End of Day Wrap Up 03/04/2021

Happy Thursday everyone! Today was another red day in the market, and I understand many of you are feeling extremely defeated. Try not to lose faith, even though I understand how frustrating is feels to be down. We’ve been spoiled by a super green December and January, so I get how scary the last few weeks have been for many of you.

What to Expect in the Months to Come

Typically December and January are prime time for penny stocks. February through April is extremely slow for the market, and there tends to be a pullback, with the exceptions of earnings in March for most companies. The market won’t pick up again until May/June, and during that time the OTC market tends to get hot along with earnings in June. This is why it’s foolish for so many people to paint this dream of trading full time during 2020 when it’s obvious we were in a bull market post market crash. If you want to see if full time trading is for you, you need to trade during times like this when the market is ugly. This will test your ability to adapt and whether you’ll be able to trade strategically. 98% of new traders won’t survive. 2% will, and the ones who do are definitely NOT the ones wasting their time on Twitter attacking other traders.

Angry Furus Out in Full Force

Today I observed Furus become extremely emotional, venting, bashing, and behaving extremely unprofessional towards others. Few went to the full extent of making voice recordings about it. If they should be mad at anyone, it should be towards the market makers, and not other traders and GameStop. It truly makes me wonder how long they’ve been trading for to behave in such an irrational manner. I’ve learned long ago that I control my inner circle, and if that circle becomes toxic, that will only bleed into my life.

Today I unfollowed a few people because they simply weren’t putting out the type of energy I felt I needed in my life. I didn’t appreciate them attacking other furus that I follow, and I saw it as pathetic, especially when their twitter followers started making fun of them for their appearance, and making inappropriate personal comments that have nothing to do with trading. There’s a line one simply shouldn’t cross, and I will never support any individual who would stoop down to that level and put others down for trying to work and make money.

If you’re spending more time talking about how great you are and how you are so much better than others, that’s a sign that you’re simply narcissistic and care more about keeping up a lifestyle to fool others into believing you’re successful, rather than actually being successful. How would I know? I’ve worked with many people who put up a front, pretending that they’re rich, happy, and so much better than others, when in reality, they have many personal demons in their lives. Behind closed doors, they were unhappy, struggling to make ends meet, drowned in debt, etc. These were people who were the “richest.” Don’t be fooled by what others try to present to you. I can see past the facade, and I don’t have energy for it.

Is this the President’s Fault?

This is not the worst thing that’s happened in the market, so to blame any President for what’s going on is crazy. It’s not logical, and the rhetoric is extremely biased. Last year, we literally had a crash, and I didn’t blame the previous President for the crash. The pandemic hit, so of course the market is going to crash. That crash ended up being a blessing in disguise, because the market recovered tenfold. We are now getting the much needed correction. I believe the harder the dip, the bigger the rip, so I’m not worried about the coming months.

How Do I Trade in this Market?

In a bear market, I switch gears. I trade defensively and I wait for the right set up to come my way. It doesn’t matter if it’s a red or green market, I’ll make a trade work for me. I don’t alert my day trades because it’s extremely risky, and I do not want someone to get burned if they’re not a strong day trader. I’ve learned to trade much smaller than I normally would, with a big lifeline. When day trading, I cut losses quickly. I will swing certain positions if I feel that there’s a strong reversal, but with the market the way it is right now, I’m simply holding some of my long swing positions, and waiting on a clear reversal before averaging down.

Today I Started Red and Ended Up Green Again

2 of 10 of my accounts are bleeding badly as they’re mostly my long hold positions. Losses range from 15-35%. I’ve avoided opening up those accounts because I don’t want to make emotional decisions. My other 8 accounts opened up EXTREMELY red, so red that I decided not to punish myself by sitting in front of the computer today. By power hour, my accounts flipped red to green, which made the day a little less painful. I share this with you because I want you to understand that it’s normal to have multiple red days. As I’ve mentioned over the last week, I am being strategic, and keeping my profits small. Small gains are better than losing money due to being greedy and trying to force plays. I am simply compounding my gains, building my accounts back up slowly.

GameStop Corp (GME)

Today was another good day for GameStop (GME). As I’ve mentioned I am still holding as they’ve been forming higher support levels as I’ve predicted over a week ago. GameStop Corp (GME) continues to move exactly how I’ve expected, which I mentioned in my previous blog posts. Like I said last week, I only need GME to hold above $120 this week, so closing at $128.50 after hours is fantastic as we went from a consolidation between $115-120 to $125-130 levels. We still need to trigger SSR so we can get another good run up, so we shall see what next week brings.

What makes today’s activity even more interesting was the amount of volume that poured in at 11:25AM-11:45AM PST, hitting an intraday high of $147.87. This tells me that there are big whales in this, because the activity is not something I would see from everyday traders. As I monitored the red tape, I saw huge buys pouring in, so I feel something good may be coming soon. Today, GME closed at $132.35, so tomorrow I’ll be looking to add between $118-119 and $105-106 if shorts dare to come out and play.

Am I Selling?

As I’ve mentioned previously, I am holding my positions until March 19-25th at the least. I’m waiting for some good PR from GameStop to launch this forward to gap up past $500. Like I mentioned in my post a few days ago, if the brokerages never halted the stock in January, and disallowed buying, some of the CEOs have admitted that GameStop would’ve broke $1000 easily. I agree with this because I watched the manipulation live, and was locked out of my accounts back in January. This time, I’m ready for the ride up. The longer we hold and allow GME to grow steady upwards, the worse it will be for the shorts who are trying to figure out what their next moves will be as we approach GameStop’s earnings.

Should You Avoid GameStop?

I know many are being told to avoid GameStop, I respect everyone’s choice, but again, I think that’s a bad call because it’s the only one moving in an upward trend over the last few weeks, even with today’s horrific day. I am trading what’s in front of me, and what’s in front of me is a clear chart that still shows bullish momentum with a steady climb upwards because LOYAL GameStop investors are holding and not selling. When you look at the cost distribution, some are STILL holding from the high $400s, many are very green, and they have NO interest in selling. I put my money where I feel my money is safest, and having it anywhere else seems to be risky with so many new traders panic selling.

What to Watch for Friday 03/05/2021

I will continue watching GME, TSLA, HCMC, SOS and ONTX. I am being VERY selective, and these are the stocks with good upside potential right now. Remember, in a bear market, we aren’t looking for oversold stocks anymore (since it’s hard to find the bottom when people are panic selling all across the board). Right now is not the time to gamble away your portfolio with risky penny stocks with no upcoming catalysts.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 5 Green Positions (03/04/21):

- REI

- GME

- RIG

- PLTR

- RCON

Top 5 Red Positions (03/04/21):

- HCMC

- OCGN

- NXTD

- ONTX

- TSLA

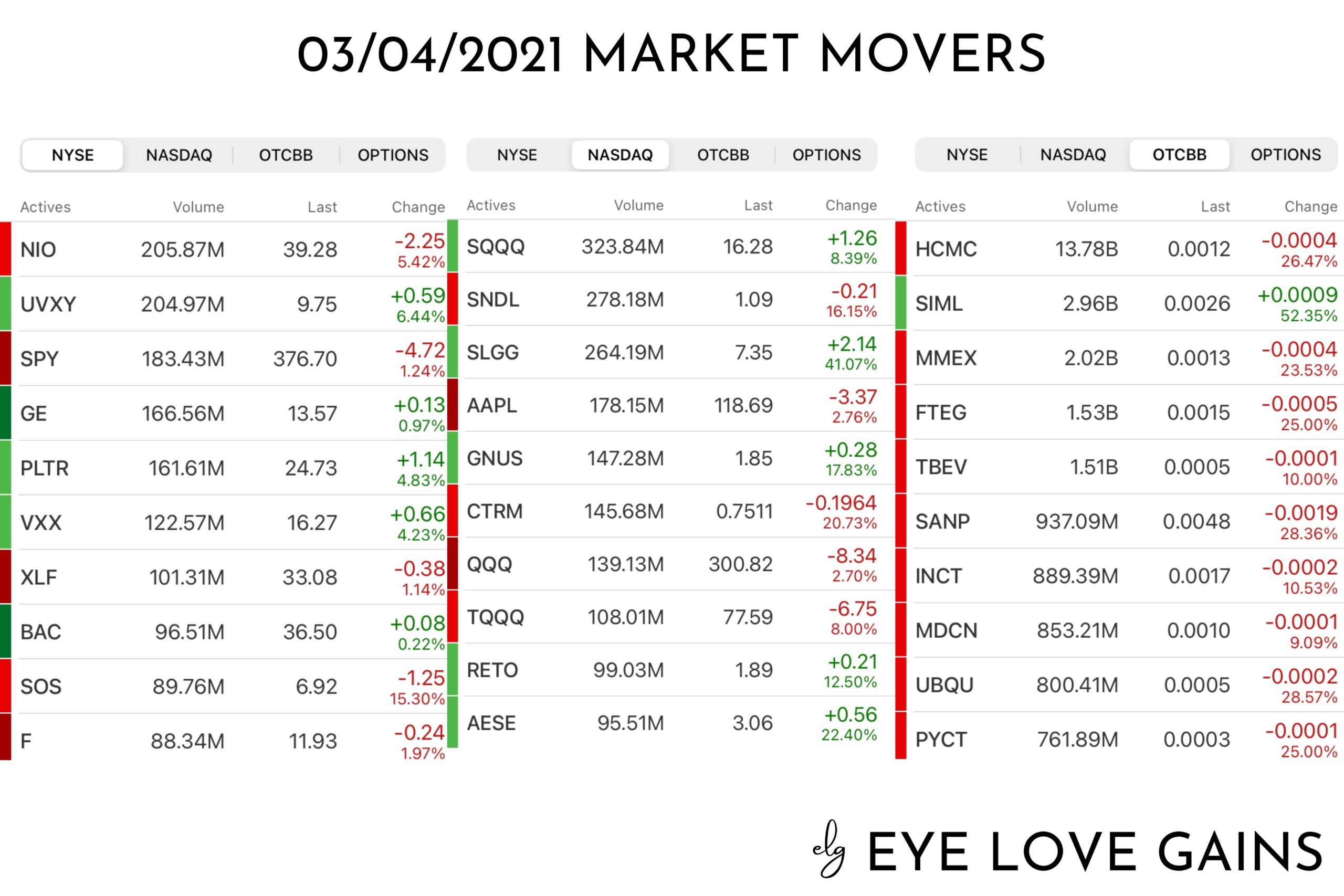

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.