End of Day Wrap Up 02/26/2021

Finally a greener day to end the week. Hopefully the next few trading days will be better, especially after a painful red week for many of us. Ocugen (OCGN), GameStop (GME) were my my top gainers for the day before the big drop.

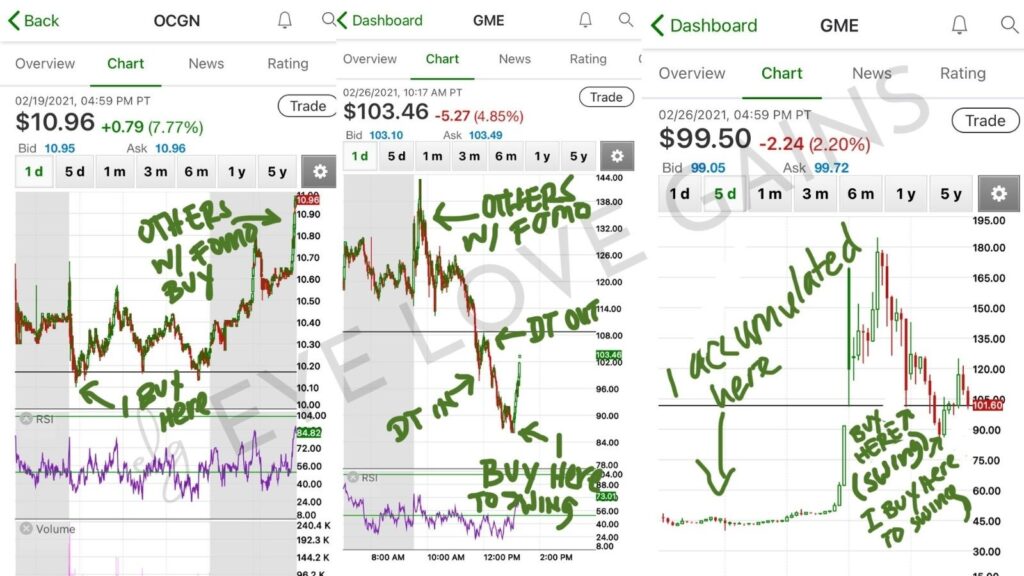

How I Catch Dips on GameStop (GME)

I had pre-set my buy limit the morning of, as I expected shorts to come in full force for GameStop. I know some riskier shorts who tend to get squeezed out in the past were trying to short to $70, but that’s an extremely risky play. Remember, trading is ALL psychology. It’s like the game of “chicken.”

I stuck to my basic strategy, and I was able to catch the $86-87 dip, as I predicted. Every chart is different. Every play is different. You cannot apply the same method to each chart. Because I’ve been in GameStop since last year, I’ve noticed a pattern, and I stick to that pattern. I will accumulate dips as long as it’s trading within VWAP. We NEVER want support to break. However, this is what I do..

When GME Breaks Support Levels:

Previous Day’s Closing Price x 0.8 (-20%) = Preset Buy Limit

Example) GameStop Previous Day’s Closing Price: $108.73

Calculation: $108.73 x 0.8 = $86.98 (Preset Buy Limit)

Highlight of the Day

GME & OCGN

OCGN had a beautiful run up, closing at $10.95. Many ask how to trade OCGN.. so I wanted to share the chart from 02/19/2021 to give some of you an idea of what I do. I DO NOT chase, and I am very careful if a position has ripped above 20%, rather than grow with a nice slow uptrend throughout the day because I know that’s what shorts are looking for.

My goal was for GME to continue holding above the $100 level for the run. In the coming weeks, I’ll be watching for higher support levels to form above $120. Once that’s established, then on the next run, I’ll be looking for a support level above $150 and so on. Many will lose patience and sell at a loss, which is what I’m betting on. Once that happens, I’ll add again for the next run.

Why I’m Holding GME

First and foremost, I’ve been long in GameStop. This whole battle between the institutions is just icing on the cake at this point. I had a stinking suspicion that something was going on behind the scenes because of the unusual buys showing on the red tape. I didn’t mention anything since people are so sensitive about the whole GameStop situation. I want everyone to do their own DD, but I’ll share some interesting YouTube videos that I feel are unbiased and have confirmed much of what I’ve concluded as well based on all the DD I’ve done. You can watch all their videos, but I’ll share a few here:

March 19th

Are Options Driving GME Higher?

Shareholders Are Here for the Ride for GME

GME is NOT the Stock to Short

Why would I say this? Trading is all psychology, and it’s important to understand the mentality behind why people would choose to invest in GameStop.

- GameStop has a loyal following, consisting primarily of gamers who want to invest, NOT day traders. Gamers who have a lot of money, money they are willing to throw away to achieve their goal. They have it set in their mind that they are not selling because they want to invest in the company. This is like a game and they have planned everything down to the T, strategizing and re-strategizing until they get the end result that they want.

- The people who chose to buy GameStop are aiming to create an even larger gamma squeeze than last month. The people buying are not just everyday people; institutions are buying too.

- The support is BEYOND just buying stocks. These individuals have gone to the full extent of making purchases from GameStop stores and posting proof of purchases all to create a movement, to ensure that GameStop will have a better than expected earnings report, which will be reported on 03/25/2021, and to make a statement to hedge funds who have done nothing but hurt companies and investors over the years.

- GameStop Options bet that stocks will reach $800 within the next 3 weeks. Read about it here.

- GameStop short-sellers have lost $1.9 billion in just 2 days amid the stock’s latest spike. Read about it here.

What to Watch for Monday 03/01/2021

I will be watching GME, AMC, SANP, HCMC, SOS and my other positions red positions. I am excited to see what happens with the market. Anything can happen, so if you’re in doubt, sit it out or trade small. I wish everyone has a greener week.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 10 Green Positions (02/26/21):

- OCGN

- RKT

- SPI

- CSCW

- NVAX

- CCL

- FCEL

- VBIV

- FRX

- GTEC

Top 10 Red Positions (02/26/21):

- SOS

- BLIAQ

- ONTX

- HCMC

- GME

- OXBR

- AHT

- ATOS

- GAXY

- CANF

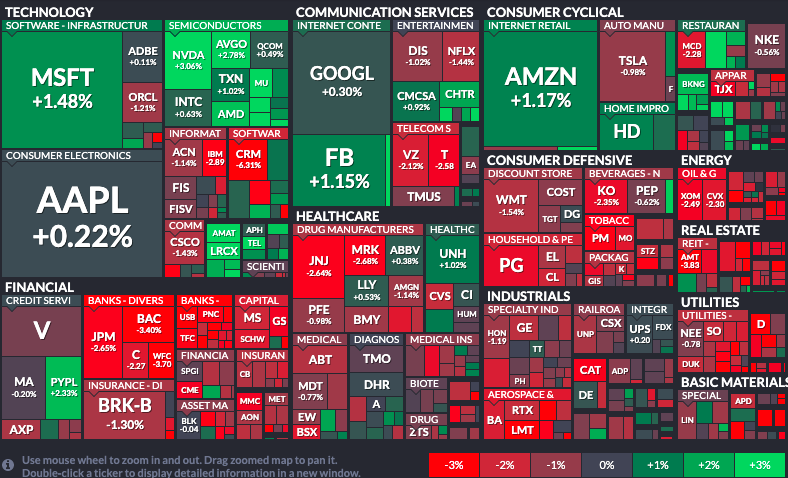

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.