End of Day Wrap Up 02/22/2021

Happy Monday everyone! Today was a very interesting day. Overall, the travel, entertainment, and hospitality stocks seem to have done really well today. About a month ago, I mentioned it would be best to start accumulating the travel/entertainment stocks while they were red, and boy did it pay off. Majority of the cryptocurrency, blockchain, tech, energy, EV, biopharma, and cannabis stocks took a hit today, so I had a very mixed portfolio across all my accounts. Today was another great day for accumulating red positions.

Highlights for the Day

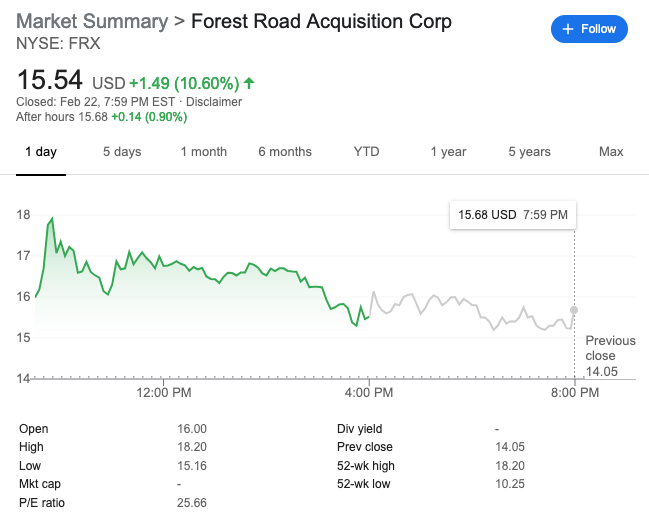

Forest Road Acquisition Corp (FRX) hit a new high of day of $18.20. I was actually contemplating re-entering after my automatic sell limit hit, but luckily, I stuck to my rules.

- I do not trade between 7am-9am PST

- I mainly buy during “lunch dips” east coast time (9am-11am PST).

- I don’t buy green positions breaking all time highs

- I don’t re-enter positions twice in a day (past experiences have burned me)

I was considering re-entering at the first big dip at $16.70 and again at $16.07, but luckily I stuck to my rules, and fear of missing out (FOMO) did not kick in. FRX dropped to $15 after hours, so I definitely dodged a bullet there.

What to Watch for Tomorrow

I’ll be watching the drama unfold for Churchill Capital Corp IV (CCIV). I was able to catch the initial dip from $43 to $49, for a quick scalp (just a day trade) after hours. I will be watching for a greater selloff tomorrow, and potential hit pieces by the infamous Hindenburg Research or Citron Research since they’re notorious for releasing hit pieces after a huge selloff like the one today. Once the volume dies down, and the drama subsides, I’ll look at re-entering for a long swing at a later time. For those who bought at the top, and unsure on what to do, if it was me, I would:

- Cut losses quickly (if day trading)

- Hold and accumulate over the next few weeks to average down, sell, and reposition

- NOT average down until there’s a clear bottom, with new support levels, on low volume

I will also be watching for HCMC to continue forming higher lows this week. I am waiting on news regarding the lawsuit. There is much speculation, but I’ll wait until there is actual PR before I react, and make further decisions on what my price target is. Hopefully tomorrow will be a super green day for everyone!

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 10 Green Positions (02/22/21):

- FRX

- HQGE

- BLIAQ

- AMC

- GAXY

- MMEX

- AAL

- RCL

- JBLU

- NCLH

Top 10 Red Positions (02/22/21):

- LYL

- DPW

- NXTD

- TSOI

- DPLS

- OCGN

- SUNW

- CSCW

- NVAX

- SSOK

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.