Watchlist 6/13/22-6/17/22 & Recap

Hi everyone,

Hope you all had a great weekend. Please manage your risks and read the disclosure below before even proceeding to read my trading plans. Whether futures are red or green, we’ll continue to compound those gains and keep our accounts green. May all your accounts continue to be blessed.

Manage Risks & Trading Plan Disclosure

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- When trading large caps, it is normal for it to move ~0.5-6%. When trading mid caps, it is normal for it to move ~5-15%. When trading small caps, it is normal for it to move ~8-30%+. When assessing goals, it’s important to make sure to take in consideration a stock’s volatility and match it to your particular trading style.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

6/13/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

Refer to the Setups Recap for the swing setups from previous weeks as most of the catalysts are happening this week.

- BLUE

- RDBX

- IMPP

- AUVI

- HUSA

- COGT

- PBTS

- ME

- AERC

BLUE

Day’s Volume: 10,714,649

Average 10 Day Volume: 2.94M

Day’s range: $0.00-0.00

Closing Price: $3.73 (halted on 6/9/22 ahead of FDA meetings for gene therapy candidates)

Short Interest: 17.84%

Analyst Price Target: High PT: $14, Low PT: $2, Average PT: $7.33

Catalysts:

- FDA Advisory Committee Unanimously Supports beti-cel Gene Therapy for People with beta-thalassemia Who Require Regular Red Blood Cell Transfusions. 6/10/22. View news here.

- FDA Advisory Committee Unanimously Endorses eli-cel Gene Therapy for Cerebral Adrenoleukodystrophy. 6/9/22. View news here.

- bluebird bio stock trading halted today June 9th and tomorrow June 10th. 6/9/22. View news here.

- bluebird bio Announces Posting of Briefing Documents for Upcoming FDA Advisory Committee Meeting. 6/7/22. View news here.

- bluebird bio Reports First Quarter 2022 Financial Results and Highlights Operational Progress. 5/9/22. View news here.

- bluebird bio Initiates Restructuring to Reduce Operating Expenses and Advance Near-term Opportunities to Bring Potentially Curative Gene Therapies to Patients in the US. 4/5/22. View news here.

- View company pipeline here.

On Thursday, June 9th, the company halted trading of their common stock. It was unhalted after the close on Friday, June 10, 2022. The U.S. Food and Drug Administration’s (FDA) Cellular, Tissue, and Gene Therapies Advisory Committee (CTGTAC) met to “discuss the biologics licensing applications (BLAs) for betibeglogene autotemcel (beti-cel) and elivaldogene autotemcel (eli-cel). Beti-cel is under review for the treatment of people with β-thalassemia who require regular red blood cell transfusions. Eli-cel is under review for the treatment of early active cerebral adrenoleukodystrophy (CALD) in patients less than 18 years of age who do not have an available and willing human leukocyte antigen (HLA)-matched sibling hematopoietic stem cell (HSC) donor.” This has been trending over the last week and ranking #32 in Real-time ranking. With the new FDA advisory committee unanimously endorsing treatment, There should be more catalysts coming following the positive news. I will be watching for Analyst upgrades in the coming weeks.

I will be buying big pullbacks for the next leg up, and will be setting this up as a multi-day/week swing for as long as there is volume to drive price action. If there is a pullback, dip zone might be at $5.95-$6.30. Once $7 levels are reclaimed, the next leg is $7.75-$8. After that is $8.50-$10. We will walk this up until we break ATH.

COGT

Day’s Volume: 106,463,837

Average 10 Day Volume: 9.25M

Day’s range: $6.50-$10.89

Closing Price: $7.87

Short Interest: 5.11%

Analyst Price Target: High PT: $31, Low PT: $15, Average PT: $20.14

Catalysts:

- Cogent Biosciences Announces Positive Initial Clinical Data from Ongoing Phase 2 APEX Trial Evaluating Bezuclastinib in Patients with Advanced Systemic Mastocytosis (AdvSM). 6/10/22. View news here.

- Cogent Biosciences to Host Investor Webcast on June 10, 2022 at 8:00am ET. 6/6/22. View news here.

- Cogent Biosciences Announces Annual Meeting of Stockholders. 6/2/22. View news here.

- Cogent Biosciences Announces Presentation at European Hematology Association (EHA) Annual Congress. 5/12/22. View news here.

- Cogent Biosciences Reports Recent Business Highlights and First Quarter 2022 Financial Results. 5/10/22. View news here.

- Cogent Biosciences to Participate in the LifeSci Partners Immunology and Inflammation Symposium. 5/6/22. View news here.

- View company pipeline here.

COGT hit low of day of $5.20 premarket, followed by a press release, “Cogent Biosciences Announces Positive Initial Clinical Data from Ongoing Phase 2 APEX Trial Evaluating Bezuclastinib in Patients with Advanced Systemic Mastocytosis (AdvSM).” 6/10/22. View news here. It hit high of day $10.89 intraday, followed by a fade into the close, and closing at $7.87. If there is a pullback, dip zone might be at $6.29-$6.68.

6/10/22 Setups Recap & Trading Plan

These are all swings so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging.

AERC

AERC hit low of day $8.36 during premarket hours, which fell far below my dip zone ($9.20-$9.40). My dip zone was reclaimed, and although it was quite a battle, we were able to break the $9 wall, $10 wall, $11 wall, and $12 wall, moving +$3.75 (+44.74%) to high of day $12.10 intraday. There was a short raid at 12:20pm PST/3:20pm EST which triggered all hard stop losses, which ruined the momentum, and there was a fade to $8.70 aftermarket, after closing at $9.01. If there is a pullback, the dip zone may be at ($8.20-$8.50). We will need to reclaim $9 levels and walk this up one step at a time. We need to form a base at $10 again, and climb up slowly one leg at a time, with healthy pullbacks in-between. Shorts are going to try to push this down so it’s important that the climb is steady to make it difficult for shorts to short the pops. The goal is to get to $20+ but that all depends on whether all the big pullbacks get bought up or not.

Day’s Volume: 38,052,065

Average 10 Day Volume: 31.77M

Day’s range: $8.34-$13.70

Closing Price: $9.01

Short Interest: 2.28%

Catalysts:

- AeroClean Announces Appointment of Jimmy Thompson as Vice President of Strategic Sales. 6/8/22. View news here.

- AeroClean Receives FDA Clearance For Pūrgo™ Medical Grade Air Hygiene Technology. 6/6/22. View news here.

- AeroClean Provides Resources To Support Government Push for Cleaner, Safer Indoor Air. 5/18/22. View news here.

- AeroClean Announces Appointment of Timothy J. Scannell to Board of Directors. 5/12/22. View news here.

- AeroClean Reports First Quarter 2022 Financial Results. 5/12/22. View news here.

AERC hit my dip zone ($8.20-$8.50) at $8.34 (✓), moving +$5.36 (+64.27%) to high of day $13.70 intraday, closing at $12.50. If there is a pullback, the dip zone may be at ($10.30-$11.00). We will need to reclaim $12 levels and walk this up one step at a time. We need to form a base at $13 again, and climb up slowly one leg at a time, with healthy pullbacks in-between to break $15 levels. Shorts are going to try to push this down so it’s important that the climb is steady to make it difficult for shorts to short the pops. The goal is to get to $20+ but that all depends on whether all the big pullbacks get bought up or not.

AUVI

AUVI hit my dip zone ($1.60-$1.70) at $1.65 (✓) premarket, and moved up +$1.65 (+100%) to $3.30 intraday. It then faded into the close, closing at $2.75. If there is a pullback, dip zone may be at ($2.20-$2.47). If shorts are able to push it below $2.47, that would trigger SSR for the remainder of the day and Monday. $3 will need to be reclaimed and walked up one leg at a time until we break all time highs.

Day’s Volume: 126,317,806

Average 10 Day Volume: 9.184,209M

Day’s range: $2.08-$2.86

Closing Price: $2.76

Short Interest: 2.49%

Analyst PT: High PT: $10.40, Low PT: $2.00, Average PT: $6.20

Catalysts:

- Tech Leaders: NEXCF, RBLX AUVI, AIMLF; Visionary CEOs Advancing Next Wave of Multi-Billion Dollar Growth Opportunities in Metaverse, HealthTech Wearables, and Clean Air Technologies. 6/9/22. View news here.

- Applied UV Announces International Dealer Awarded Sole Source Provider Contract for Airocide’s FDA Class II Listed Medical Device. 6/9/22. View news here.

- Applied UV to Present and Showcase Airocide and Scientific Air Technology at the LD Micro Invitation June 8th, 2022. 5/31/22. View news here.

- Applied UV Declares Monthly Preferred Stock Dividend. 5/24/22. View news here.

- Applied UV Adds Veteran Leader and Banking Executive Jos Luhukay to Board of Directors. 5/24/22. View news here.

- Applied UV Reports 1st Quarter 2022 Results. 5/24/22. View news here.

AUVI fell below my dip zone ($2.20-$2.47) to $2.08, triggering SSR for Monday 6/13/22, and reclaimed my dip zone shortly after (✓) intraday, and moved up +$0.78 (+37.5%) to high of day $2.86 intraday, closing at $2.76. If there is a pullback, dip zone may be at ($2.45-$2.60). $3 will need to be reclaimed and walked up to $3.50 levels, and then $4+. The goal is to break $6+ and then all time highs as long as the volume is still there to drive price action.

HUSA

HUSA was $0.15 below my dip zone ($7.30-$7.50) $7.15, but was able to reclaim it and move +$0.61 to $7.76 premarket, pulled back to $6.93 during the morning flush, and moving +$1.13 (+16.31%) to high of day $8.06 intraday. and then faded to low of day $6.68, triggering SSR for Friday, 6/10. pulling back -17.12%, and closing at $6.99. With crude oil possibly breaking all time highs next week, and HUSA under SSR tomorrow, if there is a pullback, possible dip zone might be ($6.80-$7.20). Crude oil is breaking new highs so expect this to run hard along with it.

Day’s Volume: 13,359,293

Average 10 Day Volume: 25.40M

Day’s range: $6.24-$7.59

Closing Price: $7.10

Short Interest: 12.41%

Catalysts:

- 4 Penny Stocks to Buy Amid High Inflation: HUSA NINE IMPP RIBT – Insider Financial. 6/12/22. View article here.

- Houston American Energy Increases Interest In Colombian Project. 5/31/22. View press release here.

- Houston American Energy Announces Spudding of First Well on SPO-11 Venus Exploration Area in Colombia. 5/24/22. View press release here.

- 10-Q Quarterly Filings Ended March 31, 2022. View sec-filing here.

- 8-K Current Reports. 3/27/22. View sec-filing here.

- SC 13D Current Reports. 2/2/22. View sec-filing here.

HUSA hit my dip zone ($6.80-$7.20) at $7.02 (✓), and moved +$0.57 (+8.12%) to $7.59 intraday. HUSA then faded to low of day $6.24, triggering SSR for Monday, 6/13. pulling back -17.79%, and closing at $7.10. With crude oil possibly breaking all time highs next week following Father’s Day, I’ll be buying any big pullbacks for the bigger move. HUSA is under SSR tomorrow, so if there is a pullback, possible dip zone might be ($6.50-$6.75).

INDO

INDO broke well below my dip zone ($10.56-$11.00) to low of day $9.75, due to crude oil being down yesterday. Today crude oil is going up, so if there is a pullback, the dip zone may be at ($9.80-$10.10).

Day’s Volume: 1,505,762

Average 10 Day Volume: 2.54M

Day’s range: $8.90-$10.16

Closing Price: $9.15

Short Interest: 52.29%

Catalysts:

- Indonesia Energy To Present at LD Micro Invitational XII Investor Conference on Wednesday, June 8th at 5:30pm PDT. 6/6/22. View press release here.

- Indonesia Energy Discovers Oil at Kruh 27, the First of Two Back-to-Back New Wells at Kruh Block in 2022. 5/11/22. View press release here.

- Indonesia Energy Commences Drilling of First of Two Back-to-Back Production Wells at Kruh Block. 4/8/22. View press release here.

- Indonesia Energy Mobilizes Drilling Rig to Commence Drilling of Two Back-to-Back Production Wells at Kruh Block. 3/10/22. View press release here.

- Indonesia Energy To Commence Drilling of Two Back-To-Back New Wells Within 30 Days and a Third by Mid-Year. 1/26/22. View press release here.

INDO broke well below my dip zone ($9.80-$10.10) and faded to low of day $8.90, due to crude oil being down and low volume. If there is a pullback, the dip zone may be at ($8.50-$8.75).

MF

MF fell well below my dip zone ($0.2800-$0.2900) $0.2750, along with the entire market being red, hitting low of day $0.2650. If there is a pullback, possible dip zone might be ($0.2750-$0.2850).

Day’s Volume: 6,174,336

Average 10 Day Volume: 28.39M

Day’s range: $0.2676-$0.2900

Closing Price: $0.2857

Short Interest: 0.49%

Analyst PT: High PT: $15.27, Low PT: $4.219, Average PT: $7.93

Catalysts:

- Food shortage/inflation play.

- Missfresh Announces Receipt of Nasdaq Notification Regarding Late Filing of Form 20-F. 5/24/22. View press release here.

- Missfresh’s Retail Cloud Services Enabled Up To 20X Increase in Major Traditional Retailers’ Online Sales. 5/24/22. View press release here.

- MissFresh Triples its Stock and Accelerates the Delivery Efforts to Meet Increasing Consumer Demand. 4/26//22. View press release here.

- Sales of Missfresh’s Private Label Fresh Food Brand Surged 300% For Q4 2021. 3/30/22. View press release here.

- Missfresh Expands China-wide Direct-Supply Vegetable Farm Network to Total More Than 1,300 Hectares. 3/2/22. View press release here.

- Missfresh Successfully Launches Personalized Concierge Experience for High-value Customers, Doubling Relevant Monthly ARPU. 2/16/22. View press release here.

MF hit my dip zone ($0.2750-$0.2850) $0.2676, but did not make any significant moves. $0.30 levels needs to be reclaimed for a bullish move back up.

SIGA

SIGA hit $0.05 below my dip zone ($10.85-$11.00) at $10.80 (✓) premarket, moving +$0.80 (+7.40%) and hitting high of day (HOD) $11.60, fading to low of day $10.52, and closing at $10.63. If there is a pullback, possible dip zone might be ($10.20-$10.45).

Day’s Volume: 6,068,216

Average 10 Day Volume: 25.95M

Day’s range: $10.39-$11.15

Closing Price: $10.56

Short Interest: 7.03%

Catalysts:

- SIGA Receives Approval from the FDA for Intravenous (IV) Formulation of TPOXX® (tecovirimat). 5/19/22. View press release here.

- New Contract Awarded by U.S. Department of Defense for the Procurement of up to Approximately $7.5 Million of Oral TPOXX®. 5/12/22. View press release here.

- SIGA Reports Financial Results for Three Months Ended March 31, 2022. 5/5/22. View press release here.

- SIGA Declares Special Dividend of $0.45 Per Share. 5/5/22. View press release here.

SIGA fell $0.08 below my dip zone ($10.20-$10.45) at $10.12 (✓) premarket, moving +$1.13 (+10.18%) and hitting high of day (HOD) $11.15, fading into the close, and closing at $10.56. If there is a pullback, possible dip zone might be ($10.26-$10.45).

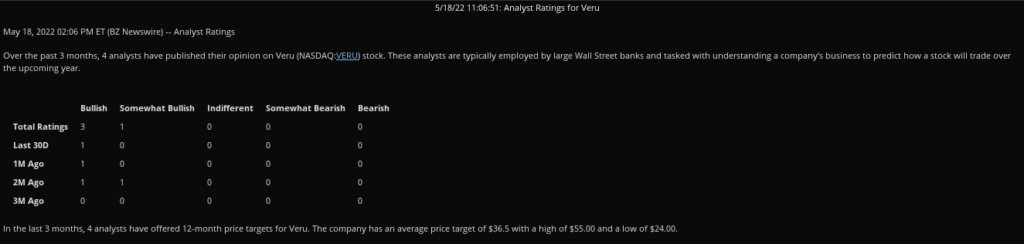

VERU

VERU broke well below my dip zone at ($14.95-$15.15), fading to a low of day$13.64, closing at $13.71. If there is a pullback, there may be a dip zone at ($13.28-$13.50).

Day’s Volume: 4,718,167

Average 10 Day Volume: 9.65M

Day’s range: $12.62-$13.75

Closing price: $13.12

Short Interest: 34.39%

Analyst PT: $24-$55, Average PT: $36.50

Catalysts:

- Veru Submits Emergency Use Authorization (EUA) Application to U.S. FDA for Sabizabulin, its Novel, Oral Antiviral and Anti-Inflammatory Drug Candidate for Hospitalized COVID-19 Patients at High Risk for ARDS. 7/7/22. View the full press release here.

- Tang Capital Partners, Lp Discloses 5.2% Passive Stake in Veru. 6/6/22.

- Veru Announces Presentation of Final Positive Phase 1b/2 Clinical Trial Results for Sabizabulin in Metastatic Castration Resistant Prostate Cancer at the 2022 American Society of Clinical Oncology Annual Meeting. 6/6/22. View the full press release here.

- Veru to Present Three Presentations at the 2022 American Society for Clinical Oncology Annual Meeting on June 3-7. 5/31/22. View the full press release here.

- Veru to Participate in Fireside Chat at the Jefferies Healthcare Conference on June 8, 2022. 5/25/22. View the full press release here.

- Veru Announces Appointment of Joel Batten to Lead U.S. Infectious Disease Franchise to Focus on Hospitalized COVID-19 Patients. 5/18/22 View the full press release here.

- Veru to Present at the H.C. Wainwright Global Investment Conference on May 24th 2022. 5/17/22. View the full press release here.

- Veru Reports Second Quarter Fiscal 2022 Results and Progress of Sabizabulin for COVID-19 Toward a Request for Emergency Use Authorization. 5/12/22. View the full press release here.

- FDA States that Veru Should Submit Request for Emergency Use Authorization (EUA) Based on Positive Efficacy and Safety Data from the Phase 3 Clinical Study of Sabizabulin in Hospitalized COVID-19 Patients. 5/11/22. View the full press release here.

- FDA Has Granted Veru a Pre-Emergency Use Authorization (EUA) Meeting Date for Positive Sabizabulin Phase 3 COVID-19 Study. 5/2/22. View the full press release here.

- Veru Announces Oral Late-Breaking Presentation of Phase 2 Data of Sabizabulin for the Treatment of Hospitalized Severe COVID-19 Patients at High Risk for Acute Respiratory Distress Syndrome at the 32nd European Congress of Clinical Microbiology & Infectious Diseases. 4/25/22. View the full press release here.

- Veru’s Novel COVID-19 Drug Candidate Reduces Deaths by 55% in Hospitalized Patients in Interim Analysis of Phase 3 Study; Independent Data Monitoring Committee Halts Study Early for Overwhelming Efficacy. 4/11/22. View the full press release here.

VERU broke well below my dip zone at ($13.28-$13.50), fading to a low of day $12.62, closing at $13.12. If there is a pullback, there may be a dip zone at ($12.60-$12.80).

RDBX

RDBX hit $0.03 above my dip zone ($9.15-$9.30) at $9.33 (✓), and from there, it moved +$1.21 (+12.97%) and hit high of day (HOD) $10.54, pulling back -15.75% from the high of day, to low of day $8.88, triggering SSR for Friday 6/10/22, and closing at $9.47. If there is another pullback, the dip zone might be at ($9.40-$9.80). This has been a short setup for the last few months due to short interest for this being extremely high, so if all the big pullbacks get bought, there’s a chance we’ll go parabolic and break new highs soon. $10 levels need to be reclaimed, and a slow climb to $11s. Once an $11 base is formed, the next leg is $13-$15 levels. After that is $15-$20 levels, then $20-$27 levels, and possibly break all time highs from October 2021. We’ve set this multi-month swing up beautifully over the last few months.

Day’s Volume: 74,747,851

Average 10 Day Volume: 30.73M

Day’s range: $9.65-$14.70

Closing Price: $9.

Short Interest: 38.56%

Catalysts:

- POS AM. Post-effective amendment to an S-Type filing. 6/3/22. View filing here.

- Redbox Entertainment Acquires North American Rights to WWII Action-Drama Come Out Fighting. 5/24/22. View press release here.

- DEFA14A Sec-Filing Additional proxy soliciting materials – definitive. 5/13/22. View filing here.

- 10-Q Quarterly report which provides a continuing view of a company’s financial position. 5/13/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- 8-K Report of unscheduled material events or corporate event. 5/11/22. View filing here.

- 425 Filing of certain prospectuses and communications in connection with business combination transactions. 5/11/22. View filing here.

- Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company. 5/11/22. View press release here.

RDBX hit $0.01 below my dip zone ($9.40-$9.80) at $9.39 premarket (✓), and from there, it moved +$5.31 (+56.55%) and hit high of day (HOD) $14.70.If there is another pullback, the dip zone might be at ($13.11-$14.25). This has been a short setup for the last few months due to short interest for this being extremely high, so if all the big pullbacks get bought, there’s a chance we’ll go parabolic and break new highs soon. $16 levels need to be reclaimed, and a slow climb to $20-$30. Once an $18 base is formed, the next leg is $19-$20 levels, then $20-$27 levels, and possibly break all time highs from October 2021. We’ve set this multi-month swing up beautifully over the last few months.

Others to Watch/Trending

Monitor volume for these in the coming weeks. Movement may be due to Analyst Upgrades, whales being spotted, or trending due to catalysts. Do your due diligence first.

- WEX

- EFOI

- IGEX

- AMD

- BASE

- TSLA

- ACVA

- RENT

- LLY

- FANG

- SCPL

- MTCH

- AMZN

- DVN

Oil/Gas Stocks to Watch

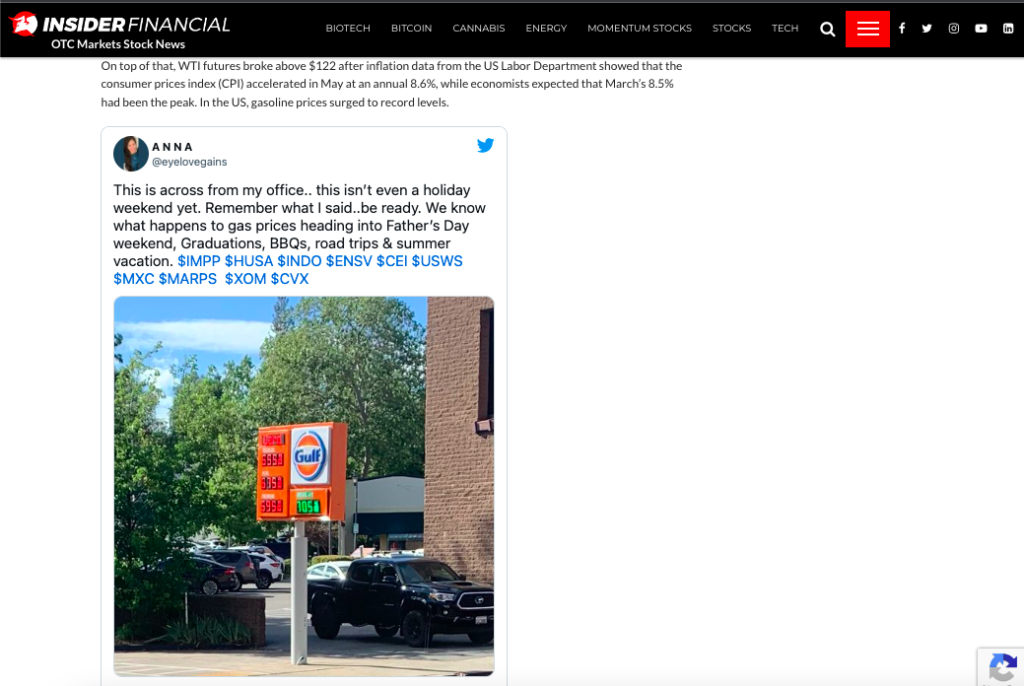

I accumulate my oil stocks while crude oil is red. It’s easier than chasing once it reverses back up. Watch for a reversal heading into next weekend as we approach Father’s Day weekend, Graduation, and summer vacation. The sentiment across the board is that gas and oil will rise higher over the summer. If crude oil flips red, that’s the best time to start accumulating to build a position to swing.

- INDO – 52.29% SI

- VTNR – 20.38% SI

- IMPP – 14.54% SI

- HUSA -12.41% SI

- ENSV – 3.54% SI

- MARPS – 2.91% SI

- MXC – 1.94% SI

- SNMP – 47.09%

- USWS – 9.14% SI

- CEI – 6.56% SI

- XOM – 1.21% SI

- CVX – 1.19% SI

Food Shortage/Agriculture Stocks to Watch

Monitor the news if trading any of these. Anytime the news mention food plant explosion, farm/crop fires, rising food price, etc. watch these for movement. Volume is everything, so follow the volume if you notice abnormal volume pour in. I like to trade the leaders and avoid weaker sympathy plays.

- AGRI

- VGFC

- MF

- RIBT

- SVFD

- WEAT

- EDBL

- FPI

- CAG

- LAND

- ANDE

- GIS

- GO

- K

- SEB

- ADM

Earnings

If entering the day of, I like to keep them as day trades unless there’s a clear direction of whether it should be a short or long swing. Unless I’m confident in the earnings result, I do not like to hold through earnings. For tech large caps, even if earnings are mediocre, as long as guidance is strong; it tends to see a bullish move.

Monday 6/13/22

- ORCL

- IDN

- BRZE

Tuesday 6/14/22

- LICY

- FERG

- HITI

- IRNT

- CXM

- RFIL

- KSPN

Wednesday 6/15/22

- MMMB

- WDH

- WLY

Thursday 6/16/22

- KR

- CMC

- JBL

Friday 6/17/22

- ALYA

Many have requested I charge a service fee, however, I won’t be doing that. For those wanting to open up a new account, you can get free stocks when you open a Webull Account with my referral link that’s on the sidebar & homepage. If you would like to help me pay it forward to help others in need, you’re welcome to donate to the link below. Every bit helps me to help others in need as I do spend hours on my research and do not receive compensation via advertising, sponsorships, etc. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.