End of Day Wrap Up 03/02/2021

Happy Tuesday everyone! Today was a good day for GameStop (GME) and Sos Ltd – ADR (SOS) in the early morning, but as the day went on, the stock slowly dropped off as many took their profits. They started picking up again after hours, so tomorrow I’ll be watching for higher support levels to form.

As I’ve mentioned in previous posts, I want GME to accumulate in the $120 range this week, and next week I want to see it accumulate in the $150 range. We may need to trigger SSR tomorrow so we can get another good run up on Thursday, so we shall see. I’ll be looking to add between $106-107 and $94-95 if shorts come out to play. I am holding my positions until March 19-25th at the least. If you saw what RKT did today, then you’ll know that I’m waiting for some good PR from GameStop to launch this forward to gap up past $450. If the brokerages never halted the stock in January, and disallowed buying, some of the CEOs have admitted that GameStop would’ve broke $1000 easily. I also agree with this because I watched the manipulation live, and was locked out of my accounts back in January. This time, I’ll be ready for the ride up.

SOS has a long way to go before it reverses back up to the $10-12 range after that hit piece came out from Hindenburg Research last week. I am swinging long until it hits my price target.

Highlight of the Day: Rocket Companies Inc (RKT)

Rocket Companies Inc (RKT), one of my long positions since its IPO last year jumped 71.19% today. I mentioned a few months ago to accumulate for a long swing, and mentioned again 2 weeks ago as we were approaching their Earnings. Momentum started building over the last few days, and it began gaining popularity amongst Reddit users. Unfortunately, this has also turned into a meme stock, but for those wanting to get in on the fun, there could be more upside potential. However, I want to manage my risks since the last time furus got in with their followers, last year, it destroyed the stock value. I will wait for the hype to die down to find a re-entry point at a later time.

What to Watch for Wednesday 03/03/2021

I will continue watching SOS, GME, HCMC, AMC, ONTX, RKT, along with SRNE, SLS, HTBX, IDXG, VISL, NOVN, FUBO, KXIN, XL, SAVA, SQ, LTNC, GAXY.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 10 Green Positions (03/02/21):

- RKT

- DLOC

- SAVA

- CCL

- SQ

- AHT

- GAXY

- TLRY

- WWR

- SNDL

Top 10 Red Positions (03/02/21):

- HAON

- SANP

- HCMC

- NVAX

- DPLS

- INO

- AIKI

- DPW

- LYL

- OXBR

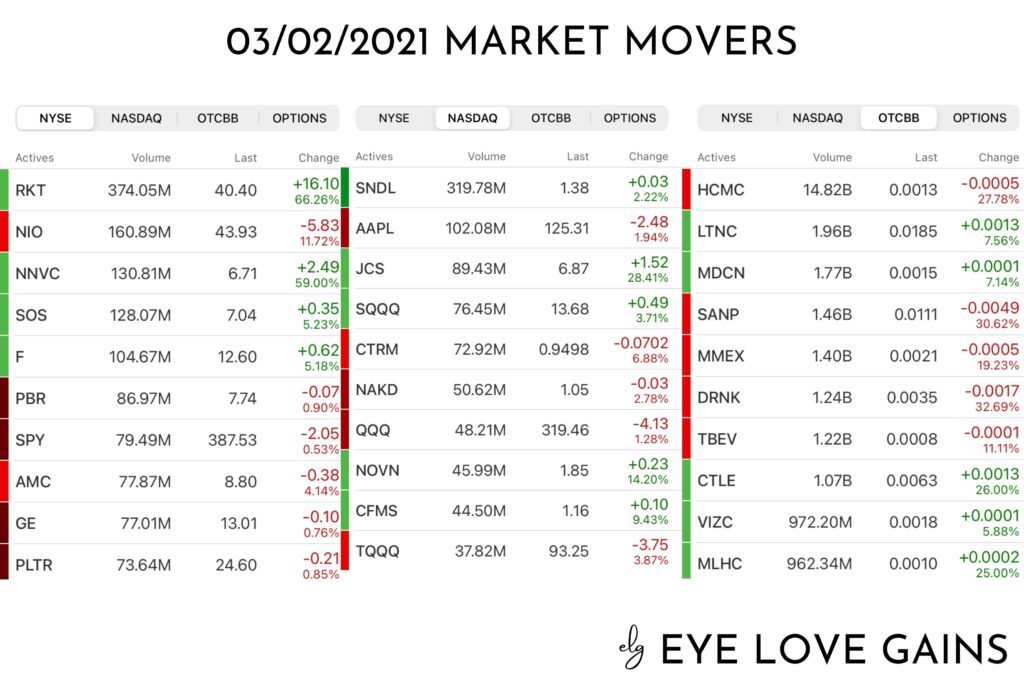

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.