End of Day Wrap Up 02/18/2021

Happy Thursday everyone! Today was another bloody day as I mentioned I expected another red day in yesterday’s blog post here. It was red all across the market with my watchlists being only 5% green and 95% red, which is quite telling. I was accumulating to continue building my positions for the future months. This is the reason it’s so important to size positions properly and never to go all in. We can never predict what will happen, so it’s best to stay on the more cautious side when trading.

Highlights for the Day

After a long six months, ONTX has finally broke above $1.50 after hours. As usual, I am swinging this position long.

My newer swing position KKUR was up 33.33% today, so we shall see if there will be a continuation tomorrow.

Expectations for Tomorrow

Tomorrow I am expected a greener day than the last two trading days. However, because it’s a friday, anything can happen. Typically, people do tend to sell off their positions heading into the weekend. If it continues to be red, then I may sit on my hands until next week.

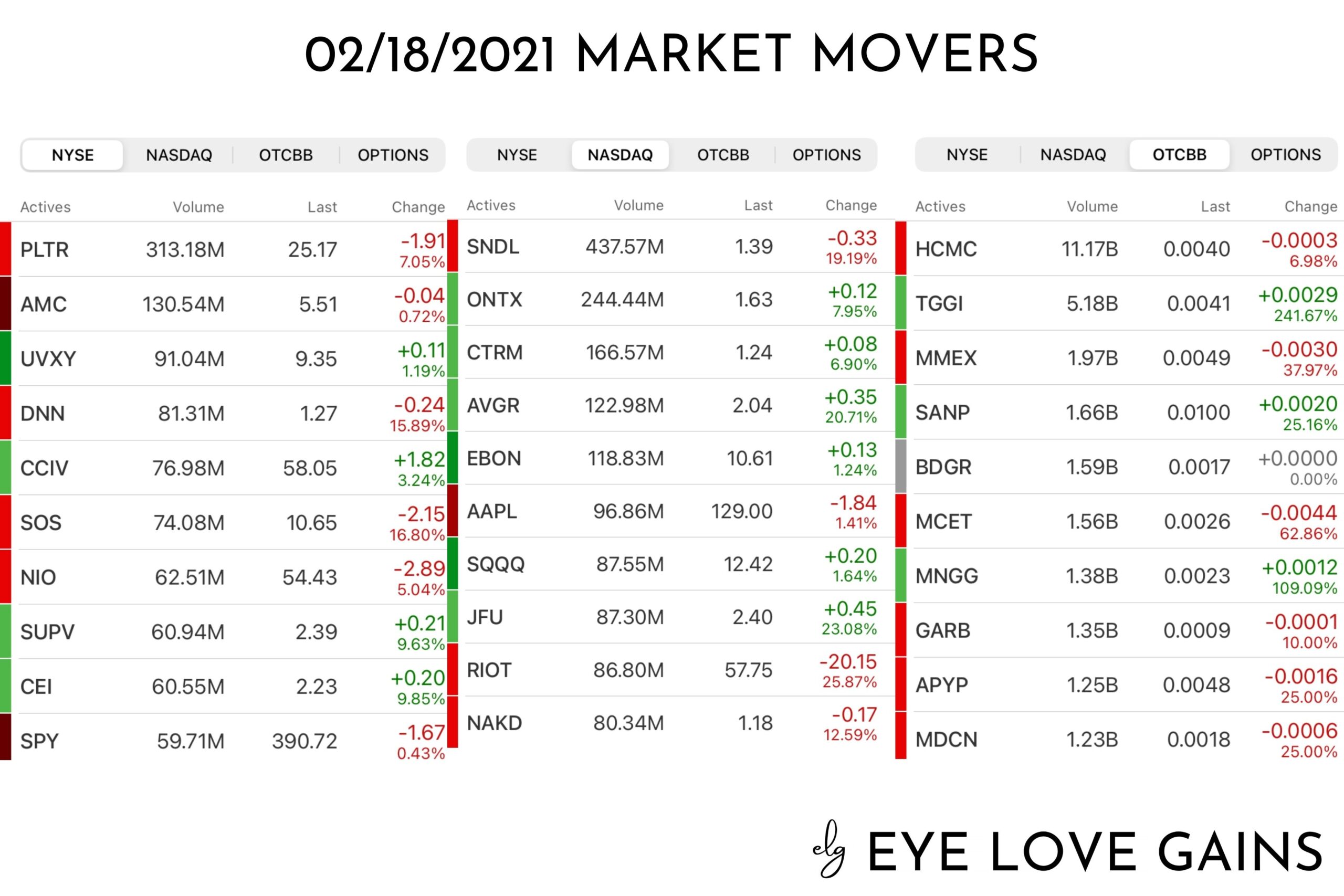

I will be watching the following market movers:

- CTRM, with 166.57M in volume, for a reversal heading into next week, as it was one of the few green positions today

- JFU, with 87.30M in volume, looks like it’s ready for a reversal back up as well

- SQQQ, with 87.30M in volume, looks ready for a reversal back up

- HCMC, with 11.17B in volume, consistently remaining as a top market mover over the last few weeks, needs to hold above $0.004 to establish new support levels

It Will Work Out in the End

If you had a red day today, know that it will be okay. Just be patient, and trust in your DD. When it’s an ugly red day, it doesn’t make sense to sell your positions, especially if you’re investing. It’s always best to accumulate and add to your position. If you think of it as a Black Friday sale, then that should put you at ease. It’s never fun to see red, but pullbacks do happen, and they need to happen if we want there to be bullish runs. Stocks can’t go up all the time, and if it does, they tend to fall down sharply, and that’s not fun for anyone.

I’m optimistic that the coming months will be greener. If you can’t find your green on the screen, go outside and find your green outdoors. It’s healthy for us to take a step back and enjoy mother nature. By clearing your mind, it will allow you to see a different perspective, and make you a more patient trader.

How to Utilize My Positions List Below

Many ask how to utilize my top 10 green/red position lists below. Oftentimes, I will exit my green swing positions if it looks like there will be no continuation. My decision varies depending on what my cost price is. It’s all about managing risks, and if it looks like I’ll be in a position where, I’ll be down, I won’t hold, and will choose to reposition myself by accumulating dips on red days over a period of time until it’s ready for the next run.

To Buy On Green Days or Not

I will add to my green positions on green days only if it’s moving in the direction I like and forming higher lows, and showing a bullish chart. I make sure to scale when adding, especially on green days, because it can go south quickly.

To Buy on Red Days or Not

I will almost always accumulate my red positions because they usually move back up, unless it’s a clear pump and dump, which I will never swing because it’s too risky. If there are sharp spikes and a quick drop down, then it’s a clear pump and dump. If the chart slowly drops in price throughout the day, then that’s usually people taking profits. To make the call on re-entering or accumulating, I look at the 5D, 10D, 30D, 90D, 180D charts and I monitor the volume. I love adding when there’s little to no volume when setting up long swings.

Top 10 Green Positions (02/18/21):

- KKUR

- ONTX

- CTRM

- NVAX

- KERN

- DLOC

- SNPW

- ATIF

- OXBR

- RKT

Top 10 Red Positions (02/18/21):

- MMEX

- ECEZ

- NXTD

- SSOK

- FCEL

- GAXY

- SNDL

- RCON

- GTEH

- HAON

I monitor Market Movers every single day to scan for new setups. I mainly look for positions with unusual volume that are at the bottom, ready for a reversal back up, or if they remain green, I look for a bullish chart for a continuation.

As always, if you made some massive gains, be sure to support your local and small businesses. Be the change you wish to see in the world. Believe it or not, we can make a difference in keeping these businesses open!

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.

Hello Anna, big fan of yours and love getting your tweets throughout the day. They always strengthen my resolve.

You mention your daily scan involves looking for stocks with unusual volume that are at the bottom and ready for a reversal. Would something like below be a good starting point?

https://finviz.com/screener.ashx?v=211&s=ta_unusualvolume&f=sh_price_u10,ta_change_d&ft=4&ta=0

In case the link does not work, it’s a FinViz scan with filters: Unusual Volume, Change = down

Thanks for your time as I know you are very busy!