End of Day Wrap Up 01/29/2021

Retail Traders v. Wall Street Round 3

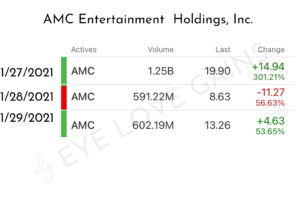

Today was redemption day for many traders who continued to hold onto GME, AMC, and many others. It is another day I will remember for a long time because the trading community came together to respond back in full force. We all know what happened on 01/29/2021. If you don’t, then you can read more about it here. Some brokerages saw the impact of their decisions, and many reversed course because the people fought back and started rolling their money out.

Robinhood, however, seemed to do the opposite. They decided to take a step further by limiting the amount of shares their traders/investors were allowed to buy. Robinhood sent out letters shifting the blame, and then eventually reversed course (somewhat). By that time, it was a little too late. The damage was already done, and the trading community stood together to help guide fellow traders towards other brokerages.

Here’s the Letter Robinhood posted in their blog:

AMC and GME Short Squeeze Rebellion

We the people showed brokerages and hedge funds that together, we can be powerful. Nearly every news station was talking about this movement. Many even started saying to sell and bashing the whole movement. Guess what happened? We banded together and started buying more. When you take food off of someone else’s table, we won’t just sit back and allow you to do so. At least, not me. I could have sold at the peak, I could have ignored the problem, and focus on other trades, but that’s not who I am as a person.

With HALF the volume, without our furus with 50k+ followers on our side, and without Robinhood traders, we were able to come out on top by the close of Friday for a bullish run into this upcoming week. Once Robinhood traders settle in with their new brokerages, hedge funds and shorts won’t know what hit them.

Be the Bull Everyone Needs When Others are Bears

There are people who got trapped, people who were seriously hurt financially due to the decisions of many of these brokerages. If I pulled my positions out, I would only be contributing further to the damage. ESPECIALLY when they won’t allow you to buy back your shares by placing limits on the amount you’re allowed to buy. So, I woke up after sleeping only an hour and a half to buy more from the time the market opened at 1AM PST/4AM EST on Friday 01/29/2021. I tried to buy as much as I can at every large dip. I wanted to be a part of the solution because I have a following who needs someone to be a bull when everyone else was choosing to be a bear by opening up short positions and then tweeting out to their followers how dumb it was that people were not selling.

I’ve studied the psychology of most of the larger traders with over 50K followers. I noticed how they’re bulls when it’s convenient for them, and then like a switch, they become bears. This is how I know they’ve decided to take a short position. Many of their followers were confused because they wanted to be a part of this “revolution.” They were being pulled in so many directions because all of a sudden, everyone wants them to switch over to SPAC and Silver plays. Guess what? Half your followers were most likely down, and then you wanted them to switch over, selling at a loss when the momentum was clearly shifting back up. I went against what was popular, and I continued to be a bull. As long as I have a voice and a platform, I won’t let any of my followers sell at a loss. Their loss is my loss, their win is my win. Together, we’re united, and we’re powerful when we fight together against one common enemy.

Bears Switched Back to Being Bulls

Today, on Sunday 01/31/2021, many of the larger traders changed their tones and are back to being Bulls for GME and AMC. Some traders updated their blogs revealing that they did, indeed, take short positions. I wasn’t surprised, but I wanted to see some of them admit it. It’s okay to be wrong, but to be a good trader, you need to learn humility and accountability, and know when to admit when you’ve made a bad call. The power of retail traders, the reddit community, and gaming community is more powerful than the everyday trading community. I recognized this long ago, because I monitor patterns and irregularities. Fundamentally, the crazy movement from these positions don’t make sense, but you can’t ignore the chart, the volume, and the message behind it all. This GME and AMC movement is the people protesting to the events that took place on 01/28/2021 when they were not allowed to buy any shares and locked out of their accounts.

My Expectation for the Upcoming Week 02/01/2021-02/05/2021

This week I expect GME and AMC to continue moving upward to close the gap. If we can build new support, then we can focus on the next level. It’s becoming clear that many are refusing to sell their positions, so I’ll be watching these charts closely. All sympathy plays I’ll watch will include SNDL, NAKD, CTRM, BBBY, BB, TR, NOK, etc.

Top 8 Green Positions (1/29/21):

- GME

- NVAX

- AMC

- LMFA

- NXTD

- WORX

- SOS

- BRQS

Top 8 Red Positions (1/29/21):

- GHSI

- OPTT

- ADMP

- CBAT

- ATIF

- POLA

- CSCW

- AQMS