End of Day Wrap Up 02/11/2021

Today was an awesome day for SNDL my long swing from last year finally hit $4.87 during pre-market today, and I am absolutely ecstatic. As I mentioned in my post yesterday, it’s my last penny stock (excluding OTC) and I am so happy to see how far it’s come from it’s low of $0.14 back in October 2020. I took position back then around the $0.20 mark, and have been swinging, and repositioning ever since. I am holding my long position until it gaps up past $9, being that there are expected catalysts in the coming weeks and months. I am also waiting for the PR that Sundial Growers Inc has reached compliance, and then the real party begins.

The Highlight of the Day: Sundial Growers Inc (SNDL)

Sympathy plays that ran together were TLRY, ACB, KERN, CANF, and HEXO. If you follow the charts of each of these plays, they tend to look almost identical.

On Watch Tomorrow

I will be watching all my OTC plays as I’ve set them up for the coming week(s) and months. I have spread out my portfolio to dabble into different industries, that way, I’m already in my positions before they get found. The reason I’ve transitioned my portfolios over to OTC is due to market manipulation in the recent weeks that’s beyond my control. I’ve also noticed the trend of many traders dabbling into the OTC market, more than previous years, and the runs have been insane. For me, it’s worthwhile for me to take the risk for higher profit margins. I posted my positions here for those interested.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 10 Green Positions (02/11/21):

- ECEZ

- SNDL

- AZFL

- FUTL

- BRQS

- CTRM

- AIKI

- NXTD

- HCMC

- TSOI

Top 10 Red Positions (02/11/21):

- SNDL

- HYII

- HAON

- LPPI

- KKUR

- DLOC

- TPAC

- MMEX

- SNPW

- EHOS

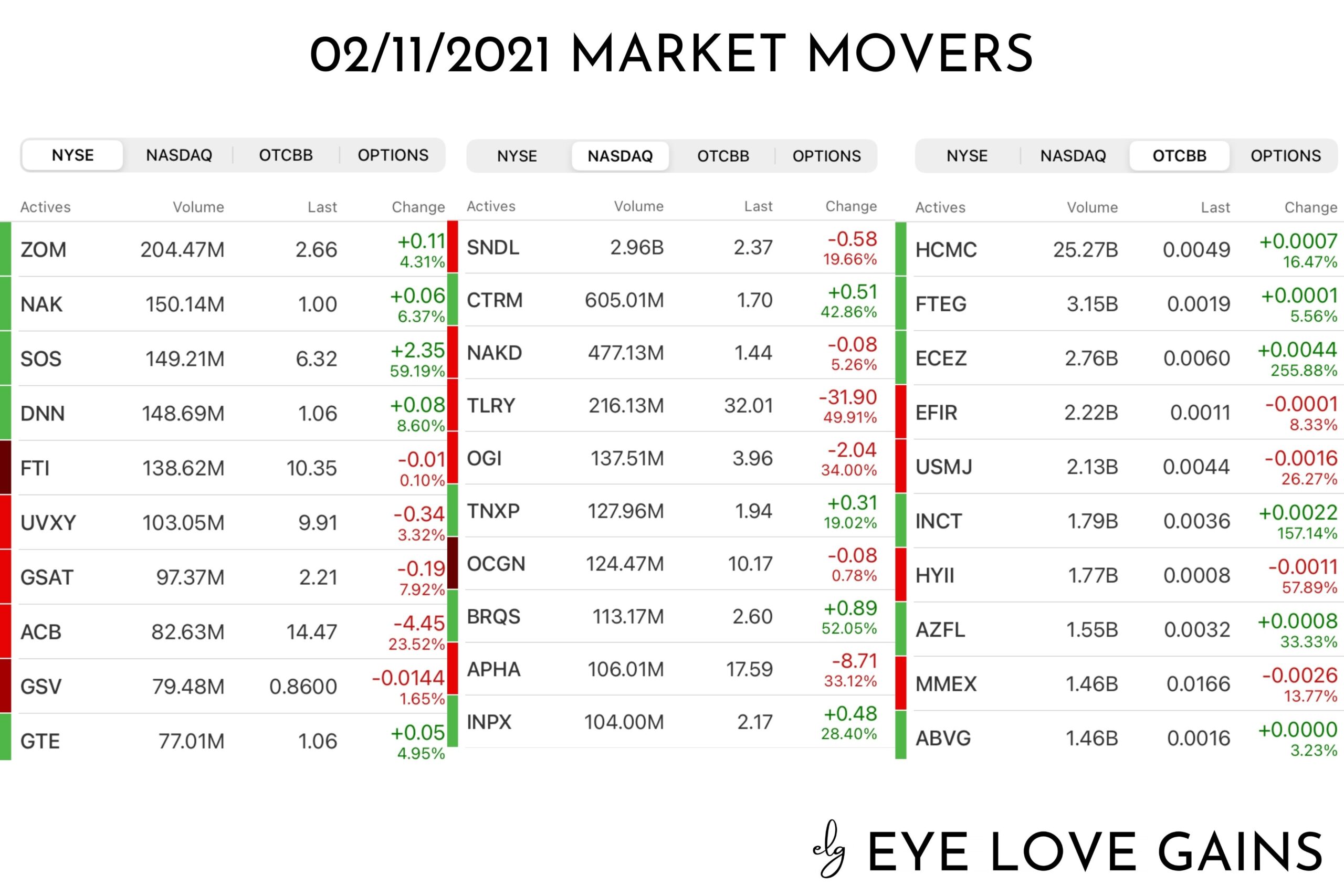

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.

Hi Anna, hope you and family are well. I want to ask you about HCMC. Seems like there is soo much being spouted about it on Twitter and as a newb hard to know/ believe what’s true. Today I read that it could be $2 in a year and $25 in 5 years! I have a good position on it: 500k at 0.0001. Would love to hear your take on it as well all know you’re ace.

Ps. Read your schedule post. Don’t know where you get the energy from.

Sean (aka Cecil)

Hi Sean, I like HCMC as a long hold. I believe depending on the law suit, if Healthier Choices Management Corp wins, it will easily go up to $0.10 in the short term. For now, I think expecting it to climb to $0.10 is the more realistic approach. If it holds above $0.10, then the next leg up would be $0.15 > $0.20 >….$1.00. I’ll be looking to see if they are able to get relisted on the NYSE/NASDAQ. If they are able to do that, then yes I can see this climbing higher in the long term. I don’t like to jump the gun and say $2-$25 because there are too many variables. Hope this helps!