End of Day Wrap Up 02/02/2021

Today’s Highlights:

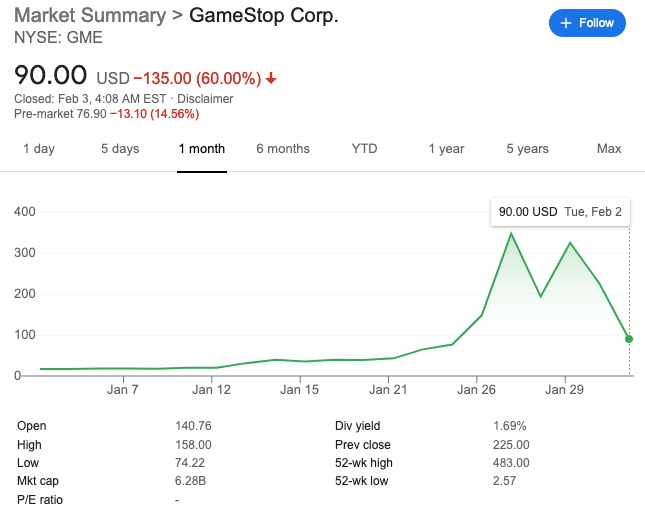

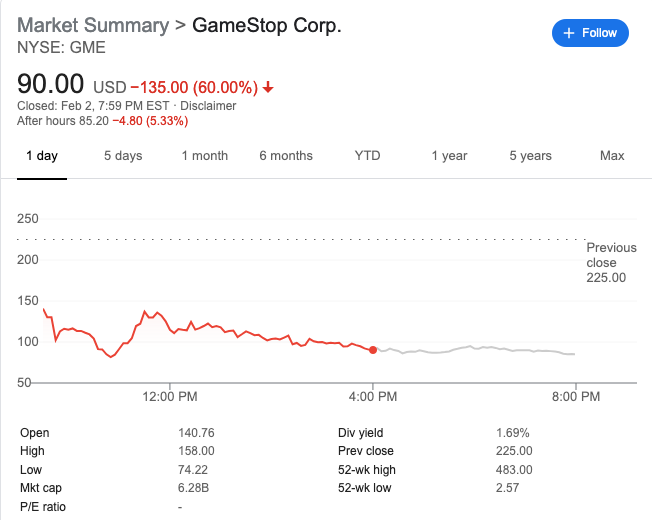

Today was a pretty tough day, but we will make it out alive long term. GameStop and AMC were the top 2 biggest sell offs today. AMC looks to be getting a short ladder attack, filled with naked shares to drive the price down lower. Dave Portney announced that he sold all his positions for a $700k loss. Many larger traders also exited their positions. I am still holding my full positions long, and have been accumulating all the big dips. Once the hype around Hedge Funds vs. the Retail Traders dies down, we can go back to being unwanted again so we can move back up slowly over time (or so I hope).

Check the charts out for yourselves:

What I’ll Be Looking For Tomorrow (02/03/21):

I will be watching for AMC, GME, and SNDL to make a small comeback since they’ll be under the Short Sale Restrictions (SSR), This is typically triggered when a stock goes down more than 10% from its prior close. The SSR remains in effect for the rest of the trading day and will remain on for the following trading day as well.

Top 10 Green Positions (02/02/21):

- SAVA

- OCGN

- VTVT

- TLRY

- ATOS

- HEXO

- ACB

- BNGO

- SPI

- CANF

Top 10 Red Positions (02/02/21):

- GME

- AMC

- NAK

- INO

- SNDL

- PHUN

- CTRM

- AHT

- NOK

- IBIO

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.