What is a Short Ladder Attack?

What Is It? Is it real?

Most recently, the terminology has been thrown around since many haven’t paid enough attention to notice it’s been happening for a long time. No one thought anything of it, so there was never an actual term for the strategy. A short ladder attack is a highly detailed strategy that is used by traders to buy and sell with the goal of dropping the value of the stock. It’s said to be used for helping hedge funds grow their assets quickly. The intent is to manipulate the laws of supply and demand by essentially flooding the offer side with fake shares.

Who Do They Target?

Companies operating under extremely difficult circumstances, especially during this pandemic, are typically the key targets.

Example

Lucifer sells a fake share at $16. Crowley buys that same $16 share. Crowley will then offer a fake share at $15. Lucifer will buy that offer and Crowley will come down and hit Lucifer’s $15 bid. Lucifer then buys that share for $15, covering its open $16 short and take the $1/share profit. Lucifer and Crowley will continue to double team until the stock price drops down to their intended target.

What’s The Goal?

Shorts can flood the market with an attack of fake offers, which will then overwhelm the demand on the buying side. By driving down the price, it makes the stock less desirable to retail investors, therefore investors who claim to have diamond hands turn into traders with paper hands. *womp womp* These hedge funds may even go to the full extent of putting the companies into bankruptcy due to this maneuver. If they accomplish this, they never need to transfer those fake (counterfeit) shares that they used to short the stocks into real shares. Therefore, the capital gains tax are no longer relevant.

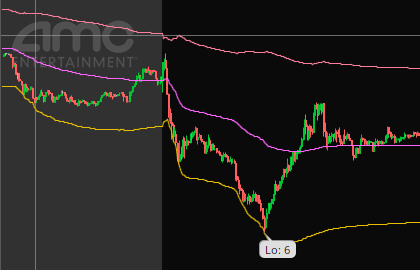

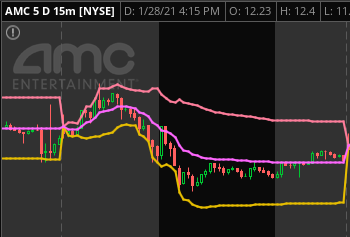

What Does it Look Like?

Here’s AMC as a reference:

The huge drop on 02/02/2021 also include factors such as Robinhood limiting the amount of shares traders were allowed to buy, contributing to the drop in price.

The huge drop on 01/28/2021 also include factors such as Robinhood, TD Ameritrade, Charles Schwab, Webull, and other brokerages not allowing people to buy and platforms being down during this time.

Should You Sell?

That’s completely up to you. Before entering any type of trade, you should always do your due diligence. If you’re investing long, the end goal should still be the same, and today’s prices should not matter. If you’re day trading, and you’re down, you should have already cut losses within the first 5%. If you’re swinging, and you’re down, you should have averaged down at the steep drops on red days, and once you’re up, reposition or exit the trade. Whatever you decide, just make sure you stick to your strategy so you don’t make emotional decisions.

Many deny this is an actual strategy. Many others believe that it is. Both sides have valid arguments. What are your thoughts?

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.