Watchlist 6/9/22 & Recap

Hi everyone,

Hope you all had a super green Wednesday. Please manage your risks and read the disclosure below before even proceeding to read my trading plans. Whether futures are red or green, we’ll continue to compound those gains and keep our accounts green. May all your accounts continue to be blessed.

Manage Risks & Trading Plan Disclosure

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- When trading large caps, it is normal for it to move ~0.5-6%. When trading mid caps, it is normal for it to move ~5-15%. When trading small caps, it is normal for it to move ~8-30%+. When assessing goals, it’s important to make sure to take in consideration a stock’s volatility and match it to your particular trading style.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

6/9/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

Refer to the Setups Recap for the swing setups from previous weeks as most of the catalysts are happening this week.

- HUSA

- IMPP

- RDBX

- AERC

- AUVI

- GRAB

- DBVT

- MF

- EFOI

- IGEX

6/8/22 Setups Recap & Trading Plan

These are all swings so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging.

AERC

AERC was alerted on Twitter on 6/6/22, and I mentioned I will be waiting for the pullback to trigger SSR for 6/7/22 and 6/8/22 to swing. It dropped to low of day $3.85, and I began building a full position under $3.90. We took it up leg by leg, dollar by dollar, halting it up twice, to a high of day of $15.25 after hours, and pulling back nearly -35%, which is the pullback we needed for the next leg up. If we open below $10.89, we will trigger SSR for Thursday 6/9/22, which will allow us to climb higher if the volume continues to be there. The next leg is to reclaim $15 levels for a push above $20. Once a base is formed at $10, there will be an attempt to move it up leg by leg again. Due to volatility, I will alert on Twitter. If there is a pullback, dip zone may be at ($9.60-$10.00).

Day’s Volume: 67,294,003

Average 10 Day Volume: 23.68M

Day’s range: $9.17-$12.76

Closing Price: $9.23

Short Interest: 0.74%

Analyst PT: $7.00

Catalysts:

- AeroClean Announces Appointment of Jimmy Thompson as Vice President of Strategic Sales. 6/8/22. View news here.

- AeroClean Receives FDA Clearance For Pūrgo™ Medical Grade Air Hygiene Technology. 6/6/22. View news here.

- AeroClean Provides Resources To Support Government Push for Cleaner, Safer Indoor Air. 5/18/22. View news here.

- AeroClean Announces Appointment of Timothy J. Scannell to Board of Directors. 5/12/22. View news here.

- AeroClean Reports First Quarter 2022 Financial Results. 5/12/22. View news here.

Many were frustrated that AERC didn’t go to $20 today. I mentioned this was an SSR swing setup to trigger SSR for Thursday, 6/9/22, and we did just that. I have no control over what happens; I can only plan my trades and go with the flow. For those who don’t see the profit potential at my dip zones, let me break this down to remove all bias and emotions from the equation so that one can see the facts.

AERC hit my dip zone ($9.60-$10.00) 4 times today. (✓)

- $9.50 ($0.10 below the dip zone, but the dip zone was reclaimed) and moved +$1.75 (+18.42%) to $11.25 premarket

- $9.67 and moved +$2.28 (+23.58%) to $11.95 premarket

- broke below my dip zone to $9.25, but reclaimed the dip zone and was halted up +$3.51 (+37.95%) to high of day $12.76 intraday

- $9.64 and moved +$1.56 (+16.18%) to $11.20 intraday

There was the potential to make a TOTAL of 96.13% for a day trader because of those pullbacks. AERC then faded to low of day $8.93 after hours, which equates to a -30% pullback from the high of day (HOD) $12.76, which is when I alerted that I’ll be buying to reposition my swing for tomorrow. This is simple math $12.76 x 0.7 (-30%) = $8.93, which is exactly where the low of day ended after hours. Not every stock is the same, but based on AERC’s volatility, that’s where it faded to, which is where I loaded up. If there is a pullback, the dip zone may be at ($9.20-$9.40) with SSR on. If we can form a base at $10 again, and climb up slowly one leg at a time, with healthy pullbacks in-between, it will make it difficult for shorts to short the pops, and we would move up much better.

AUVI

AUVI hit $2.82 after hours, after closing at $2.18. I needed to see it pull back to opening price since it ran up hard after hours. It was able to pull back almost -35%, which is perfect for the next leg up. This is an SSR swing setup. SSR triggers at $1.96 at the open if it can get triggered at that price. If the buy volume pours in to flip this red (-10%) to green, the ball is in bulls court for 6/8 and 6/9 to bring this higher with the increased volume that’s been pouring in and a huge gap fill. First leg is $3.75, second leg is $5, up to $10+. Due to volatility, I will alert on Twitter. For now, if there is a pullback, dip zone may be at ($1.96-$2.11).

Day’s Volume: 20,116,720

Average 10 Day Volume: 3.78M

Day’s range: $1.59-$2.29

Closing Price: $1.77

Short Interest: 0.54%

Analyst PT: High PT: $10.40, Low PT: $2.00, Average PT: $6.20

Catalysts:

- Applied UV to Present and Showcase Airocide and Scientific Air Technology at the LD Micro Invitation June 8th, 2022. 5/31/22. View news here.

- Applied UV Declares Monthly Preferred Stock Dividend. 5/24/22. View news here.

- Applied UV Adds Veteran Leader and Banking Executive Jos Luhukay to Board of Directors. 5/24/22. View news here.

- Applied UV Reports 1st Quarter 2022 Results. 5/24/22. View news here.

AUVI fell $0.08 below my dip zone ($1.96-$2.11) $1.88 but reclaimed the dip zone (✓) and moved up +$0.36 (+18.36%) to $2.32 premarket. It hit my dip zone a second time at $1.96 and moved up +$0.40 (+20.41%) to $2.36. As you can see, there was the opportunity to make a total of 38.77% with the pullbacks.

It then faded to low of day $1.59, triggering SSR for tomorrow, 6/9/22, and moving back up, closing at $1.77. If there is a pullback, dip zone may be at ($1.60-$1.70).

HUSA

HUSA was a multi-day swing from Thursday 6/2/22, when it dropped under $4 premarket. It fell $0.13 below my dip zone ($4.85-$4.95) to $4.72 but reclaimed the dip zone (✓) premarket and moved +$2.48 (+51.13%) to $7.33, closing at $7.06. With crude oil possibly breaking all time highs, if there is a pullback, possible dip zone might be ($6.35-$6.60).

Day’s Volume: 44,215,338

Average 10 Day Volume: 22.63M

Day’s range: $6.01-$8.60

Closing Price: $7.54

Short Interest: 11.14%

Catalysts:

- Oil play; follows crude oil; crude oil is looking to break all time highs.

- Houston American Energy Increases Interest In Colombian Project. 5/31/22. View press release here.

- Houston American Energy Announces Spudding of First Well on SPO-11 Venus Exploration Area in Colombia. 5/24/22. View press release here.

- 10-Q Quarterly Filings Ended March 31, 2022. View sec-filing here.

- 8-K Current Reports. 3/27/22. View sec-filing here.

- SC 13D Current Reports. 2/2/22. View sec-filing here.

As expected, HUSA pulled back after a big run yesterday. The goal was to trigger SSR for today and tomorrow, Thursday 6/9/22, and we accomplished just that. I alerted on Twitter as soon as it looked strong for a reversal back up after hitting low of day $6.01, which was $0.34 below my dip zone ($6.35-$6.60). My dip zone was reclaimed (✓), and moved +$2.25 (+35.43%) to high of day $8.60 intraday, pulling back -12.33%, and closing at $7.54. With crude oil possibly breaking all time highs, and HUSA under SSR tomorrow, if there is a pullback, possible dip zone might be ($7.30-$7.50). Make sure to monitor crude oil prices when trading oil plays.

INDO

INDO fell $0.11 below my dip zone ($12.25-$12.35) but reclaimed it shortly after (✓), moving +$1.34 (+10.94%) to high of day $13.59. If there is a pullback, the dip zone may be at ($12.20-$12.35), but make sure to monitor crude oil prices if trading oil plays.

Day’s Volume: 6,005,559

Average 10 Day Volume: 2.27M

Day’s range: $11.15-$13.21

Closing Price: $11.58

Short Interest: 12.61%

Catalysts:

- Oil play; follows crude oil; crude oil is looking to break all time highs.

- Indonesia Energy To Present at LD Micro Invitational XII Investor Conference on Wednesday, June 8th at 5:30pm PDT. 6/6/22. View press release here.

- Indonesia Energy Discovers Oil at Kruh 27, the First of Two Back-to-Back New Wells at Kruh Block in 2022. 5/11/22. View press release here.

- Indonesia Energy Commences Drilling of First of Two Back-to-Back Production Wells at Kruh Block. 4/8/22. View press release here.

- Indonesia Energy Mobilizes Drilling Rig to Commence Drilling of Two Back-to-Back Production Wells at Kruh Block. 3/10/22. View press release here.

- Indonesia Energy To Commence Drilling of Two Back-To-Back New Wells Within 30 Days and a Third by Mid-Year. 1/26/22. View press release here.

INDO broke well below my dip zone ($12.20-$12.35) to low of day $11.15, but reclaimed it after (✓), moving +$1.01 (+8.28%) to high of day $13.21, and closing at $11.58. If there is a pullback, the dip zone may be at ($10.56-$11.00), but make sure to monitor crude oil prices if trading oil plays.

TNXP

TNXP hit $0.02 above my dip zone ($2.10-$2.20) at $2.22 premarket (✓), then moving up +$0.20 (+9%) to high of day $2.42, closing at $2.23. If there is a pullback, possible dip zone might be ($2.10-$2.15).

Day’s Volume: 7,676,344

Average 10 Day Volume: 22.44M

Day’s range: $2.20-$2.37

Closing Price: $2.27

Analyst PT: High PT: $10, Low PT: $1.27, Average PT: $3.86

Catalysts:

- Tonix Pharmaceuticals Announces Presentation of Licensed Antiviral Drug Technology at the 4th Symposium of the Canadian Society for Virology. 6/8/22. View article here.

- Tonix Pharmaceuticals Announces Presentation on TNX-801 Vaccine Protection Against Monkeypox at the 4th Symposium of the Canadian Society for Virology. 6/8/22. View article here.

- Tonix Pharmaceuticals Announces Presentation at the 2022 BIO International Convention. 6/6/22. View article here.

- TNXP: Monkeypox Cases Push TNX-801 Into the Spotlight by Zacks Small Cap Research. 6/5/22. View article here.

- Tonix Pharmaceuticals Regains Compliance with Nasdaq Minimum Bid Price Requirement. 6/2/22. View press release here.

- Tonix Pharmaceuticals Announces Issuance of U.S. Patent for TNX-801 Smallpox and Monkeypox Vaccine and Recombinant Pox Virus (RPV) Platform Technology. 6/1/22. View press release here.

- Tonix Pharmaceuticals Announces Share Repurchase Program. 5/31/22. View press release here.

- Tonix Pharmaceuticals Announces Two Oral Presentations Involving TNX-1500 (Fc-modified anti-CD40L mAb) on Prevention of Rejection in Kidney and Heart Allograft Transplantation at the 2022 American Transplant Congress. 5/31/22. View press release here.

- Tonix Pharmaceuticals Extends Research Collaboration with the University of Alberta to Develop Antiviral Drugs Against SARS-CoV-2. 5/18/22. View press release here.

- Tonix Pharmaceuticals Announces 1-for-32 Reverse Stock Split. 5/16/22. View press release here.

TNXP hit $0.01 above my dip zone ($2.10-$2.15) at $2.16 premarket (✓), then moving up +$0.23 (+10.65%) to high of day $2.39 premarket, closing at $2.27. Tonix Pharmaceuticals dropped press releases once during premarket, and again after hours. If there is a pullback, possible dip zone might be ($2.20-$2.25).

MF

MF hit $0.0002 above my dip zone ($0.26-$0.2850) $0.2852 (✓) premarket, moving +$0.0248 (+9.70%) to high of day $0.31, closing at $0.2750. If there is a pullback, possible dip zone might be ($0.2700-$0.2800).

Day’s Volume: 11,997,906

Average 10 Day Volume: 27.93M

Day’s range: $0.2800-$0.3100

Closing Price: $0.3013

Short Interest: 0.66%

Analyst PT: High PT: $15.27, Low PT: $4.219, Average PT: $7.93

Catalysts:

- Food shortage/inflation play.

- Missfresh Announces Receipt of Nasdaq Notification Regarding Late Filing of Form 20-F. 5/24/22. View press release here.

- Missfresh’s Retail Cloud Services Enabled Up To 20X Increase in Major Traditional Retailers’ Online Sales. 5/24/22. View press release here.

- MissFresh Triples its Stock and Accelerates the Delivery Efforts to Meet Increasing Consumer Demand. 4/26//22. View press release here.

- Sales of Missfresh’s Private Label Fresh Food Brand Surged 300% For Q4 2021. 3/30/22. View press release here.

- Missfresh Expands China-wide Direct-Supply Vegetable Farm Network to Total More Than 1,300 Hectares. 3/2/22. View press release here.

- Missfresh Successfully Launches Personalized Concierge Experience for High-value Customers, Doubling Relevant Monthly ARPU. 2/16/22. View press release here.

MF hit my dip zone ($0.2700-$0.2800) $0.2750 (✓) premarket, moving +$0.035 (+12.73%) to high of day $0.31, closing at $0.3013. If there is a pullback, possible dip zone might be ($0.2800-$0.2900).

SIGA

SIGA hit my dip zone ($10.30-$10.45) at $10.39 (✓)premarket, moving +$1.70 (+16.36%) and hitting high of day (HOD) $12.09, closing at $11.94. If there is a pullback, possible dip zone might be ($11.55-$11.75).

Day’s Volume: 7,816,099

Average 10 Day Volume: 27.71M

Day’s range: $10.83-$12.10

Closing Price: $10.96

Short Interest: 3.69%

Catalysts:

- SIGA Receives Approval from the FDA for Intravenous (IV) Formulation of TPOXX® (tecovirimat). 5/19/22. View press release here.

- New Contract Awarded by U.S. Department of Defense for the Procurement of up to Approximately $7.5 Million of Oral TPOXX®. 5/12/22. View press release here.

- SIGA Reports Financial Results for Three Months Ended March 31, 2022. 5/5/22. View press release here.

- SIGA Declares Special Dividend of $0.45 Per Share. 5/5/22. View press release here.

SIGA hit my dip zone ($11.55-$11.75) at $11.70 (✓) premarket, moving +$0.99 (+8.46%) and hitting high of day (HOD) $12.69, fading at the open to a low of day $10.83, closing at $10.96. If there is a pullback, possible dip zone might be ($10.85-$11.00).

CRTD

CRTD dropped $0.04 below my dip zone ($1.06-$1.09) $1.02 and moved +$0.08 (+7.84%) to high of day $1.10. It still did not make any significant moves from the dip zone. A press release dropped, “Creatd’s Vocal Platform Announces Upcoming App Launch and Record-Breaking KPIs.” 6/7/22. View press release here. The market did not have a big reaction to the news. We are still consolidating at these levels, and sitting at the dip zone ($1.04-$1.09). The swing continues with the next leg up being $1.25-$1.50 levels, and then $1.75-$2. We’re taking this day by day, week by week. This is week 2 of this multi-week swing to $6+. This is a long patience play.

Day’s Volume: 430,586

Average 10 Day Volume: 4.56M

Day’s range: $1.02-$1.08

Closing Price: $1.05

Short Interest: 2.86%

Catalysts:

- Creatd’s Vocal Platform Announces Upcoming App Launch and Record-Breaking KPIs. 6/7/22. View press release here.

- Creatd Studios Announces Full 2022 Production Slate, Including the “No One’s Pet” Re-Release and Film Adaptation. 6/6/22. View press release here.

- Creatd Ventures Provides Post-Acquisition Update on its DTC Wellness Brand, Basis; Surpasses Expectations With Record Quarter Projected. 6/1/22. View press release here.

- Creatd, Inc. Announces $4 Million Above-Market Expansion Plan Financing. 5/31/22. View press release here.

- Creatd Announces Up to $40 Million Rights Offering, Priced at $2.00 per Unit. 5/26/22. View press release here.

- Creatd 2022 Expansion Plan Investor Presentation. 5/26/22. View press release here.

- Creatd’s Vocal Teams Up with Microsoft’s Two Hat to Deliver Updates to its Proprietary Moderation Technology. 5/24/22. View press release here.

- Creatd Establishes Graphic Novel Development Arm and Unveils Inaugural Project-Larry Blamire’s ‘Steam Wars.’ 5/23/22. View press release here.

- Creatd’s DTC Wellness Drink, Dune, Reaches Milestone of 100,000 Bottles Sold; Secures Placement in 130 Urban Outfitters Retail Stores. 5/23/22. View press release here.

- Creatd’s Vocal Onboards Four Key WHE Influencers with a Combined Following of Over 4 Million. 5/20/22. View press release here.

- Creatd Announces Record Reduction of 45% in QoQ Operating Expenses for its First Quarter 2022. 5/16/22. View press release here.

- Creatd Unveils New Integrated Agency Offerings. 5/16/22. View press release here.

- Creatd’s Vocal Platform Releases Highly Anticipated Feature: Comments. 5/12/22. View press release here.

- Creatd to Launch First Original Podcast, Featuring Stories from Vocal Creators. 5/11/22. View press release here.

- Creatd Announces Entry into Print Publishing; Partners with Unbound to Publish First Book of Vocal Stories. 5/10/22. View press release here.

- Creatd Ventures’ Camp Reaches Milestone; Sells 45,000 Boxes & Secures Placement on New Online Wholesale Marketplaces. 5/9/22. View press release here.

- Creatd’s WHE Agency Increases Audience Reach by 26 Million Since Start of 2022; WHE’s Brand Partnerships Expand Along with New Talent Acquisitions. 5/6/22. View press release here.

- Dune, the Creatd-Owned Wellness Drink, Launches at LA-Based Erewhon Market and Sells Out at Urban Outfitters. 5/5/22. View press release here.

Sec-Filings:

- S-3/A – Securities Registration Statement (simplified form). 05/23/22. View sec-filing here.

- 4 – Statement of Changes in Beneficial Ownership. 5/18/22. View sec-filing here.

- 8-K – Current report filing. 05/17/22. View sec-filing here.

- 10-Q – Quarterly Report. 5/16/22. View sec-filing here.

- 8-K – Current report filing. 05/13/22. View sec-filing here.

- S-3 – Securities Registration Statement (simplified form). 5/13/22. View sec-filing here.

CRTD hit high of day $1.09 premarket, and faded to a low of day $1.02, and closing at $1.05. It has not made any significant moves due to lack of volume. CRTD has many catalysts this year, but the market isn’t reacting at the moment. We are sitting at the bottom, so as soon as volume pours in, this will move up. Until then, it’s a waiting game. This is a long patience play.

BKSY

BKSY hit low of day at $2.36 and moved up $0.16 to high of day $2.52. $2.50 levels were reclaimed, now the next leg is $2.75 levels for a push back above $3. This is a multi-week swing to $6 as long as the price action and volume is still there.

Day’s Volume: 3,994,872

Average 10 Day Volume: 32.77M

Day’s range: $2.43-$2.72

Closing Price: $2.44

Short Interest: 0.53%

Analyst PT: $6

Catalysts:

- BlackSky Awarded 10-Year Electro Optical Commercial Layer (EOCL) Contract with U.S. Government. 5/25/22. View press release here.

- BlackSky Reports First Quarter 2022 Results. 5/11/22. View press release here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K/A – Current report filing. 5/25/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K – Current report filing. 5/25/22. View sec-filing here.

- 4 – Statement of changes in beneficial ownership of securities. 05/12/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/11/22. View sec-filing here.

- 8-K – Current report filing. 5/11/22. View sec-filing here.

- 10-Q – Quarterly report pursuant to Section 13 or 15(d). 5/11/22. View sec-filing here.

- BlackSky to Participate at the 17th Annual Needham Technology and Media Conference. 5/6/22. View press release here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/2/22. View sec-filing here.

- 10-K/A – Annual report pursuant to Section 13 and 15(d). 5/2/22. View sec-filing here.

BKSY hit low of day at $2.41 premarket and was able to reclaim $2.50 levels and moved up $0.31 (+12.86%) to high of day $2.72. Once consolidation forms at $2.50 levels, the next leg is $2.75 levels for a push back above $3. This is a multi-week swing to $6 as long as the price action and volume is still there.

VERU

VERU has been a multi-week swing, and it hit $0.06 above my dip zone at ($13.55-$13.75) at $13.81 (✓) and moved +$2.60 (+18.83%) to high of day $16.41, closing at $15.85. There was a press release, “Veru Submits Emergency Use Authorization (EUA) Application to U.S. FDA for Sabizabulin, its Novel, Oral Antiviral and Anti-Inflammatory Drug Candidate for Hospitalized COVID-19 Patients at High Risk for ARDS.” 7/7/22. View the full press release here. It has also been disclosed that “Tang Capital Partners, Lp Discloses 5.2% Passive Stake in Veru.” If there is a pullback, there may be a dip zone at ($14.80-$15.35.

Day’s Volume: 9,344,572

Average 10 Day Volume: 10.14M

Day’s range: $14.96-$16.10

Closing price: $15.30

Short Interest: 27.81%

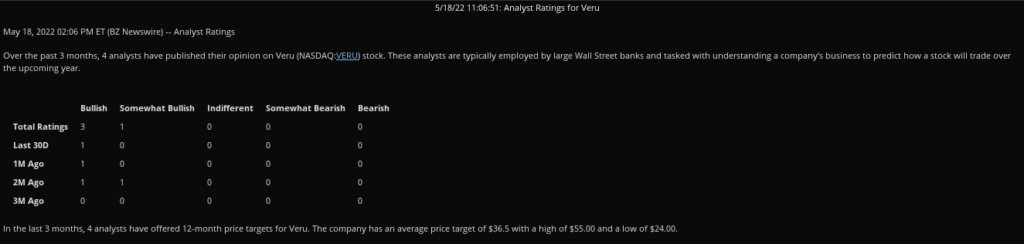

Analyst PT: $24-$55, Average PT: $36.50

Catalysts:

- Veru Submits Emergency Use Authorization (EUA) Application to U.S. FDA for Sabizabulin, its Novel, Oral Antiviral and Anti-Inflammatory Drug Candidate for Hospitalized COVID-19 Patients at High Risk for ARDS. 7/7/22. View the full press release here.

- Tang Capital Partners, Lp Discloses 5.2% Passive Stake in Veru. 6/6/22.

- Veru Announces Presentation of Final Positive Phase 1b/2 Clinical Trial Results for Sabizabulin in Metastatic Castration Resistant Prostate Cancer at the 2022 American Society of Clinical Oncology Annual Meeting. 6/6/22. View the full press release here.

- Veru to Present Three Presentations at the 2022 American Society for Clinical Oncology Annual Meeting on June 3-7. 5/31/22. View the full press release here.

- Veru to Participate in Fireside Chat at the Jefferies Healthcare Conference on June 8, 2022. 5/25/22. View the full press release here.

- Veru Announces Appointment of Joel Batten to Lead U.S. Infectious Disease Franchise to Focus on Hospitalized COVID-19 Patients. 5/18/22 View the full press release here.

- Veru to Present at the H.C. Wainwright Global Investment Conference on May 24th 2022. 5/17/22. View the full press release here.

- Veru Reports Second Quarter Fiscal 2022 Results and Progress of Sabizabulin for COVID-19 Toward a Request for Emergency Use Authorization. 5/12/22. View the full press release here.

- FDA States that Veru Should Submit Request for Emergency Use Authorization (EUA) Based on Positive Efficacy and Safety Data from the Phase 3 Clinical Study of Sabizabulin in Hospitalized COVID-19 Patients. 5/11/22. View the full press release here.

- FDA Has Granted Veru a Pre-Emergency Use Authorization (EUA) Meeting Date for Positive Sabizabulin Phase 3 COVID-19 Study. 5/2/22. View the full press release here.

- Veru Announces Oral Late-Breaking Presentation of Phase 2 Data of Sabizabulin for the Treatment of Hospitalized Severe COVID-19 Patients at High Risk for Acute Respiratory Distress Syndrome at the 32nd European Congress of Clinical Microbiology & Infectious Diseases. 4/25/22. View the full press release here.

- Veru’s Novel COVID-19 Drug Candidate Reduces Deaths by 55% in Hospitalized Patients in Interim Analysis of Phase 3 Study; Independent Data Monitoring Committee Halts Study Early for Overwhelming Efficacy. 4/11/22. View the full press release here.

VERU hit my dip zone at ($14.80-$15.35) at $14.96 (✓) and moved +$1.14 (+7.62%) to high of day $16.10, closing at $15.30. If there is a pullback, there may be a dip zone at ($14.95-$15.15.

RDBX

RDBX hit $0.21 above my dip zone ($6.05-$6.25) at $6.46, and from there, it moved +$2.99 (+46.28%) and hit high of day (HOD) $9.45, after closing at $8.55. If there is another pullback, the dip zone might be at ($7.69-$8.20).

Day’s Volume: 53,490,501

Average 10 Day Volume: 26.19M

Day’s range: $9.12-$11.25

Closing Price: $9.93

Short Interest: 33.28%

Catalysts:

- POS AM. Post-effective amendment to an S-Type filing. 6/3/22. View filing here.

- Redbox Entertainment Acquires North American Rights to WWII Action-Drama Come Out Fighting. 5/24/22. View press release here.

- DEFA14A Sec-Filing Additional proxy soliciting materials – definitive. 5/13/22. View filing here.

- 10-Q Quarterly report which provides a continuing view of a company’s financial position. 5/13/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- 8-K Report of unscheduled material events or corporate event. 5/11/22. View filing here.

- 425 Filing of certain prospectuses and communications in connection with business combination transactions. 5/11/22. View filing here.

- Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company. 5/11/22. View press release here.

RDBX hit $0.17 above my dip zone ($7.69-$8.20) at $8.37, and from there, it moved +$2.95 (+35.24%) and hit high of day (HOD) $11.32, pulling back -12.28% from the high of day, and closing at $9.93. If there is another pullback, the dip zone might be at ($9.15-$9.30). Short interest for this is extremely high at this point, so if all the big pullbacks get bought, there’s a chance we’ll go parabolic and break new highs soon. Once an $11 base is formed, the next leg is $13-$15 levels. After that is $15-$20 levels, then $20-$27 levels, and possibly break all time highs from October 2021. We’ve set this multi-month swing up beautifully over the last few months.

AGRI

AGRI broke below my dip zone ($2.32-$2.40), and faded to low of day $2.11. This is due to a lack of volume. At this point, the risk level is low since we’re at the bottom again. AGRI needs to reclaim $2.50 levels before moving back up again.

Day’s Volume: 1,588,030

Average 10 Day Volume: 1.99M

Day’s range: $2.19-$2.43

Closing Price: $2.31

Short Interest: 0.42%

Analyst PT: $5

Catalysts:

- “AgriForce to Present at the Food & AgTech Conference on June 8th.” 6/2/22. View full press release here.

- “AgriForce to Present at the H.C. Wainwright Global Investment Conference on May 25th” 5/23/22. View full press release here.

- “AgriFORCE Growing Systems Completes Acquisition of Food Production & Processing IP from Manna Nutritional Group (MNG)” 5/18/22. View full press release here.

- “Quarterly report pursuant to Section 13 or 15(d) (10-Q).” 5/16/22. View sec-filing here.

- “AgriFORCE Growing Systems Provides Update on Acquisition of Delphy, a Leading European Agriculture/Horticulture and AgTech Consulting Firm.” 5/12/22. View the full press release here.

- AgriFORCE is presenting at “Microcap Rodeo’s Spring into Action Best Ideas Virtual Conference on May 17th.” Management is scheduled to present on Tuesday, May 17, 2022 at 3:00 p.m. ET. The presentation will be webcast live and available for replay https://www.webcaster4.com/Webcast/Page/2882/45580. 5/11/22. View the full press release here.

- Agriculture stocks are a very hot sector due to food shortage, food inflation, and plant/farm explosions. Agriforce is one of the main leaders according to what’s trending across discords and most mentions.

AGRI hit low of day at $2.18 and move up +$0.25 (+11.47%) to $2.43, closing at $2.31. AGRI needs to reclaim $2.50 levels before moving back up again.

AMD

AMD dropped $0.89 below my dip zone ($103.50-$105.50), but reclaimed it (✓) and moved up +$2.74 (+2.65%) to high of day $106.24, closing at $105.28. If there is a pullback, the dip zone might be at $102.50-$104.

Day’s Volume: 97,641,865

Average 10 Day Volume: 108.90M

Day’s range: $100.41-$105.85

Closing Price: $101.90

Short Interest: 2.07%

Analyst PT: High PT: $200, Low PT: $97, Average PT: $137.91

Catalysts:

- AMD to Host Financial Analyst Day on June 9, 2022. 6/2/22. View press release here.

- AMD Expands High Performance Compute Fund to Aid Researchers Solving the World’s Toughest Challenges. 6/1/22. View press release here.

- World’s First Exascale Supercomputer Powered by AMD EPYC™ Processors and AMD Instinct™ Accelerators. 5/30/22. View press release here.

- AMD Instinct™ MI200 Adopted for Large-Scale AI Training in Microsoft Azure. 5/26/22. View press release here.

- AMD Expands Data Center Solutions Capabilities with Acquisition of Pensando. 5/26/22. View press release here.

- AMD Expands Confidential Computing Presence on Google Cloud. 5/25/22. View press release here.

- AMD Showcases Industry-Leading Gaming, Commercial, and Mainstream PC Technologies at COMPUTEX 2022. 5/23/22. View press release here.

- AMD Chair and CEO Dr. Lisa Su to Keynote at COMPUTEX 2022. 5/20/22. View press release here.

- Statement of changes in beneficial ownership of securities. 5/19/22 View press release here.

- AMD Robotics Starter Kit Kick-Starts the Intelligent Factory of the Future. 5/17/22. View press release here.

- AMD and Qualcomm Collaborate to Optimize FastConnect Connectivity Solutions for AMD Ryzen Processors. 5/17/22. View press release here.

- AMD Enables 4G/5G Radio Access Network Solutions to Support Meta Connectivity Evenstar Program. 5/11/22. View press release here.

- AMD Announces Three New Radeon RX 6000 Series Graphics Cards and First Games Adding Support for AMD FidelityFX Super Resolution 2.0. 5/10/22. View press release here.

- New AMD Ryzen 5000 C-Series Processors Bring Leadership Performance and All-Day Battery Life to Chrome OS. 5/5/22. View press release here.

- AMD Reports First Quarter 2022 Financial Results. 5/3/22. View press release here.

AMD hit my dip zone ($102.50-$104) at $104.03 (✓) and moved $1.82 (+1.75%) to high of day $105.85 but it did not make any significant moves. It faded to a low of day $100.41. If there is a pullback, the dip zone might be at ($98-$100).

DIDI

DIDI was a swing setup from the previous day’s dip zone and it hit high of day $2.57 premarket, and then faded to low of day $2.23, sitting at my dip zone ($2.26-$2.36), after closing at $2.24. It did not make any significant moves, so the dip zone remains the same. There are news so watch for the move if the volume pours in. “Exclusive: Didi pursues EV stake, aiming to emerge from regulatory shadows.” 6/8/22. View news here. If there is a pullback, dip zone may be at ($2.26-$2.36). I would keep this as a day trade until we get further news.

Day’s Volume: 129,811,949

Average 10 Day Volume: 90.47M

Day’s range: $2.27-$2.61

Closing Price: $2.51

Short Interest: 0.74%

Analyst PT: $4.72

Catalysts:

- “Exclusive: Didi pursues EV stake, aiming to emerge from regulatory shadows.” 6/8/22. View news here.

- “China to Conclude Didi Cybersecurity Probe, Lift Ban on New Users.” 6/6/22. View news here.

DIDI hit my dip zone ($2.26-$2.36) at $2.27 (✓) and moved $0.34 (+14.98%) to high of day $2.61, closing at $2.51. If there is another pullback, the dip zone may be at ($2.25-$2.40). I would keep this as a day trade until we get further news.

Others to Watch/Trending

- SNMP

- DBVT

- VIEW

- BILI

- RIGL

- XELA

- TLRY

- RIVN

- VRM

- SOPA

- BABA

- PDD

- YMM

- RLX

- KWEB

- GME

- AMC

- VRAR

- SOS

- NIO

Oil/Gas Stocks to Watch

I accumulate my oil stocks while crude oil is red. It’s easier than chasing once it reverses back up.

- INDO – 12.61% SI

- HUSA – 11.14% SI

- ENSV – 4.32% SI

- CEI – 8.51% SI

- USWS – 8.35% SI

- MXC – 4.99% SI

- MARPS – 2.41% SI

- IMPP – unknown SI

- XOM – 0.83% SI

- CVX – 1.07% SI

Food Shortage/Agriculture Stocks to Watch

- AGRI

- VGFC

- MF

- RIBT

- SVFD

- WEAT

- EDBL

- FPI

- CAG

- LAND

- ANDE

- GIS

- K

- SEB

- ADM

Earnings

6/9/22

- NIO

- FCEL

- BILI

- DOCU

- CMTL

Many have requested I charge a service fee, however, I won’t be doing that. For those wanting to open up a new account, you can get free stocks when you open a Webull Account with my referral link that’s on the sidebar & homepage. If you would like to help me pay it forward to help others in need, you’re welcome to donate to the link below. Every bit helps me to help others in need as I do spend hours on my research and do not receive compensation via advertising, sponsorships, etc. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.