Watchlist 6/6/22-6/10/22 & Recap

Hi everyone,

Hope you all had a super green Friday and a relaxing weekend. This week is exciting as Amazon will be trading at its new 20:1 split price $122.35, after closing at $2447 on Friday. Crude oil is ripping higher, so this week is the week to watch for new all time highs. As I mentioned, you always want Cybersecurity, Oil/Gas, and Food Shortage stocks in your portfolio. I have shared my setups, and this week they’re all in play. We have the cushions for the ride up. Whether futures are red or green, we’ll continue to compound those gains and keep our accounts green. May all your accounts continue to be blessed.

Manage Risks & Trading Plan Disclosure

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- When trading large caps, it is normal for it to move ~0.5-6%. When trading mid caps, it is normal for it to move ~5-15%. When trading small caps, it is normal for it to move ~8-30%+. When assessing goals, it’s important to make sure to take in consideration a stock’s volatility and match it to your particular trading style.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

6/6/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

Refer to the Setups Recap for the swing setups from previous weeks as most of the catalysts are happening this week.

- AMZN

- HUSA

- INDO

- DIDI

- SOPA

- MF

- AGRI

- CYRN

DIDI

Day’s Volume: 49,686,000

Average 10 Day Volume: 49.95M

Day’s range: $1.75-$1.95

Closing Price: $1.85

Short Interest: 0.74%

Analyst PT: $4.72

Catalysts:

- “China to Conclude Didi Cybersecurity Probe, Lift Ban on New Users.” 6/6/22. View news here.

This has been on my watchlist the last few weeks. We finally got news. If there is a pullback, dip zone may be at ($2.60-$2.75).

INDO

Day’s Volume: 2,271,309

Average 10 Day Volume: 1.31M

Day’s range: $13.21-$15.39

Closing Price: $13.93

Short Interest: 12.61%

Catalysts:

- Oil play; follows crude oil; crude oil is looking to break all time highs.

- Indonesia Energy Discovers Oil at Kruh 27, the First of Two Back-to-Back New Wells at Kruh Block in 2022. 5/11/22. View press release here.

- Indonesia Energy Commences Drilling of First of Two Back-to-Back Production Wells at Kruh Block. 4/8/22. View press release here.

- Indonesia Energy Mobilizes Drilling Rig to Commence Drilling of Two Back-to-Back Production Wells at Kruh Block. 3/10/22. View press release here.

- Indonesia Energy To Commence Drilling of Two Back-To-Back New Wells Within 30 Days and a Third by Mid-Year. 1/26/22. View press release here.

We are sitting at the bottom with crude oil ripping. INDO likes $13-$14 levels. It is under SSR today, so if crude oil breaks all time highs, watch for this to get squeezed into the $20s.

6/3/22 Setups Recap & Trading Plan

These are all swings so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging.

HUSA

HUSA hit low of day $3.91 premarket, high of day $4.55 intraday, closing at $4.43. If there is a pullback, possible dip zone might be ($4.18-$4.30).

Day’s Volume: 23,343,546

Average 10 Day Volume: 11.28M

Day’s range: $4.33-$5.69

Closing Price: $5.65

Short Interest: 11.14%

Catalysts:

- Oil play; follows crude oil; crude oil is looking to break all time highs.

- Houston American Energy Increases Interest In Colombian Project. 5/31/22. View press release here.

- Houston American Energy Announces Spudding of First Well on SPO-11 Venus Exploration Area in Colombia. 5/24/22. View press release here.

- 10-Q Quarterly Filings Ended March 31, 2022. View sec-filing here.

- 8-K Current Reports. 3/27/22. View sec-filing here.

- SC 13D Current Reports. 2/2/22. View sec-filing here.

HUSA hit my dip zone ($4.18-$4.30) at $4.28 (✓) premarket and moved +$1.49 (+34.81%) to high of day $5.77 after hours, after closing at $5.65. With crude oil possibly breaking all time highs, if there is a pullback, possible dip zone might be ($5.30-$5.45).

TNXP

TNXP hit high of day $3.18 premarket, low of day $2.67, triggering SSR for Friday, 6/3/22, and closing at $2.80. If there is a pullback, possible dip zone might be ($2.70-$2.80).

Day’s Volume: 15,195,203

Average 10 Day Volume: 24.78M

Day’s range: $2.41-$2.87

Closing Price: $2.47

Analyst PT: High PT: $10, Low PT: $1.27, Average PT: $3.86

Catalysts:

- TNXP: Monkeypox Cases Push TNX-801 Into the Spotlight by Zacks Small Cap Research. 6/5/22. View article here.

- Tonix Pharmaceuticals Regains Compliance with Nasdaq Minimum Bid Price Requirement. 6/2/22. View press release here.

- Tonix Pharmaceuticals Announces Issuance of U.S. Patent for TNX-801 Smallpox and Monkeypox Vaccine and Recombinant Pox Virus (RPV) Platform Technology. 6/1/22. View press release here.

- Tonix Pharmaceuticals Announces Share Repurchase Program. 5/31/22. View press release here.

- Tonix Pharmaceuticals Announces Two Oral Presentations Involving TNX-1500 (Fc-modified anti-CD40L mAb) on Prevention of Rejection in Kidney and Heart Allograft Transplantation at the 2022 American Transplant Congress. 5/31/22. View press release here.

- Tonix Pharmaceuticals Extends Research Collaboration with the University of Alberta to Develop Antiviral Drugs Against SARS-CoV-2. 5/18/22. View press release here.

- Tonix Pharmaceuticals Announces 1-for-32 Reverse Stock Split. 5/16/22. View press release here.

TNXP hit my dip zone ($2.70-$2.80) at $2.72 (✓) premarket and moved +$0.35 (+12.89%) to high of day $3.07 premarket. If there is a pullback, possible dip zone might be ($2.45-$2.55).

MF

MF was on yesterday’s watchlist, and it gained momentum premarket, which is when I alerted on Twitter. It hit $0.41 premarket and faded to low of day $0.2541, pulling back -$0.1559 (-38.02%) from the premarket’s high of day, which filled the gap to the downside, and became a good entry point for a swing position. It closed at $0.2857. This will be a long swing position, but we will take it $0.10-$0.15 at a time. It has a high analyst price target of $15.27, and low price target of $4.219. For now, the focus is to get it to $0.75 levels. After that $1+, then we shall take it one leg at a time. If there is a pullback, possible dip zone might be ($0.2850-$0.30).

Day’s Volume: 18,449,299

Average 10 Day Volume: 23.92M

Day’s range: $0.2300-$2800

Closing Price: $0.2501

Short Interest: 0.66%

Analyst PT: High PT: $15.27, Low PT: $4.219, Average PT: $7.93

Catalysts:

- Food shortage/inflation play.

- Missfresh Announces Receipt of Nasdaq Notification Regarding Late Filing of Form 20-F. 5/24/22. View press release here.

- Missfresh’s Retail Cloud Services Enabled Up To 20X Increase in Major Traditional Retailers’ Online Sales. 5/24/22. View press release here.

- MissFresh Triples its Stock and Accelerates the Delivery Efforts to Meet Increasing Consumer Demand. 4/26//22. View press release here.

- Sales of Missfresh’s Private Label Fresh Food Brand Surged 300% For Q4 2021. 3/30/22. View press release here.

- Missfresh Expands China-wide Direct-Supply Vegetable Farm Network to Total More Than 1,300 Hectares. 3/2/22. View press release here.

- Missfresh Successfully Launches Personalized Concierge Experience for High-value Customers, Doubling Relevant Monthly ARPU. 2/16/22. View press release here.

MF was a swing setup from the pullback on 6/2/22, and it hit premarket highs of $0.33. MF faded to low of day $0.23, triggering SSR for Monday 6/6/22. If there is a pullback, possible dip zone might be ($0.23-$0.25).

SIGA

SIGA fell $0.49 below my dip zone ($11.60-$11.80) but was able to reclaim it (✓) moving +$1.85 (+21.06%) and hitting high of day (HOD) $13.45, closing at $12.87. If there is a pullback, possible dip zone might be ($11.58-$12.20).

Day’s Volume: 32,792,104

Average 10 Day Volume: 42.32M

Day’s range: $11.18-$13.75

Closing Price: $11.62

Short Interest: 3.69%

Catalysts:

- SIGA Receives Approval from the FDA for Intravenous (IV) Formulation of TPOXX® (tecovirimat). 5/19/22. View press release here.

- New Contract Awarded by U.S. Department of Defense for the Procurement of up to Approximately $7.5 Million of Oral TPOXX®. 5/12/22. View press release here.

- SIGA Reports Financial Results for Three Months Ended March 31, 2022. 5/5/22. View press release here.

- SIGA Declares Special Dividend of $0.45 Per Share. 5/5/22. View press release here.

SIGA was $0.01 above my dip zone ($11.58-$12.20) at $12.21 (✓), moving +$1.54 (+12.61%) and hitting high of day (HOD) $13.75, closing at $11.62. If there is a pullback, possible dip zone might be ($11.60-$11.85).

CRTD

CRTD hit my dip zone ($1.04-$1.07) at $1.05 and moved +$0.20 (+19.04%) to high of day (HOD) $1.25, and closed at $1.15. It’s been a week of forming higher lows, after breaking the downtrend and we’re getting closer. Once the volume pours in, this is setup to run. If there is a pullback, the dip zone might be ($1.06-$1.12). The swing continues with the next leg up being $1.25-$1.50 levels, and then $1.75-$2. We’re taking this day by day. This is a multi-week swing to $6+.

Day’s Volume: 449,672

Average 10 Day Volume: 4.38M

Day’s range: $1.06-$1.13

Closing Price: $1.09

Short Interest: 2.86%

Catalysts:

- Creatd Ventures Provides Post-Acquisition Update on its DTC Wellness Brand, Basis; Surpasses Expectations With Record Quarter Projected. 6/1/22. View press release here.

- Basis’ first full quarter under Creatd Ventures expected to accrue over $200K in sales, along with lowest CAC (customer acquisition costs) and highest LTV (lifetime value) of all portfolio brands.

- Company additionally reports Basis’ first-ever brick-and-mortar launch with placement at Erewhon Market, and signs new distribution partnership with wholesale marketplace platform Pod Foods.

- Creatd, Inc. Announces $4 Million Above-Market Expansion Plan Financing. 5/31/22. View press release here.

- Creatd (CRTD) was nearly 1% higher after announcing a $4 million private placement.

- The company will also issue 2 million series C warrants to buy shares with an initial price of $3 per share and 2 million series C warrants to buy shares with an initial exercise price of $6 per share.

- The Private Placement is expected to close on or about May 31, 2022, subject to the satisfaction of customary closing conditions.

- Creatd Announces Up to $40 Million Rights Offering, Priced at $2.00 per Unit. 5/26/22. View press release here.

- Why Does It Matter? Creatd looks to utilize the offering proceeds for its expansion plan. Creatd Chair acknowledged the offering as its most significant offering since September 2020 uplisting.

- If fully subscribed, the offering could yield between a 10x – 20x increase in revenues over the next 12 to 18 months.

- Creatd Chair disclosed a tight float compared to microcap stocks like Remark Holdings, Inc (NASDAQ:MARK) and Genius Brands International, Inc (NASDAQ:GNUS), which trade at sub $1.00 with over $100 million and $250 million in outstanding shares.

- Creatd grew revenues from zero to $4.3 million for FY21 and looked to reach between $7 million – $10 million for FY22, pre-expansion plan initiation.

- Creatd maintained flat operating expenses, except for one-time charges and a decrease in its core platform, Vocal’s, marketing spend over the past three quarters.

- Vocal’s network grew to over 1.4 million creators and an audience reach exceeding 75 million.

- Creatd eliminated nearly all outstanding debt from its balance sheet, unlike small-cap companies like BuzzFeed, Inc (NASDAQ:BZFD), Esports Entertainment Group Inc (NASDAQ:GMBL), and Ipsidy Inc (NASDAQ:AUID) struggling with debt.

- Creatd Chair expressed that it was finally in a position to compete head-to-head with the multi-billion-dollar-valued platforms in its space, at a fraction of its internal headcount and with far lower development costs.

- Creatd 2022 Expansion Plan Investor Presentation. 5/26/22. View press release here.

- Creatd’s Vocal Teams Up with Microsoft’s Two Hat to Deliver Updates to its Proprietary Moderation Technology. 5/24/22. View press release here.

- Creatd, Inc. (Nasdaq CM: CRTD) (“Creatd” or the “Company”), a creator-first holding company and the parent company of Vocal, today announced the integration of a moderation technology powered by Two Hat into Creatd’s flagship technology platform, Vocal.

- Two Hat, acquired by Microsoft (MSFT) in 2021, has emerged as a leading provider of content moderation and protection solutions for digital communities.

- Creatd Establishes Graphic Novel Development Arm and Unveils Inaugural Project-Larry Blamire’s ‘Steam Wars.’ 5/23/22. View press release here.

- Creatd’s DTC Wellness Drink, Dune, Reaches Milestone of 100,000 Bottles Sold; Secures Placement in 130 Urban Outfitters Retail Stores. 5/23/22. View press release here.

- Creatd’s Vocal Onboards Four Key WHE Influencers with a Combined Following of Over 4 Million. 5/20/22. View press release here.

- Creatd Announces Record Reduction of 45% in QoQ Operating Expenses for its First Quarter 2022. 5/16/22. View press release here.

- Creatd Unveils New Integrated Agency Offerings. 5/16/22. View press release here.

- Creatd’s Vocal Platform Releases Highly Anticipated Feature: Comments. 5/12/22. View press release here.

- Creatd to Launch First Original Podcast, Featuring Stories from Vocal Creators. 5/11/22. View press release here.

- Creatd Announces Entry into Print Publishing; Partners with Unbound to Publish First Book of Vocal Stories. 5/10/22. View press release here.

- Creatd Ventures’ Camp Reaches Milestone; Sells 45,000 Boxes & Secures Placement on New Online Wholesale Marketplaces. 5/9/22. View press release here.

- Creatd’s WHE Agency Increases Audience Reach by 26 Million Since Start of 2022; WHE’s Brand Partnerships Expand Along with New Talent Acquisitions. 5/6/22. View press release here.

- Dune, the Creatd-Owned Wellness Drink, Launches at LA-Based Erewhon Market and Sells Out at Urban Outfitters. 5/5/22. View press release here.

Sec-Filings:

- S-3/A – Securities Registration Statement (simplified form). 05/23/22. View sec-filing here.

- 4 – Statement of Changes in Beneficial Ownership. 5/18/22. View sec-filing here.

- 8-K – Current report filing. 05/17/22. View sec-filing here.

- 10-Q – Quarterly Report. 5/16/22. View sec-filing here.

- 8-K – Current report filing. 05/13/22. View sec-filing here.

- S-3 – Securities Registration Statement (simplified form). 5/13/22. View sec-filing here.

CRTD hit my dip zone ($1.06-$1.12) but did not make any significant moves from the dip zone. We are consolidating at these levels, and sitting at the dip zone ($1.06-$1.12). The swing continues with the next leg up being $1.25-$1.50 levels, and then $1.75-$2. We’re taking this day by day. This is a multi-week swing to $6+.

BKSY

BKSY hit my dip zone ($2.69-$2.79) at $2.70, and moved up +$0.63 (23.33%) and closing at $2.86. If there is a pullback, the dip zone may be at ($2.65-$2.75). The next leg is to reclaim $3-$3.25 levels, consolidate, and then claim $4 levels. This is a multi-week swing to $6.

Day’s Volume: 5,423,994

Average 10 Day Volume: 29.16M

Day’s range: $2.51-$2.82

Closing Price: $2.60

Short Interest: 0.53%

Analyst PT: $6

Catalysts:

- BlackSky Awarded 10-Year Electro Optical Commercial Layer (EOCL) Contract with U.S. Government. 5/25/22. View press release here.

- “Contract with options is valued up to $1.021 billion over the course of the 5-year base period of performance and the five 1-year option periods for imagery from current and future satellite constellations.”

- BlackSky Reports First Quarter 2022 Results. 5/11/22. View press release here.

- First Quarter Financial Highlights:

- Record revenue of $13.9 million, up 91% from prior year period

- Imagery & software analytical services revenue improves 63% over prior year’s quarter

- Net loss of $20.0 million

- Adjusted EBITDA loss of $9.5 million

- Cash balance at the end of March 2022 was $138.4 million

- Capital expenditures of $13.4 million

- First Quarter Financial Highlights:

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K/A – Current report filing. 5/25/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 05/25/22. View sec-filing here.

- 8-K – Current report filing. 5/25/22. View sec-filing here.

- 4 – Statement of changes in beneficial ownership of securities. 05/12/22. View sec-filing here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/11/22. View sec-filing here.

- 8-K – Current report filing. 5/11/22. View sec-filing here.

- 10-Q – Quarterly report pursuant to Section 13 or 15(d). 5/11/22. View sec-filing here.

- BlackSky to Participate at the 17th Annual Needham Technology and Media Conference. 5/6/22. View press release here.

- 424B3 – Prospectus filed pursuant to Rule 424(b)(3). 5/2/22. View sec-filing here.

- 10-K/A – Annual report pursuant to Section 13 and 15(d). 5/2/22. View sec-filing here.

BKSY dropped below my dip zone ($2.65-$2.75) to a low of day $2.51, and stayed stagnant after reclaiming the dip zone, closing at $2.60. If there is a pullback, the dip zone may be at ($2.55-$2.70). The next leg is to reclaim $3-$3.25 levels, consolidate, and then claim $4 levels. This is a multi-week swing to $6.

NILE

NILE hit $0.0075 above my dip zone ($0.3725-$0.3925) at $0.40 (✓) premarket and moved +$0.025 (+6.25%) to high of day $0.4250 intraday, and closing at $0.41. If there is a pullback, the dip zone may be at ($0.3850-$0.40). Since we were able to let it have a healthy red day, this made it difficult for shorts to try to short because they were anticipating pops. This is a multi-week swing until we’re back above $0.75.

Day’s Volume: 16,134,332

Average 10 Day Volume: 19.38M

Day’s range: $0.3660-$0.4100

Closing Price: $0.37

Short Interest: 4.55%

Analyst PT: High PT: $6.25, Low PT: $4.00, Average PT: $5.13

Catalysts:

- BitNile Announces Closing of Public Offering of 144,000 Shares of 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock. 6/3/22. View press release here.

- BitNile to Present at 12th Annual LD Micro Invitational Investor Conference. 6/3/22. View press release here.

- 424B5 Form of prospectus disclosing information, facts, events covered in both forms 424B2, 424B3. 6/2/22. View press release here.

- 8-K Report of unscheduled material events or corporate event. 6/2/22. View press release here.

- 4 Statement of changes in beneficial ownership of securities. 6/2/22. View press release here.

- BitNile Holdings Issues May Bitcoin Production and Mining Operation Report. 6/1/22. View press release here.

- BitNile Announces Revised Pricing of Public Offering of Shares of 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock. 6/1/22. View sec-filing here.

- 8-K Report of unscheduled material events or corporate event. 6/1/22. View sec-filing here.

- Gresham Worldwide, a BitNile Holdings Subsidiary, Booked New Orders Exceeding $8.6 Million in the First Quarter of 2022. 5/26/22. View press release here.

- 4 Statement of changes in beneficial ownership of securities. 5/26/22. View sec-filing here.

- 8-A12B Registration of certain classes of securities 12(b) of the Securities Exchange Act. 5/26/22. View sec-filing here.

- Form of prospectus disclosing information, facts, events covered in both forms 424B2, 424B3. 5/25/22. View sec-filing here.

- BitNile Holdings Reports Q1 2022 Financial Results, Including Revenue of $33 Million, up 148% From the Prior First Fiscal Quarter. 5/23/22. View press release here.

- BitNile Holdings Announces its Subsidiary, BitNile, Inc., Now Owns 100% of Alliance Cloud Services, LLC, Which Owns and Operates the 617,000 Square Foot Michigan Data Center. 5/12/22. View press release here.

- BitNile Holdings Reports Preliminary Q1 2022 Financial Results Including Revenue of Approximately $32 Million, up 142% From the Prior First Fiscal Quarter. 05/9/22. View press release here.

- BitNile Holdings Issues April Bitcoin Production and Mining Operation Report. 05/2/22. View press release here.

NILE hit high of day $0.43 premarket, and pulled back to low of day $0.366, closing at $0.37, and reclaimed my dip zone ($0.3850-$0.40) (✓) If there is a pullback, the dip zone may be at ($0.3750-$0.39).

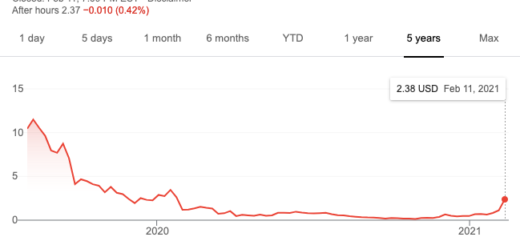

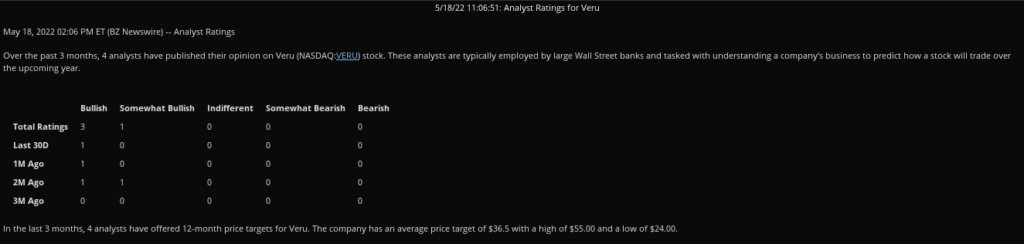

VERU

VERU hit $0.14 above my dip zone at ($11.60-$11.80) at $11.94 (✓) and moved +$1.38 (+11.56%), and closing at $13.21. If there is a pullback, there may be a dip zone at ($12.60-$13.00.

Day’s Volume: 18,019,754

Average 10 Day Volume: 9.03M

Day’s range: $12.91-$14.92

Closing price: $14.46

Short Interest: 27.81%

Analyst PT: $24-$55, Average PT: $36.50

Catalysts:

- Veru to Present Three Presentations at the 2022 American Society for Clinical Oncology Annual Meeting on June 3-7. 5/31/22. View the full press release here.

- Veru to Participate in Fireside Chat at the Jefferies Healthcare Conference on June 8, 2022. 5/25/22. View the full press release here.

- Veru Announces Appointment of Joel Batten to Lead U.S. Infectious Disease Franchise to Focus on Hospitalized COVID-19 Patients. 5/18/22 View the full press release here.

- Veru to Present at the H.C. Wainwright Global Investment Conference on May 24th 2022. 5/17/22. View the full press release here.

- Veru Reports Second Quarter Fiscal 2022 Results and Progress of Sabizabulin for COVID-19 Toward a Request for Emergency Use Authorization. 5/12/22. View the full press release here.

- FDA States that Veru Should Submit Request for Emergency Use Authorization (EUA) Based on Positive Efficacy and Safety Data from the Phase 3 Clinical Study of Sabizabulin in Hospitalized COVID-19 Patients. 5/11/22. View the full press release here.

- FDA Has Granted Veru a Pre-Emergency Use Authorization (EUA) Meeting Date for Positive Sabizabulin Phase 3 COVID-19 Study. 5/2/22. View the full press release here.

- Veru Announces Oral Late-Breaking Presentation of Phase 2 Data of Sabizabulin for the Treatment of Hospitalized Severe COVID-19 Patients at High Risk for Acute Respiratory Distress Syndrome at the 32nd European Congress of Clinical Microbiology & Infectious Diseases. 4/25/22. View the full press release here.

- Veru’s Novel COVID-19 Drug Candidate Reduces Deaths by 55% in Hospitalized Patients in Interim Analysis of Phase 3 Study; Independent Data Monitoring Committee Halts Study Early for Overwhelming Efficacy. 4/11/22. View the full press release here.

VERU hit my dip zone at ($12.60-$13.00) at $12.82 (✓) and moved +$2.10 (+16.38%) to high of day $14.92, and closing at $14.46. If there is a pullback, there may be a dip zone at ($13.90-$14.20.

RDBX

RDBX hit $0.20 above my dip zone ($5.30-$5.50) at $5.70 (✓), and from there, it moved +$1.87 (+32.81%) and hit high of day (HOD) $7.57 intraday, and closing at $6.63. If there is another pullback, the dip zone might be at ($6.70-$7.00).

Day’s Volume: 8,211,947

Average 10 Day Volume: 25.87M

Day’s range: $6.03-$7.07

Closing Price: $6.39

Short Interest: 33.28%

Catalysts:

- POS AM. 6/3/22. Post-effective amendment to an S-Type filing. View filing here.

- Redbox Entertainment Acquires North American Rights to WWII Action-Drama Come Out Fighting. 5/24/22. View press release here.

- DEFA14A Sec-Filing Additional proxy soliciting materials – definitive. 5/13/22. View filing here.

- 10-Q Quarterly report which provides a continuing view of a company’s financial position. 5/13/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- 8-K Report of unscheduled material events or corporate event. 5/11/22. View filing here.

- 425 Filing of certain prospectuses and communications in connection with business combination transactions. 5/11/22. View filing here.

- Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company. 5/11/22. View press release here.

RDBX hit my dip zone ($6.70-$7.00) at $6.88 (✓), and from there, it moved +$0.36 (+5.23%) and hit high of day (HOD) $7.24 premarket, fading to a low of day $6.03, and closing at $6.39. If there is another pullback, the dip zone might be at ($6.30-$6.50).

AGRI

AGRI hit my dip zone ($2.30-$2.40) at $2.37, moving $0.21 ( %) to high of day $2.58. If there is a pullback, possible dip zone ($2.40-$2.50). AGRI needs to reclaim $3 levels, consolidate, reclaim $4, and consolidate again, for the leg above $5.

Day’s Volume: 832,569

Average 10 Day Volume: 4.54M

Day’s range: $2.36-$2.57

Closing Price: $2.41

Short Interest: 0.42%

Analyst PT: $5

Catalysts:

- “AgriForce to Present at the Food & AgTech Conference on June 8th.” 6/2/22. View full press release here.

- “AgriForce to Present at the H.C. Wainwright Global Investment Conference on May 25th” 5/23/22. View full press release here.

- “AgriFORCE Growing Systems Completes Acquisition of Food Production & Processing IP from Manna Nutritional Group (MNG)” 5/18/22. View full press release here.

- “Quarterly report pursuant to Section 13 or 15(d) (10-Q).” 5/16/22. View sec-filing here.

- “AgriFORCE Growing Systems Provides Update on Acquisition of Delphy, a Leading European Agriculture/Horticulture and AgTech Consulting Firm.” 5/12/22. View the full press release here.

- AgriFORCE is presenting at “Microcap Rodeo’s Spring into Action Best Ideas Virtual Conference on May 17th.” Management is scheduled to present on Tuesday, May 17, 2022 at 3:00 p.m. ET. The presentation will be webcast live and available for replay https://www.webcaster4.com/Webcast/Page/2882/45580. 5/11/22. View the full press release here.

- Agriculture stocks are a very hot sector due to food shortage, food inflation, and plant/farm explosions. Agriforce is one of the main leaders according to what’s trending across discords and most mentions.

AGRI hit high of day $2.68 premarket, then faded to low of day of $2.36 and reclaimed my dip zone ($2.40-$2.50), closing at $2.41. If there is a pullback, possible dip zone ($2.45-$2.55). AGRI needs to reclaim $3 levels, consolidate, reclaim $4, and consolidate again, for the leg above $5.

AMD

AMD hit $0.35 above my dip zone ($98.75-$100) at $100.35 (✓) and moved up +$9.15 (+9.12%) to high of day $109.50, closing at $108.59. I’ve mentioned I’ll be continuing this swing, taking it day by day, holding my core position from the $80s. As I’ve mentioned previously, AMD will be announcing lots of news over the summer. AMD dropped news again, as expected, “AMD to Host Financial Analyst Day on June 9, 2022. 6/2/22. View press release here.” If there is a pullback, the dip zone might be at $104-$107.50.

Day’s Volume: 110,844,697

Average 10 Day Volume: 123.54M

Day’s range: $104.65-$109.39

Closing Price: $106.30

Short Interest: 2.07%

Analyst PT: High PT: $200, Low PT: $97, Average PT: $137.91

Catalysts:

- AMD to Host Financial Analyst Day on June 9, 2022. 6/2/22. View press release here.

- AMD Expands High Performance Compute Fund to Aid Researchers Solving the World’s Toughest Challenges. 6/1/22. View press release here.

- World’s First Exascale Supercomputer Powered by AMD EPYC™ Processors and AMD Instinct™ Accelerators. 5/30/22. View press release here.

- AMD Instinct™ MI200 Adopted for Large-Scale AI Training in Microsoft Azure. 5/26/22. View press release here.

- AMD Expands Data Center Solutions Capabilities with Acquisition of Pensando. 5/26/22. View press release here.

- AMD Expands Confidential Computing Presence on Google Cloud. 5/25/22. View press release here.

- AMD Showcases Industry-Leading Gaming, Commercial, and Mainstream PC Technologies at COMPUTEX 2022. 5/23/22. View press release here.

- AMD Chair and CEO Dr. Lisa Su to Keynote at COMPUTEX 2022. 5/20/22. View press release here.

- Statement of changes in beneficial ownership of securities. 5/19/22 View press release here.

- AMD Robotics Starter Kit Kick-Starts the Intelligent Factory of the Future. 5/17/22. View press release here.

- AMD and Qualcomm Collaborate to Optimize FastConnect Connectivity Solutions for AMD Ryzen Processors. 5/17/22. View press release here.

- AMD Enables 4G/5G Radio Access Network Solutions to Support Meta Connectivity Evenstar Program. 5/11/22. View press release here.

- AMD Announces Three New Radeon RX 6000 Series Graphics Cards and First Games Adding Support for AMD FidelityFX Super Resolution 2.0. 5/10/22. View press release here.

- New AMD Ryzen 5000 C-Series Processors Bring Leadership Performance and All-Day Battery Life to Chrome OS. 5/5/22. View press release here.

- AMD Reports First Quarter 2022 Financial Results. 5/3/22. View press release here.

AMD hit my dip zone ($104-$107.50) at $105.17 (✓) and moved up +$4.22 (+4.01%) to high of day $109.39, closing at $106.30. I’ve mentioned I’ll be continuing this swing, taking it day by day, holding my core position from the $80s. As I’ve mentioned previously, AMD will be announcing lots of news over the summer. If there is a pullback, the dip zone might be at $106.00-$107.75.

Others to Watch/Trending

- EFOI

- BABA

- MULN

- SNDL

- PDD

- YMM

- BTMD

- RLX

- TMI

- KWEB

- GME

- AMC

- BBIG

- GGPI

- VRAR

- XELA

- SOS

- BBI

- PIXY

- GFAI

Oil/Gas Stocks to Watch for a Reversal

If trading oil, make sure you’re monitoring crude oil prices. Load up on red days. If you chase the day it runs, be careful as they’re more volatile. Be careful swinging anything that’s been trading under $1 for greater than 30 days due to delisting/delinquency requirements or reverse splits; I’d keep them as day trades if uncertain.

- INDO – 12.61% SI

- HUSA – 11.14% SI

- ENSV – 4.32% SI

- CEI – 8.51% SI

- USWS – 8.35% SI

- MXC – 4.99% SI

- MARPS – 2.41% SI

- IMPP – unknown SI

- XOM – 0.83% SI

- CVX – 1.07% SI

Earnings

6/6/22

- HQY

- FUTU

- COUP

- GTLB

- NGL

6/7/22

- GIII

- HOLX

- SMAR

- GWRE

- VRNT

6/8/22

- CPB

- KC

- VRA

- ALOT

- SKIL

6/9/22

- NIO

- FCEL

- BILI

- DOCU

- CMTL

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps as I do spend hours on my research and do not receive compensation via advertising, sponsorships, etc. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.