Watchlist for 5/4/22 & Long Swing Setups

Hello everyone,

Hope you all are starting off May right. We’ve had amazing swings from last week including AMD, CYN, RDBX, ATER, OST, MDVL, DOGZ and AMZN. Swings since Monday that are moving nicely include HYMC, FCEL, PIK, and HCDI.

Major Events

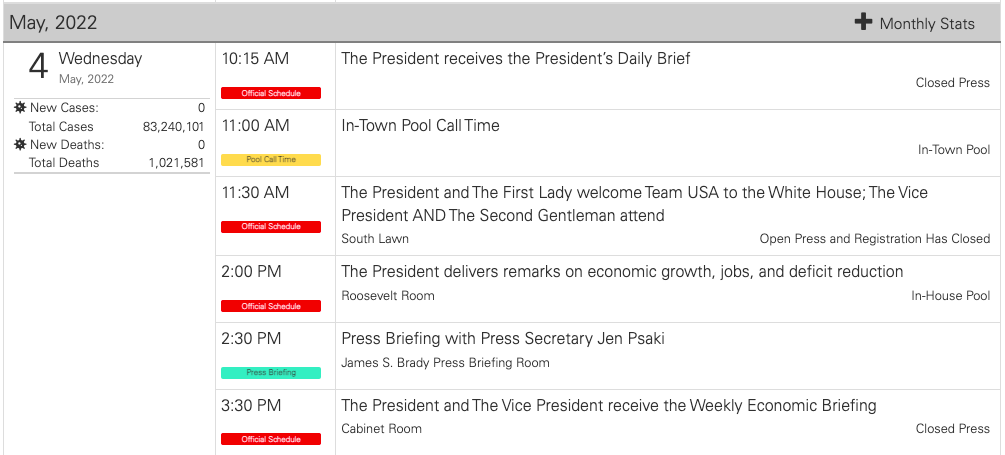

Today, 5/4/22, there will be another FOMC meeting, view calendar here. The President is also set to deliver remarks on economic growth, jobs, and deficit reduction at 2pm EST. With these events taking place, expect volatility in the market.

Roe v. Wade

With great outrage surrounding Roe v. Wade, and protests taking place; be cautious of overall sentiment.

Manage Risks & Trading Plan

These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter. Never bag hold, never average down on a loser unless you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan. For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone). Always make sure you have a day trade available in case you need to exit and reposition. It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

As I’ve mentioned previously, I’m simply weeding out the most likely to move stocks in the coming weeks for everyone. There are thousands of tickers so it’s impossible to be in every single one. Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

With this volatile market, position size is everything. I am only trading with 5% of my money. Many of you are still going in with 100% of your accounts. Be careful because trying to go heavy in this type of market is a sure way to blow up accounts, leading one to give up on trading completely.

I have 15 trading accounts I manage including Traditional IRAs and Roth IRAs. 95% of my money is liquid as this is when my investor side kicks in as I await the bottom so I can go long. With earnings season, this will give us a clearer direction of which companies to invest in over the next few years. I’ll write a separate post for those and include all the research along with it.

Main Watch/Setups

AMD

AMD reported strong earnings today after hours. See full report here. For those interested in investing long term, consider AMD in the coming weeks if you didn’t buy in last week when I mentioned to long it. You can also swing long, and play the momentum as they have many catalysts and strong guidance. It hit a low of day (LOD) of $89.01 and high of day (HOD) at $98.79 after hours (AH). The next leg up will be to reclaim $100-$115 levels. We will be looking for $150-$200 levels over the next few months. If there is a pullback, look for the dip zone to be in the $91-94 levels. Short Interest is 11.31% of float as of 4/15/22. Based on 44 Analysts, the higher end of the Price Targets is set at $200, lower end $100, with an average PT $145.88. AMD is currently No. 6 on the Webull Popularity List, so I expect great volatility with this one over the coming weeks.

LCID

LCID hit low of day (LOD) $18.80 pre-market and high of day (HOD) $19.68. It needs to reclaim $21.87 levels for a bullish move upward. Watch for a dip in the $18.90-19.02 range. They have earnings on Thursday, 5/5/22 so I’m expecting volatility heading into Thursday. Short Interest is 6.98% of float as of 4/15/22. Based on 7 Analysts, the higher end of the Price Targets is set at $50, lower end at $12, with an average PT of $38.

OST

OST, a new IPO, priced at $4 after debuting, hit low of day (LOD) $2.90 premarket and high of day (HOD) $5.20 after hours today. This is a swing setup I mentioned to watch for a reversal last Friday. Today it finally made the move back up. The dip zone I alerted during after hours (AH) was for $4.50-$4.68. IF there is another pullback, the next dip zone may be at $4.27-$4.49. If it hits $4.27, that would trigger SSR for the day and the follow day, Thursday. I’m looking for a day 2 run, with the next leg back above $5 levels. Once we consolidate above $5, watch for the move back above $6-$7+.

As you can see OST hit a HOD of $55 Pre-market on 4/28/22 before dropping. The risk:reward here is worthy of swinging long for me. Adding on BIG pullbacks is the key to trading this one. If the volume dies and it begins to fade, respect your stop loss.

RVSN

RVSN hit high of day (HOD) $1.86 after hours (AH) after hitting its intraday low of $1.22. It would need to reclaim $2.11 levels for a bullish and parabolic move back above $3s, with the possibility of breaking new all time highs (ATH) over the new few weeks. If there is a pullback, dip zone will be $1.48-$1.67. Analyst Upgrade sets Price Target at $7.

HCDI

HCDI hit high of day of $4.14 premarket. I alerted this one on 5/2/22 to swing long, buying up big pullbacks. I re-added back to continue my swing over the next few weeks heading into earnings on 5/12/22. Short interest is 20.40% of float as of 4/15/22. Analyst Price Targets sits at $8. SSR will be on 5/4/22, so it will need to reclaim $3 levels, consolidate, and then move back above $3.50-$4.00 levels for the next leg up. The week of earnings, I’ll be watching for the move above $6-$7+ levels.

RDBX

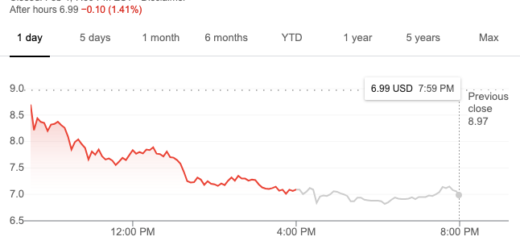

RDBX hit high of day (HOD) premarket (PM) $8.42 and low of day (LOD) after hours (AH) $6.09. Dip zone may be $5.95-$6.05. I added after hours for a swing since it will be under SSR. I’ll be looking for it to reclaim $7 levels, consolidate and then $8-$8.50 levels. Short Interest is 11.31% of float as of 4/15/22. Based on 4 Analysts, the higher end of the Price Targets is set at $10. RDBX is currently No. 3 on the Webull Popularity List, so I expect great volatility with this one over the coming weeks.

NVDA

NVDA hit low of day (LOD) $191.33, hitting high of day (HOD) $201.67 after hours. Dip zone levels may be in the $193-$198 range. If it breaks support levels, respect your stop loss. Watch for the move into the $205-$210 range. Based on 48 Analysts, the higher end of the Price Targets is set at $400, lower end $160, with an average PT $329. NVDA is currently No. 30 on the Webull Popularity List, so I expect this to move up as we get closer to their earnings date towards the end of the month on 5/25/22.

FTRP

FTRP hit low of day (LOD) $0.99, after hitting high of day (HOD) $1.68 premarket hours. Dip zone levels may be in the $0.99-$1.05 range. If it breaks support levels, respect your stop loss. Watch for the move into the $1.50-$1.75 range. If those levels are reclaimed, we can close the gap above $3-$4 over the following weeks. Based on 5 Analysts, the higher end of the Price Targets is set at $24.96, lower end $4.99, with an average PT $12.78.

SBFM

SBFM hit high of day (HOD) $2.88 after hitting low of day (LOD) premarket. At these levels, it makes more sense to swing long or invest long term with everything in their pipeline as I’ve mentioned previously. In the coming weeks, watch for it to reclaim $3.50-$4 levels.

Others to Watch/Trending

Watch these for the move up as well.

- TSLA

- FCEL

- PIK

- BBI

- SQL

- BRQS

- BOLT

- AMC

- GME

- VERU

- NKTX

- LGVN

- ITP

- DOGZ

- TKLF

- SNDL

- MULN

- HYMC

- GFAI

- NILE

Oil Stocks to Watch for a Reversal

- INDO

- HUSA

- IMPP

- ENSV

- CEI

- USWS

- MXC

- MARPS

Earnings

5/4/22

- MRNA

- CVS

- MAR

- UBER

- ETSY

5/5/22

- SHOP

- CROX

- PENN

- W

- FUBO

- OPEN

- NET

- WISH

- DASH

5/6/22

- DKNG

- UA, UAA

- CI

- GT

- CNK

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.