Most of you are full time employees, and now you can see that there’s a place for you in trading. We may not trade like day traders, technical traders, momentum traders, or whatever they want to call themselves. We may not have 50k people in a discord, but we have a strong group that supports one another, and that outweighs anything else that’s out there. I will screen every single person, because it’s important to me that you all feel safe, and that I feel safe.

I am so thankful I was built to overcome obstacles. If I hadn’t faced what I’ve faced since I was little girl, I don’t know if I’d be able to handle everything I’ve been through up to this point in my life. I’ve learned so much about everyone, and feel safer because I don’t have to show my face anymore since everyone already knows what I look like. I tweeted how I felt earlier about how some of you felt alone or misunderstood because you’re not the type to really engage with others. I am that way too.. and for a long time, I liked staying hidden. I was led to the best individuals on Twitter who are now my friends; including my best friend who I absolutely adore but will not add to my private group because they’re a paperhander and impatient lol jkjk (kinda, not really). Truthfully, I have more than enough love and support in my life and I am forever grateful that in my darkest moments, I have so many wonderful people to lift me up. I prayed for everyone last night because I understand how scary this market is and how many of you really need to make trading work so that you can put food on the table, pay your bills, and help your family. I will continue to do my best, and no one can tell me how to live my life because I love my life and I love who I am because of that life.

We only need a strong foundation in life: love, honor, trust, courage, and respect. My mama always told me, money will come when you stop focusing on making money; focus on the “why,” and the rest will follow. For example, I just want to take care of my family so they never have to go hungry or be homeless again. I want to help the selfless ones who always put others first and never ask for anything in return. I want to make a difference so that those people will one day create a ripple effect and help someone else in need. Change starts with us. We can’t expect things to change unless we are willing to make changes. As a tribe, our light will outshine all the darkness.

UPDATE ON NEW PRIVATE ACCOUNT

To cut to the chase, MANY completing questionnaires are only giving me long stories without answering any of the legal questions and avoiding the attestation. I cannot and will not approve without the crucial questions being answered. I need to scan quickly, not weed through stories to search for answers. These are simple instructions; MOST are Yes/No responses and very straight forward. 280 of you have been approved so far. Some of you are resubmitting responses even though you’ve already been approved. It should show that you’re following my account if you’ve been approved. To ensure everyone is active (even if lurking), PLEASE like the pinned post or be removed for the next phase. I am alerting on that account and giving swing setups. Let’s start July off the right way. Trust the process, stick to the rules, and I know you’ll end up green in the end. Please manage your risks and read the disclosure below before even proceeding. Whether futures are red or green, we’ll continue to compound those gains and keep our accounts green. May all your accounts continue to be blessed.

I am on hiatus on my main twitter account and removed my picture for safety reasons. I have logged out & shut off all notifications for that account. I will return when I feel it’s safe to do so. I am only active in my new account, where I’ve screened each person.

For those who are still lost on finding the Questionnaire for the New Private Account..

Step 1 is here. Please answer 1-20 and complete the attestions. Those who have their accounts private; I am unable to message you to inform you of what needs correcting. The only way I can respond back to you is to publish your responses (and I won’t do that for privacy reasons). I am @ mentioning you on a different account, and some aren’t replying. Please be certain that you answered everything in order. I need the attestation portion to be complete.

IF YOU HAVE A LINKEDIN PROFILE, LINK IT. THAT WILL EXPEDITE THE SCREENING PROCESS.

Step 2 is here. After answering the questionnaire, you NEED to request to follow to show up in the queue. I have more responses than I have requests to follow. If you’re not in the queue, I can’t approve your request to follow.

All Updates are here.

I tried reaching out to some of you but did not hear back. Please make sure you follow the instructions.

Please allow up to 3-4 weeks for me to screen everyone. I’ve had over 1000+ to screen and have not opened this up to everyone on Twitter yet. That might add an additional 1-2 weeks on top. Trading plans will not be published until a few weeks from now when the market is a bit more stable for me to set up longer swings; so please don’t worry about missing out. There is no deadline.

Referrals

Many have requested I accept their friends/family’s request to follow my account. I have over 1400 new requests which I have not screened or considered accepting. However, if you have someone you’d like to refer and can give me a character witness statement about their character, then I will consider accepting them. I will not accept anyone who is rude or disrespectful. You may respond below with your username and the other person’s username that you would like to refer.

Manage Risks / Trading Plan Disclosure / Tips

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- It does NOT matter how strong the DD/Catalysts are; if the setup or volume isn’t there; the market won’t care about your feelings when you choose not to respect your trading rules.

- In a bear market, POSITION SIZE IS EVERYTHING. Do NOT trade with more than 2-10% of your accounts unless you’re able to CONSISTENTLY make $100/day or 1-2%/day. You are NOT smarter than the market. The market doesn’t care if you blow up your accounts.

- Consistency builds good habits. The goal should be to build a strong trader mindset by being systematic, logical, unemotional, and quick to make those executions. Accountability is key; if you blame others for your mistakes; you will NEVER grow and you are setting yourself up for failure.

- These are MOSTLY swings (days/weeks/months DEPENDING on volume), so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging and there is VOLUME to drive PRICE ACTION. If one chooses not to respect their mental stop losses, prepare for lower lows.

- When I accumulate dips to build a full position while swinging, I make sure they’re holding key support levels on the 5D/30D chart. If it breaks the trend line, it is likely to gap down.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Once the initial dip zone is eaten, respect the trend line on the way up and only accumulate at the pullbacks that respect the trend line. Pulling us back down to the initial dip zone ISN’T a good thing; it only sets us back. The goal is HIGHER LOWS.

- During crucial points, when we’re build a bull flag and setting up a short squeeze, those are the times to buy the ASK so we can break the wall down for the next leg.

- Selling into the bid LOWERS the stock and kills momentum. There’s nothing wrong with setting sell limits, when scaling out profits, and letting it hit; but when everyone sells into the bid while shorts are shorting, this is what causes stop loss raids, therefore, the stock knifes down.

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- When trading large caps, it is normal for it to move ~0.5-6%. When trading mid caps, it is normal for it to move ~5-15%. When trading small caps, it is normal for it to move ~8-30%+. When assessing goals, it’s important to make sure to take in consideration a stock’s volatility and match it to your particular trading style.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- DO NOT enter an SSR setup if using hard stops; this RUINS the setup since it’s a bottom play setup; only those accumulating dips to build full positions for the bigger move should consider this type of trade. Hard stops will cause the stock to break CRUCIAL support levels that are needed to be established for the move up.

- If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

Trending

Monitor volume for these in the coming weeks. Movement may be due to Analyst Upgrades, whales being spotted, or trending due to catalysts. Do your due diligence first. If it’s a news play; possibly keep them as day trades. I’ll try to highlight in after the fact as my way of recapping what ended the day green ✓ from my watchlist I shared from the previous day.

I don’t want anyone to fail. I just want my peace. I’ll try to help some of you who are still following my blog and not yet added to the new account with some possible dip zones. Manage your risks.

- SFT

- AERC

- TXTM

- REVB

- TOUR

- AGRX; SSR triggered on 6/30/22 for 7/1/22; dz $0.99-$1.12

- ENDP; SSR triggered on 6/30/22 for 7/1/22; dz $0.395-$0.425

- AKBA; SSR triggered on 6/30/22 for 7/1/22

- BOXD; SSR triggered on 6/30/22 for 7/1/22; dz $1.69-$1.80

- EVFM; SSR triggered on 6/30/22 for 7/1/22; dz $1.02-$1.10

- RDBX; dz $7.03-$7.25

- RDBXW

Oil/Gas Stocks to Watch

I accumulate my oil stocks while crude oil is red. It’s easier than chasing once it reverses back up. Watch for a reversal heading into next weekend. The sentiment across the board is that gas and oil will rise higher over the summer. If crude oil flips red, that’s the best time to start accumulating to build a position to swing.

- INDO – 52.29% SI

- VTNR – 20.38% SI

- IMPP – 14.54% SI

- HUSA -12.41% SI

- ENSV – 3.54% SI

- MARPS – 2.91% SI

- MXC – 1.94% SI

- SNMP – 47.09%

- USWS – 9.14% SI

- CEI – 6.56% SI

- XOM – 1.21% SI

- CVX – 1.19% SI

Food Shortage/Agriculture Stocks to Watch

Monitor the news if trading any of these. Anytime the news mention food plant explosion, farm/crop fires, rising food price, etc. watch these for movement. Volume is everything, so follow the volume if you notice abnormal volume pour in. I like to trade the leaders and avoid weaker sympathy plays.

- AGRI

- VGFC

- MF

- RIBT

- SVFD

- WEAT

- EDBL

- FPI

- CAG

- LAND

- ANDE

- GIS

- GO

- K

- SEB

- ADM

Many have requested I start a patreon or telegram to charge a service fee, however, I won’t be doing that. For those wanting to open up a new account, you can get free stocks when you open a Webull Account with my referral link that’s on the sidebar & homepage.

Paying it Forward

If you would like to help me pay it forward to help others in need, you’re welcome to donate to the link below. I typically send groceries, gas gift cards, or wire transfers to help others pay for their bills to keep the lights and water on, give cash to charities, support those selling fruit on the side of the road, and tip servers generously to hopefully turn their day around. I simply want to make someone’s day a little bit brighter. Every bit helps me to help others in need as I do spend hours on my research and do not receive compensation via advertising, sponsorships, etc. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.