Watchlist 6/2/22 & Recap

Hi everyone,

Hope you all had a super green Wednesday in spite of futures being red again. This week, we will continue to manage our risks and stick to our own trading plans. As usual, I only accumulated red while futures were red to swing. Be cautious when chasing green positions as you wouldn’t want to be caught in a bull trap. The best way to ensure one don’t get caught in a bull trap is to trade defensely. Looks like many of you are doing very well in this bear market, and I am ecstatic to see the progress. May all your accounts continue to be blessed.

Manage Risks & Trading Plan Disclosure

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- When trading large caps, it is normal for it to move ~0.5-6%. When trading mid caps, it is normal for it to move ~5-15%. When trading small caps, it is normal for it to move ~8-30%+. When assessing goals, it’s important to make sure to take in consideration a stock’s volatility and match it to your particular trading style.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

6/2/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

Refer to the Setups Recap for the swing setups from previous weeks as most of the catalysts are happening this week.

- SIGA

- CRTD

- NILE

- MTP

- BKSY

- TNXP

- IMMX

- AMD

6/1/22 Setups Recap & Trading Plan

These are all swings so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging.

SIGA

SIGA was a swing setup from 5/25/22, and from my dip zone on 5/27 ($8.36-$9.51) $9.53 (✓), it moved +$5.62 (+58.97%) and it hit high of day (HOD) $15.15 premarket (✓). From there, it faded to a low of day (LOD) $10.88, triggering SSR for Wednesday, 6/1/22, and closing at $10.94. If there is a pullback, possible dip zone ($9.90-$10.25).

Day’s Volume: 33,902,246

Average 10 Day Volume: 36.78M

Day’s range: $10.88-$12.69

Closing Price: $12.19

Short Interest: 3.69%

Catalysts:

- SIGA Receives Approval from the FDA for Intravenous (IV) Formulation of TPOXX® (tecovirimat). 5/19/22. View press release here.

- New Contract Awarded by U.S. Department of Defense for the Procurement of up to Approximately $7.5 Million of Oral TPOXX®. 5/12/22. View press release here.

- SIGA Reports Financial Results for Three Months Ended March 31, 2022. 5/5/22. View press release here.

- SIGA Declares Special Dividend of $0.45 Per Share. 5/5/22. View press release here.

SIGA hit my dip zone ($9.90-$10.25) at $10.00 premarket (✓) and it moved +$3.50 (+35%) and hit high of day (HOD) $13.50 after hours. It closed at $12.19. If there is a pullback, and the price is above the closing price before the market open, possible dip zone might be ($12.20-$12.50). If the price is below the closing price before the market open, possible dip zone might be ($11.60-$11.80).

CRTD

CRTD was a swing setup from 5/26, and it dropped to a low of day $0.97, triggering SSR for the second day in a row for Wednesday 6/1/22, making it the third red day. It reclaimed my dip zone ($1.00-$1.05) (✓) , moving up +$0.19 (+19%) to $1.19 and then pulled back $0.11 (-9.24%) to $1.08 after hours. We are sitting at the dip zone ($1.05-$1.13). The next leg up is $1.25-$1.50 levels, and then $1.75-$2. We’re taking this day by day. This will be a multi-week swing to $6+ or however long the momentum is there. We also got news today, “Creatd, Inc. Announces $4 Million Above-Market Expansion Plan Financing. 5/31/22. View press release here.” The market did not react to the news, so there may be a delay in overall sentiment. “The Private Placement is expected to close on or about May 31, 2022, subject to the satisfaction of customary closing conditions.”

Day’s Volume: 2,280,892

Average 10 Day Volume: 4.10M

Day’s range: $1.03-$1.19

Closing Price: $1.095

Short Interest: 2.86%

Catalysts:

- Creatd Ventures Provides Post-Acquisition Update on its DTC Wellness Brand, Basis; Surpasses Expectations With Record Quarter Projected. 6/1/22. View press release here.

- Basis’ first full quarter under Creatd Ventures expected to accrue over $200K in sales, along with lowest CAC (customer acquisition costs) and highest LTV (lifetime value) of all portfolio brands.

- Company additionally reports Basis’ first-ever brick-and-mortar launch with placement at Erewhon Market, and signs new distribution partnership with wholesale marketplace platform Pod Foods.

- Creatd, Inc. Announces $4 Million Above-Market Expansion Plan Financing. 5/31/22. View press release here.

- Creatd (CRTD) was nearly 1% higher after announcing a $4 million private placement.

- The company will also issue 2 million series C warrants to buy shares with an initial price of $3 per share and 2 million series C warrants to buy shares with an initial exercise price of $6 per share.

- The Private Placement is expected to close on or about May 31, 2022, subject to the satisfaction of customary closing conditions.

- Creatd Announces Up to $40 Million Rights Offering, Priced at $2.00 per Unit. 5/26/22. View press release here.

- Why Does It Matter? Creatd looks to utilize the offering proceeds for its expansion plan. Creatd Chair acknowledged the offering as its most significant offering since September 2020 uplisting.

- If fully subscribed, the offering could yield between a 10x – 20x increase in revenues over the next 12 to 18 months.

- Creatd Chair disclosed a tight float compared to microcap stocks like Remark Holdings, Inc (NASDAQ:MARK) and Genius Brands International, Inc (NASDAQ:GNUS), which trade at sub $1.00 with over $100 million and $250 million in outstanding shares.

- Creatd grew revenues from zero to $4.3 million for FY21 and looked to reach between $7 million – $10 million for FY22, pre-expansion plan initiation.

- Creatd maintained flat operating expenses, except for one-time charges and a decrease in its core platform, Vocal’s, marketing spend over the past three quarters.

- Vocal’s network grew to over 1.4 million creators and an audience reach exceeding 75 million.

- Creatd eliminated nearly all outstanding debt from its balance sheet, unlike small-cap companies like BuzzFeed, Inc (NASDAQ:BZFD), Esports Entertainment Group Inc (NASDAQ:GMBL), and Ipsidy Inc (NASDAQ:AUID) struggling with debt.

- Creatd Chair expressed that it was finally in a position to compete head-to-head with the multi-billion-dollar-valued platforms in its space, at a fraction of its internal headcount and with far lower development costs.

- Creatd 2022 Expansion Plan Investor Presentation. 5/26/22. View press release here.

- Creatd’s Vocal Teams Up with Microsoft’s Two Hat to Deliver Updates to its Proprietary Moderation Technology. 5/24/22. View press release here.

- Creatd, Inc. (Nasdaq CM: CRTD) (“Creatd” or the “Company”), a creator-first holding company and the parent company of Vocal, today announced the integration of a moderation technology powered by Two Hat into Creatd’s flagship technology platform, Vocal.

- Two Hat, acquired by Microsoft (MSFT) in 2021, has emerged as a leading provider of content moderation and protection solutions for digital communities.

- Creatd Establishes Graphic Novel Development Arm and Unveils Inaugural Project-Larry Blamire’s ‘Steam Wars.’ 5/23/22. View press release here.

- Creatd’s DTC Wellness Drink, Dune, Reaches Milestone of 100,000 Bottles Sold; Secures Placement in 130 Urban Outfitters Retail Stores. 5/23/22. View press release here.

- Creatd’s Vocal Onboards Four Key WHE Influencers with a Combined Following of Over 4 Million. 5/20/22. View press release here.

- Creatd Announces Record Reduction of 45% in QoQ Operating Expenses for its First Quarter 2022. 5/16/22. View press release here.

- Creatd Unveils New Integrated Agency Offerings. 5/16/22. View press release here.

- Creatd’s Vocal Platform Releases Highly Anticipated Feature: Comments. 5/12/22. View press release here.

- Creatd to Launch First Original Podcast, Featuring Stories from Vocal Creators. 5/11/22. View press release here.

- Creatd Announces Entry into Print Publishing; Partners with Unbound to Publish First Book of Vocal Stories. 5/10/22. View press release here.

- Creatd Ventures’ Camp Reaches Milestone; Sells 45,000 Boxes & Secures Placement on New Online Wholesale Marketplaces. 5/9/22. View press release here.

- Creatd’s WHE Agency Increases Audience Reach by 26 Million Since Start of 2022; WHE’s Brand Partnerships Expand Along with New Talent Acquisitions. 5/6/22. View press release here.

- Dune, the Creatd-Owned Wellness Drink, Launches at LA-Based Erewhon Market and Sells Out at Urban Outfitters. 5/5/22. View press release here.

Sec-Filings:

- S-3/A – Securities Registration Statement (simplified form). 05/23/22. View sec-filing here.

- 4 – Statement of Changes in Beneficial Ownership. 5/18/22. View sec-filing here.

- 8-K – Current report filing. 05/17/22. View sec-filing here.

- 10-Q – Quarterly Report. 5/16/22. View sec-filing here.

- 8-K – Current report filing. 05/13/22. View sec-filing here.

- S-3 – Securities Registration Statement (simplified form). 5/13/22. View sec-filing here.

CRTD hit $0.02 below my dip zone ($1.05-$1.13) at $1.03 but was able to reclaim it, and move +$0.14 (+13.33%) to high of day (HOD) $1.19, and closed at $1.095. It’s been a week of forming higher lows, after breaking the downtrendm and we’re getting closer. Once the volume pours in, this is setup to run. If there is a pullback, the dip zone might be ($1.04-$1.07). We didn’t make any significant moves, therefore the swing continues. The next leg up is $1.25-$1.50 levels, and then $1.75-$2. We’re taking this day by day. This is a multi-week swing to $6+. We also got news today, “Creatd Ventures Provides Post-Acquisition Update on its DTC Wellness Brand, Basis; Surpasses Expectations With Record Quarter Projected.” 6/1/22. View press release here.

BKSY

BKSY was a swing setup from 5/26/22 and it hit just $0.02 below my dip zone and reclaimed the dip zone ($2.43-$2.58) at $2.41 (✓) premarket. From there it moved +$1.30 (+53.50%) to high of day $3.73 intraday, closing at $3.27. If there is a pullback, the dip zone may be at ($2.95-$3.17). To trigger SSR for Wednesday 6/1/22 and Thursday 6/2/22, it needs to drop to $2.94, and that dip needs to get eaten for a bullish move up to $4+. This is a multi-week swing to $6.

Day’s Volume: 17,875,682

Average 10 Day Volume: 29.53M

Day’s range: $2.70-$3.15

Closing Price: $2.81

Short Interest: 0.53%

Analyst PT: $6

Catalysts:

- BlackSky Awarded 10-Year Electro Optical Commercial Layer (EOCL) Contract with U.S. Government. 5/25/22. View press release here.

- “Contract with options is valued up to $1.021 billion over the course of the 5-year base period of performance and the five 1-year option periods for imagery from current and future satellite constellations.”

- BlackSky Reports First Quarter 2022 Results. 5/11/22. View press release here.

- First Quarter Financial Highlights:

- Record revenue of $13.9 million, up 91% from prior year period

- Imagery & software analytical services revenue improves 63% over prior year’s quarter

- Net loss of $20.0 million

- Adjusted EBITDA loss of $9.5 million

- Cash balance at the end of March 2022 was $138.4 million

- Capital expenditures of $13.4 million

- First Quarter Financial Highlights:

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K/A – Current report filing. 5/25/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K – Current report filing. 5/25/22. View sec-filing here.

- 4 – Statement of changes in beneficial ownership of securities. 05/12/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/11/22. View sec-filing here.

- 8-K – Current report filing. 5/11/22. View sec-filing here.

- 10-Q – Quarterly report pursuant to Section 13 or 15(d). 5/11/22. View sec-filing here.

- BlackSky to Participate at the 17th Annual Needham Technology and Media Conference. 5/6/22. View press release here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/2/22. View sec-filing here.

- 10-K/A – Annual report pursuant to Section 13 and 15(d). 5/2/22. View sec-filing here.

BKSY sat at my dip zone ($2.95-$3.17), but eventually broke below, and faded to a low of day (LOD)$2.70, triggering SSR (Short Sale Restriction) for Thursday 6/2/22, and closing at $2.81. If there is a pullback, the dip zone may be at ($2.69-$2.79). The next leg is to reclaim $3-$3.25 levels, consolidate, and then claim $4 levels. This is a multi-week swing to $6.

NILE

NILE hit $0.0150 above my dip zone at ($0.3150-$0.3350) at $0.35 (✓) and moved +$0.0685 (+19.57%) to high of day $0.4185 after hours. If there is a pullback, the dip zone may be at ($0.35-$0.3775). This is a multi-week swing until we’re back above $0.75.

Day’s Volume: 27,331,841

Average 10 Day Volume: 19.81M

Day’s range: $0.3775-$0.4384

Closing Price: $0.4225

Short Interest: 4.55%

Analyst PT: High PT: $6.25, Low PT: $4.00, Average PT: $5.13

Catalysts:

- BitNile Holdings Issues May Bitcoin Production and Mining Operation Report. 6/1/22. View press release here.

- BitNile Announces Revised Pricing of Public Offering of Shares of 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock. 6/1/22. View sec-filing here.

- 8-K Report of unscheduled material events or corporate event. 6/1/22. View sec-filing here.

- Gresham Worldwide, a BitNile Holdings Subsidiary, Booked New Orders Exceeding $8.6 Million in the First Quarter of 2022. 5/26/22. View press release here.

- 4 Statement of changes in beneficial ownership of securities. 5/26/22. View sec-filing here.

- 8-A12B Registration of certain classes of securities 12(b) of the Securities Exchange Act. 5/26/22. View sec-filing here.

- Form of prospectus disclosing information, facts, events covered in both forms 424B2, 424B3. 5/25/22. View sec-filing here.

- BitNile Holdings Reports Q1 2022 Financial Results, Including Revenue of $33 Million, up 148% From the Prior First Fiscal Quarter. 5/23/22. View press release here.

- BitNile Holdings Announces its Subsidiary, BitNile, Inc., Now Owns 100% of Alliance Cloud Services, LLC, Which Owns and Operates the 617,000 Square Foot Michigan Data Center. 5/12/22. View press release here.

- BitNile Holdings Reports Preliminary Q1 2022 Financial Results Including Revenue of Approximately $32 Million, up 142% From the Prior First Fiscal Quarter. 05/9/22. View press release here.

- BitNile Holdings Issues April Bitcoin Production and Mining Operation Report. 05/2/22. View press release here.

NILE hit my dip zone ($0.35-$0.3775) at $0.3775 (✓) and moved +$0.0609 (+16.13%) to high of day $0.4384 intraday. If there is a pullback, the dip zone may be at ($0.3725-$0.3925). This is a multi-week swing until we’re back above $0.75. Be cautious at these levels since it’s ran over 100% and due for a healthy pullback before the next leg up.

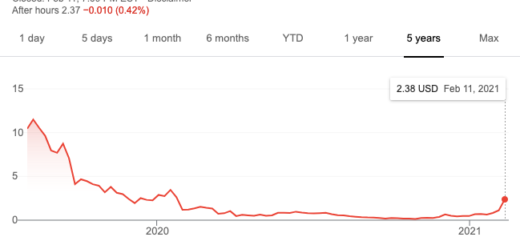

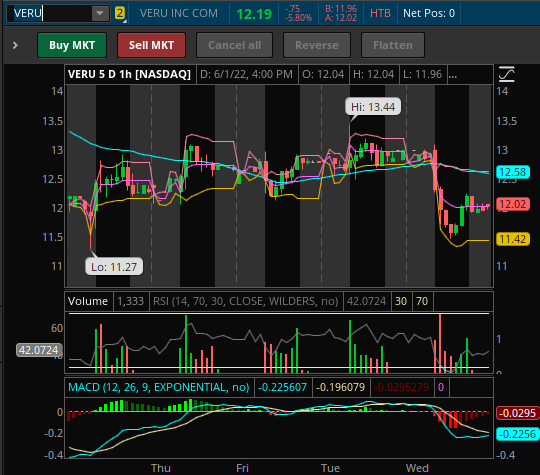

VERU

VERU hit my dip zone ($12.45-$12.65) to $12.60 (✓) premarket and moved up +$0.84 (+6.67%) to high of day $13.44 premarket, pulling back -$0.97 (-7.22%) to a low of day (LOD) $12.47 intraday, hitting my dip zone again ($12.45-$12.65), and closing at $12.94. If there is a pullback, there may be a dip zone at $12.60-$12.80.

Day’s Volume: 6,278,911

Average 10 Day Volume: 13.74M

Day’s range: $11.46-$12.89

Closing price: $12.19

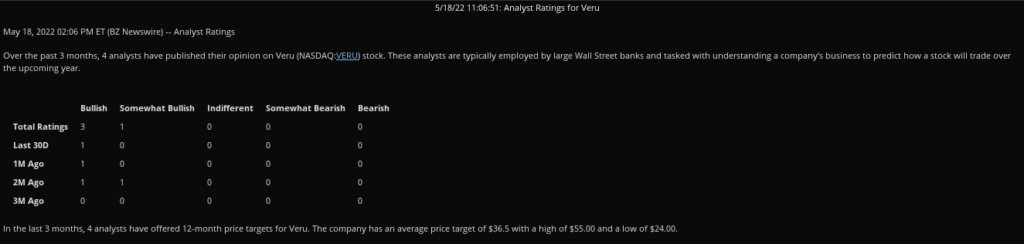

Short Interest: 27.81%

Analyst PT: $24-$55, Average PT: $36.50

Catalysts:

- Veru to Present Three Presentations at the 2022 American Society for Clinical Oncology Annual Meeting on June 3-7. 5/31/22. View the full press release here.

- Veru to Participate in Fireside Chat at the Jefferies Healthcare Conference on June 8, 2022. 5/25/22. View the full press release here.

- Veru Announces Appointment of Joel Batten to Lead U.S. Infectious Disease Franchise to Focus on Hospitalized COVID-19 Patients. 5/18/22 View the full press release here.

- Veru to Present at the H.C. Wainwright Global Investment Conference on May 24th 2022. 5/17/22. View the full press release here.

- Veru Reports Second Quarter Fiscal 2022 Results and Progress of Sabizabulin for COVID-19 Toward a Request for Emergency Use Authorization. 5/12/22. View the full press release here.

- FDA States that Veru Should Submit Request for Emergency Use Authorization (EUA) Based on Positive Efficacy and Safety Data from the Phase 3 Clinical Study of Sabizabulin in Hospitalized COVID-19 Patients. 5/11/22. View the full press release here.

- FDA Has Granted Veru a Pre-Emergency Use Authorization (EUA) Meeting Date for Positive Sabizabulin Phase 3 COVID-19 Study. 5/2/22. View the full press release here.

- Veru Announces Oral Late-Breaking Presentation of Phase 2 Data of Sabizabulin for the Treatment of Hospitalized Severe COVID-19 Patients at High Risk for Acute Respiratory Distress Syndrome at the 32nd European Congress of Clinical Microbiology & Infectious Diseases. 4/25/22. View the full press release here.

- Veru’s Novel COVID-19 Drug Candidate Reduces Deaths by 55% in Hospitalized Patients in Interim Analysis of Phase 3 Study; Independent Data Monitoring Committee Halts Study Early for Overwhelming Efficacy. 4/11/22. View the full press release here.

VERU hit my dip zone at ($12.60-$12.80) at $12.76 (✓) but only moved +$0.31 (+2.43%) before fading to a low of day $11.46, and triggering SSR for Thursday, 6/2/22, and closing at $12.19. If there is a pullback, there may be a dip zone at $11.60-$11.80.

RDBX

RDBX hit $0.10 above my dip zone ($6.92-$7.15) at $7.25 (✓), and from there, it moved +$0.62 (+8.55%) and hit high of day (HOD) $7.87 intraday, pulling back to low of day $6.23, and closing at $6.72. We are sitting at the dip zone ($6.40-$6.60).

Day’s Volume: 9,694,176

Average 10 Day Volume: 25.11M

Day’s range: $5.02-$6.89

Closing Price: $5.61

Short Interest: 33.28%

Catalysts:

- Redbox Entertainment Acquires North American Rights to WWII Action-Drama Come Out Fighting. 5/24/22. View press release here.

- DEFA14A Sec-Filing Additional proxy soliciting materials – definitive. 5/13/22. View filing here.

- 10-Q Quarterly report which provides a continuing view of a company’s financial position. 5/13/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- 8-K Report of unscheduled material events or corporate event. 5/11/22. View filing here.

- 425 Filing of certain prospectuses and communications in connection with business combination transactions. 5/11/22. View filing here.

- Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company. 5/11/22. View press release here.

RDBX hit my dip zone ($6.40-$6.60) at $6.40 (✓), and from there, it moved +$0.49 (+7.66%) and hit high of day (HOD) $6.89 intraday, then pulling back again to low of day $5.02, and closing at $5.61. If there is another pullback, the dip zone might be at ($5.30-$5.50).

AGRI

AGRI hit high of day (HOD) $2.87 premarket. AGRI hit my dip zone ($2.68-$2.75) at $2.68 (✓) intraday, then moving +$0.11 (+4.10%) to a high of day $2.79, then fading to low of day (LOD) $2.47, triggering SSR for Wednesday, 6/1/22, and closing at $2.53. AGRI did not make any significant moves today, so the swing continues. If there is a pullback, possible dip zone ($2.45-$2.55). AGRI needs to reclaim $3.25 levels, consolidate, reclaim $4, and consolidate again, for the leg above $5.

Day’s Volume: 1,065,938

Average 10 Day Volume: 11.79M

Day’s range: $2.35-$2.51

Closing Price: $2.42

Short Interest: 0.42%

Analyst PT: $5

Catalysts:

- “AgriForce to Present at the H.C. Wainwright Global Investment Conference on May 25th” 5/23/22. View full press release here.

- “AgriFORCE Growing Systems Completes Acquisition of Food Production & Processing IP from Manna Nutritional Group (MNG)” 5/18/22. View full press release here.

- “Quarterly report pursuant to Section 13 or 15(d) (10-Q).” 5/16/22. View sec-filing here.

- “AgriFORCE Growing Systems Provides Update on Acquisition of Delphy, a Leading European Agriculture/Horticulture and AgTech Consulting Firm.” 5/12/22. View the full press release here.

- AgriFORCE is presenting at “Microcap Rodeo’s Spring into Action Best Ideas Virtual Conference on May 17th.” Management is scheduled to present on Tuesday, May 17, 2022 at 3:00 p.m. ET. The presentation will be webcast live and available for replay https://www.webcaster4.com/Webcast/Page/2882/45580. 5/11/22. View the full press release here.

- Agriculture stocks are a very hot sector due to food shortage, food inflation, and plant/farm explosions. Agriforce is one of the main leaders according to what’s trending across discords and most mentions.

AGRI fell below my dip zone at $2.27 premarket, and then reclaimed my dip zone ($2.45-$2.55) at $2.51, but faded to low of day $2.35 intraday, and closing at $2.42. It did not make any significant moves today, so the swing continues. If there is a pullback, possible dip zone ($2.30-$2.40). AGRI needs to reclaim $3 levels, consolidate, reclaim $4, and consolidate again, for the leg above $5.

AMD

AMD hit low of day $100.04 intraday and high of day $104.55. I’ve mentioned I’ll be continuing this swing, taking it day by day, holding my core position from the $80s. As I’ve mentioned previously, AMD will be announcing lots of news over the summer, so if AMD continues to hold $100 levels, I would long it from here. If there is a pullback, the dip zone might be at $100-$100.75.

Day’s Volume: 99,351,389

Average 10 Day Volume: 130.36M

Day’s range: $99.55-$103.57

Closing Price: $101.22

Short Interest: 2.07%

Analyst PT: High PT: $200, Low PT: $97, Average PT: $137.91

Catalysts:

- AMD Expands High Performance Compute Fund to Aid Researchers Solving the World’s Toughest Challenges. 6/1/22. View press release here.

- World’s First Exascale Supercomputer Powered by AMD EPYC™ Processors and AMD Instinct™ Accelerators. 5/30/22. View press release here.

- AMD Instinct™ MI200 Adopted for Large-Scale AI Training in Microsoft Azure. 5/26/22. View press release here.

- AMD Expands Data Center Solutions Capabilities with Acquisition of Pensando. 5/26/22. View press release here.

- AMD Expands Confidential Computing Presence on Google Cloud. 5/25/22. View press release here.

- AMD Showcases Industry-Leading Gaming, Commercial, and Mainstream PC Technologies at COMPUTEX 2022. 5/23/22. View press release here.

- AMD Chair and CEO Dr. Lisa Su to Keynote at COMPUTEX 2022. 5/20/22. View press release here.

- Statement of changes in beneficial ownership of securities. 5/19/22 View press release here.

- AMD Robotics Starter Kit Kick-Starts the Intelligent Factory of the Future. 5/17/22. View press release here.

- AMD and Qualcomm Collaborate to Optimize FastConnect Connectivity Solutions for AMD Ryzen Processors. 5/17/22. View press release here.

- AMD Enables 4G/5G Radio Access Network Solutions to Support Meta Connectivity Evenstar Program. 5/11/22. View press release here.

- AMD Announces Three New Radeon RX 6000 Series Graphics Cards and First Games Adding Support for AMD FidelityFX Super Resolution 2.0. 5/10/22. View press release here.

- New AMD Ryzen 5000 C-Series Processors Bring Leadership Performance and All-Day Battery Life to Chrome OS. 5/5/22. View press release here.

- AMD Reports First Quarter 2022 Financial Results. 5/3/22. View press release here.

AMD fell below my dip zone by $0.45 and reclaimed the dip zone ($100-$100.75) and moved up +$3.57 (+3.57%) to high of day $103.57. I’ve mentioned I’ll be continuing this swing, taking it day by day, holding my core position from the $80s. As I’ve mentioned previously, AMD will be announcing lots of news over the summer. AMD dropped news as expected, “AMD Expands High Performance Compute Fund to Aid Researchers Solving the World’s Toughest Challenges.” 6/1/22. View press release here. If there is a pullback, the dip zone might be at $98.75-$100.00.

Others to Watch/Trending

- GME

- AMC

- MF

- TNXP

- BBIG

- GGPI

- EFOI

- VRAR

- MULN

- SOS

- PIXY

- GFAI

- SNDL

- SBFM

- BTTX

- IDRA

Oil/Gas Stocks to Watch for a Reversal

If trading oil, make sure you’re monitoring crude oil prices. Load up on red days. If you chase the day it runs, be careful as they’re more volatile. Be careful swinging anything that’s been trading under $1 for greater than 30 days due to delisting/delinquency requirements or reverse splits; I’d keep them as day trades if uncertain.

- INDO – 12.61% SI

- HUSA – 11.14% SI

- ENSV – 4.32% SI

- CEI – 8.51% SI

- USWS – 8.35% SI

- MXC – 4.99% SI

- MARPS – 2.41% SI

- IMPP – unknown SI

Earnings

6/2/22

- CAE

- SPTN

- HRL

- CIEN

- DBI

- LE

- DLTH

- SCWX

- CRWD

- LULU

- RH

- ZUMZ

6/3/22

- BRP

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps as I do spend hours on my research and do not receive compensation via advertising, sponsorships, etc. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.