End of Day Wrap Up 01/28/2021

Retail Traders v. Wall Street

Today was an upsetting day for many traders who owned GME, AMC, NOK, NAKD, SNDL, CTRM, EXPR, BBBY, BB, KOSS, TR, TRVG, and many others. It is a day I will remember for a long time, but not because the hedge funds came out in full force. It is not about being shorted; which many people assumed was the issue. The problem was Robinhood, along with other brokerages including but not limited to Charles Schwab, TD Ameritrade, Webull, Interactive Brokers and others decided they would restrict the buying of the stocks mentioned.

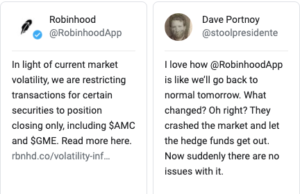

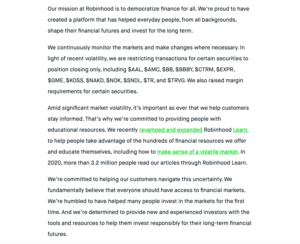

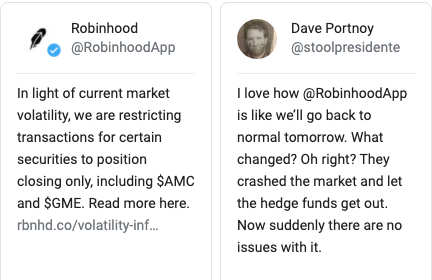

Robinhood sent out a tweet, linking to their blog which reads:

TD Ameritrade retweeted Charles Schwab’s post to their Twitter followers:

Webull restricted the following tickers:

Interactive Brokers tweeted:

So the Bloodbath Begins

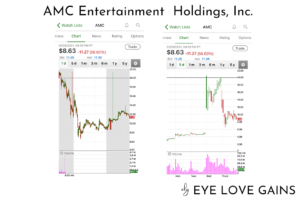

Premarket started promising with most positions opening green. Everything came crashing down once the market opened. There’s being shorted, which is fine… and then there’s the issue of not being allowed to actually BUY any of the stocks mentioned above. The only option was to SELL, and that’s the issue. “Retail traders” weren’t allowed to buy, but the big institutions were free to do as they please to manipulate the stock prices. The double standard is why this created a huge upset, and it should make us mad.

Why This is a Big Deal To Me

I wasn’t able to buy AT ALL at the lowest point in my Webull account, and that upset me DEEPLY. Those who follow me on twitter know I always buy big dips when I set up my positions or add to current positions. Stocks fall if no one buys, and the fact that they controlled others’ ability to buy should not be legal. Luckily, I was able to still buy in TD Ameritrade, so I caught nearly every big dip. Had they restricted me, I would’ve rolled my money to a new brokerage and encouraged others to take a stand as well. We should be able to control how we choose to spend OUR money. They have no right to take that right away from us, PERIOD. The ability to buy at the huge sell off point could have helped those that bought too high to average down, and get out of their positions safely. It could allow people who wanted to enter at the low to freely do so, but that didn’t happen.

A New Movement Was Created As People Began to Speak Up

My Disappointment with Some Large Furus

To my amazement, many larger furus chose to be silent while all of this was happening. It upset me to see their followers ask what to do because they’re new to the market. They didn’t understand what was happening, and I used to be them. It upset me because they could have spoke up, but they chose to ignore the problem, and go about their day as though nothing was happening. It’s their right to do nothing, but what is the point of it all if you can’t help guide them as to what you would do if it was you. I was infuriated by those who posted gains because tons of people lost their money, not because of anything they did, but because of what the brokerages did by not allowing people to buy, yet big institutions were allowed to reload their short positions, causing the stocks to plummet. I just think there’s a time and place, but once again, they are free to do as they please. Some furus openly admitted to opening short positions, and that was truly disappointing. It’s beyond money at this point, it’s about us uniting as traders to prove a point. Once again, they are free to do as they please, but I’m all about the principle.

They Won the Battle, But We’ll Win the War

Top 10 Green Positions (1/28/21):

- SNDL

- LMFA

- NVAX

- NAKD

- GHSI

- NXTD

- CTRM

- BTDG

- OCGN

- NAK

Top 10 Red Positions (1/28/21):

- AMC

- GME

- NOK

- OXBR

- NTN

- SRNE

- POLA

- PLL

- AQMS

- AHT