End of Day Wrap Up 02/25/2021

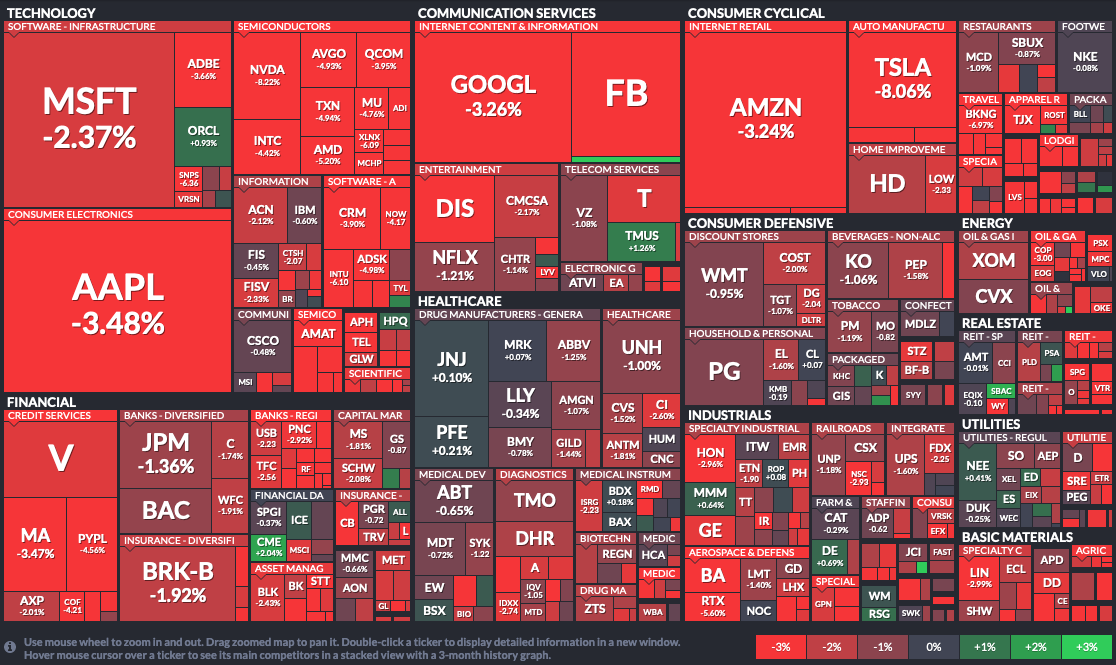

Happy Thursday everyone! Today was another bloody day for 95% of the market. I was down roughly -15-30% in most of my positions today, so it was another day of accumulating for me. Few of my positions did “okay.” I believe the market was red due to news of the 10-year Treasury bond jumping to a one-year high of 1.6%, raising concern for investors across asset classes. You can read the news article here.

Focus on the Larger Picture

During the “crashes” over the last 10 years, the market has always rebounded. If you’re a day trader or a short term swinger, days like today are terrible. If you’re long, then as you can see from years’ past, everything works out in the end. Don’t listen to others when they play the blame game and start spitting conspiracy theories, in hopes of getting their followers to panic sell, all while taking short positions.

When we get a bunch of panic sellers, the market tends to crash. Since many of the larger traders have large followings, you can see how them announcing their exits and going “all cash” can scare their followers into selling.

I had a feeling this would happen, which is why, a few of my rules are to:

1) prepare to exit my positions if a large trader with large followings are pumping a stock or

2) follow their alerts and do opposite of what they want.

I’ve been caught on the wrong side one too many times, so I knew to exit my positions at my personal PT. Risk management is important so if you’re afraid of seeing red, don’t swing and be cautious because many of the big traders are primarily day traders. I swing long 95% of the time, and haven’t day traded in weeks. During a bear market, I will enter the big momentum plays and take smaller positions.

It’s the Meme Stocks’ Fault

Many furus on Twitter were blaming GME and AMC for the market crashing, but I think many are overreacting because it’s beyond “meme stocks.” As with anything, if one is concerned about their money, they can always close out their positions, and choose to re-enter at a later time. No one is going to force anyone to hold a position if that makes them uncomfortable. I stopped scrolling through the Twitter feeds because 90% of the traders with large followings were complaining, spitting conspiracy theories (same as last year), and I just felt like that’s so much wasted energy. Not only does it make me question their authenticity and trustworthiness, but it raises questions on their level of experience. Experienced traders know how to switch gears and adapt to the market. Amateurs tend to complain, wasting time scaring their followers, instead of making money. It would be a good time to take a break from trading if you find yourself becoming over-emotional. You will start making poor decisions, and that will cause you to become more upset.

Example) I follow larger traders who are notorious for taking short positions.

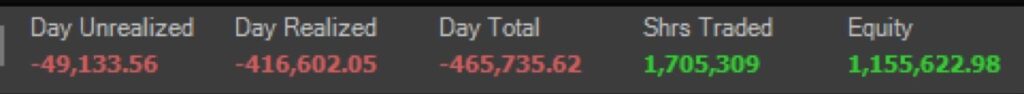

Shorts that got Burned

One short in particular lost millions so far this year, and it was because he didn’t manage his position size appropriately, became over-emotional, trying to make up for lost gains, switching long to short, short to long, and long to short again. There was no strategy, no structure, and that’s why he lost so much in GME.

Other traders I follow, lost a ton of money last month during the squeeze, but one knew better than to let their pride get in the way.

Taking a short position is dangerous because you can lose more than 100%. This is why it’s important to look at the whole picture when analyzing a chart’s movement.

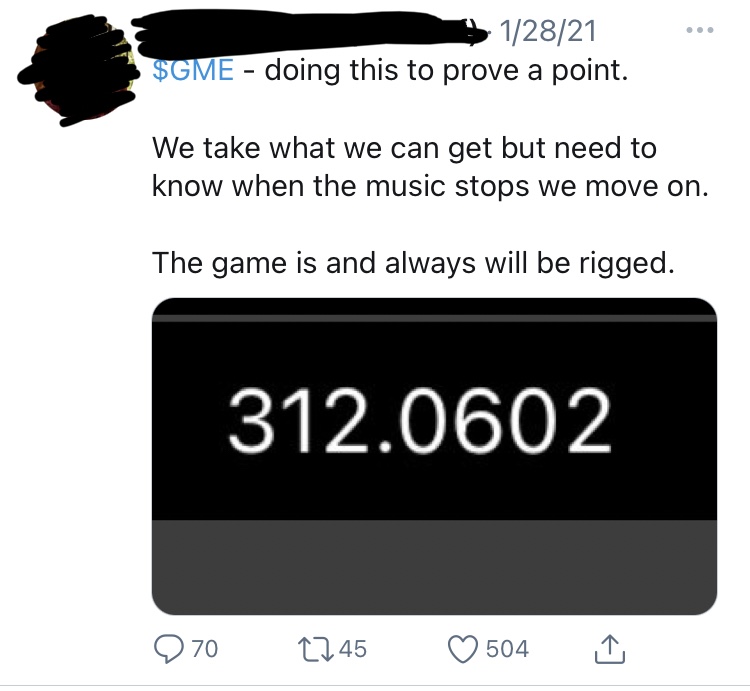

GME is NOT the Stock to Short

Why would I say this? Trading is all psychology, and it’s important to understand the mentality behind why people would choose to invest in GameStop.

- GameStop has a loyal following, consisting primarily of gamers who want to invest, NOT day traders. Gamers who have a lot of money, money they are willing to throw away to achieve their goal. They have it set in their mind that they are not selling because they want to invest in the company. This is like a game and they have planned everything down to the T, strategizing and re-strategizing until they get the end result that they want.

- The people who chose to buy GameStop are aiming to create an even larger gamma squeeze than last month. The people buying are not just everyday people; institutions are buying too.

- The support is BEYOND just buying stocks. These individuals have gone to the full extent of making purchases from GameStop stores and posting proof of purchases all to create a movement, to ensure that GameStop will have a better than expected earnings report, which will be reported on 03/25/2021, and to make a statement to hedge funds who have done nothing but hurt companies and investors over the years.

- GameStop Options bet that stocks will reach $800 within the next 3 weeks. Read about it here.

- GameStop short-sellers have lost $1.9 billion in just 2 days amid the stock’s latest spike. Read about it here.

Highlight of the Day

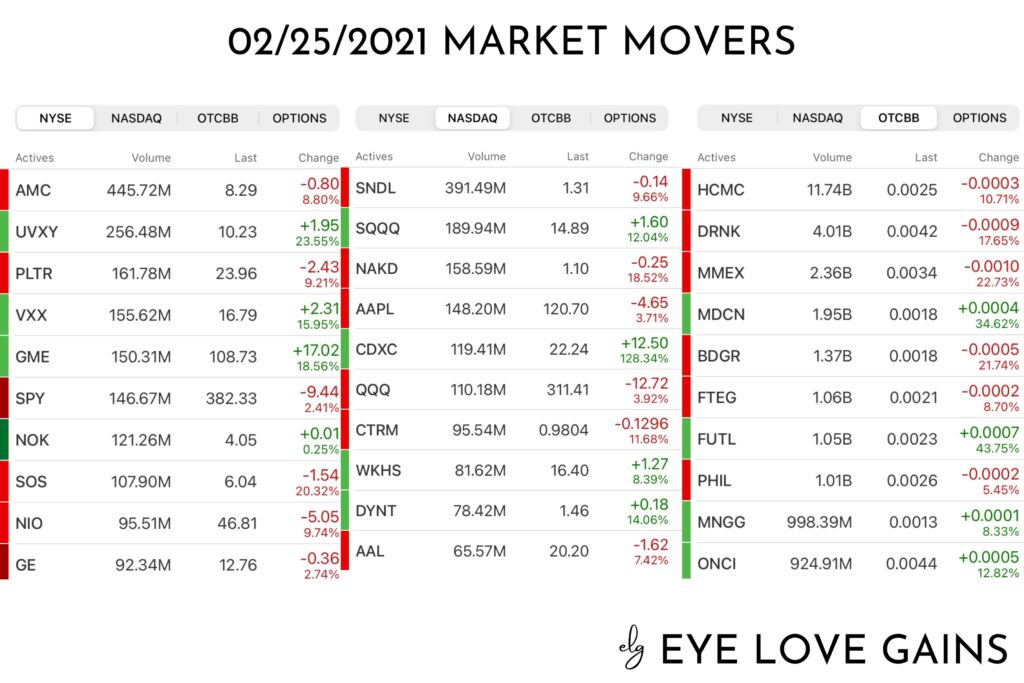

GameStop Corp

My goal for today was for GME to hold above the $100 level for the run. In the coming weeks, I’ll be watching for higher support levels to form above $70. Once that’s established, then on the next run, I’ll be looking for a support level above $90 and so on. Many will lose patience and sell at a loss, which is what I’m betting on. Once that happens, I’ll add again for the next run.

My sell off buy of WKHS from 2 days ago automatically hit my sell limit today at $19.50 from my initial entry at $12.90. I made the call to buy because it met my requirements for a ‘selloff dip buy,’ same thing as my LKCO selloff play from last month. As each of my swings hit their PT, it frees up more cash so I can buy more bottom plays on red days.

What to Watch for Tomorrow

It may be another red day due to it being a Friday and many people do not like holding over weekends. I will be watching GME, AMC, SANP, HCMC, SOS and my other positions. I will be out most of the day as I’ll be on Zoom meetings and seeing my appointments for most of the day. I hope everyone sees a green Friday before heading into the weekend. Since we’re in a bear market, tread lightly, and be safe with your plays. Trade the chart in front of you and drown out the noise. If you have confidence in your positions, and you’re long, it will all work out in the end.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 3 Green Positions (02/25/21):

- GME

- WKHS

- OXBR

Top 10 Red Positions (02/25/21):

- ONTX

- SOS

- HCMC

- SANP

- NAKD

- PHUN

- CSCW

- NXTD

- WORX

- OCGN

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.

Good stuff lady.

Have a great weekend.

I just wanna say that out of the many stock people I follow you are the only one who stays positive. I usually always apply you’re thinking of buy the dip. Sadly I do not have the buying power for these massive sales rn and I am in the red but I know my stocks are great companies. And like you always say buy when no one wants to. I use to think that was a dumb thinking until I saw you post your wins.

the comment posted before i could finish lol. I basically just wanted to conclude that I although I took a loss with AMC the first round I’m learning very quickly how the market works and plan to continue my learning for success. And you are the one that has kept me positive during these red days😁😁