How to Trade Over the Counter (OTC) Stocks

What is Over-the-Counter (OTC)?

Over the Counter (OTC) is defined as the process of how securities are traded via a Broker Dealer (B-D) for companies not listed on a standard market exchange (Nasdaq or New York Stock Exchange).

What is a Broker-Dealer (B-D)?

A broker-dealer (B-D) or market maker, is a financial entity engaged with the buying and selling of securities on behalf of their clients or themselves. They provide investment advice to their clients, facilitate trading activities, supply liquidity through market making activities, publish investment research, and raise capital for companies.

There are two types of Broker-Dealers (B-D):

- Wirehouse – a firm that sells its products to clients

- Independent Broker-Dealer (B-D) – a firm that sells products from outside sources

What are OTC Stocks?

Over-the-Counter stocks are known as unlisted stocks, and aren’t typically traded on a regulated exchange (NYSE or NASDAQ). They are typically trading OTC due to them not meeting the listing requirements of major stock exchanges. They typically trade with lower volume than those on the NYSE or NASDAQ. Many companies trading OTC are typically developing new products, technology, or engaging in research and development. Although inexpensive, they come with a great deal of risk, so it’s important to learn how to trade it properly.

Why Buy OTC Stocks if it’s Risky?

OTC stocks are appealing because they typically trade for less than $1 per share, and the companies that sell them typically have a market capitalization of $50M or less. It is appealing to many traders who like the idea of owning millions of shares for very little money. If the companies do well over time, investors can make a ton of money. If they don’t, well.. it might not be a pretty picture.

How to Buy OTC stocks?

Once you’ve done your due diligence on a company, you can take the following steps:

- Open an account with a brokerage that allows trading OTC securities

- Fund your account

- Purchase your OTC stock (Only buy what you’re willing to lose)

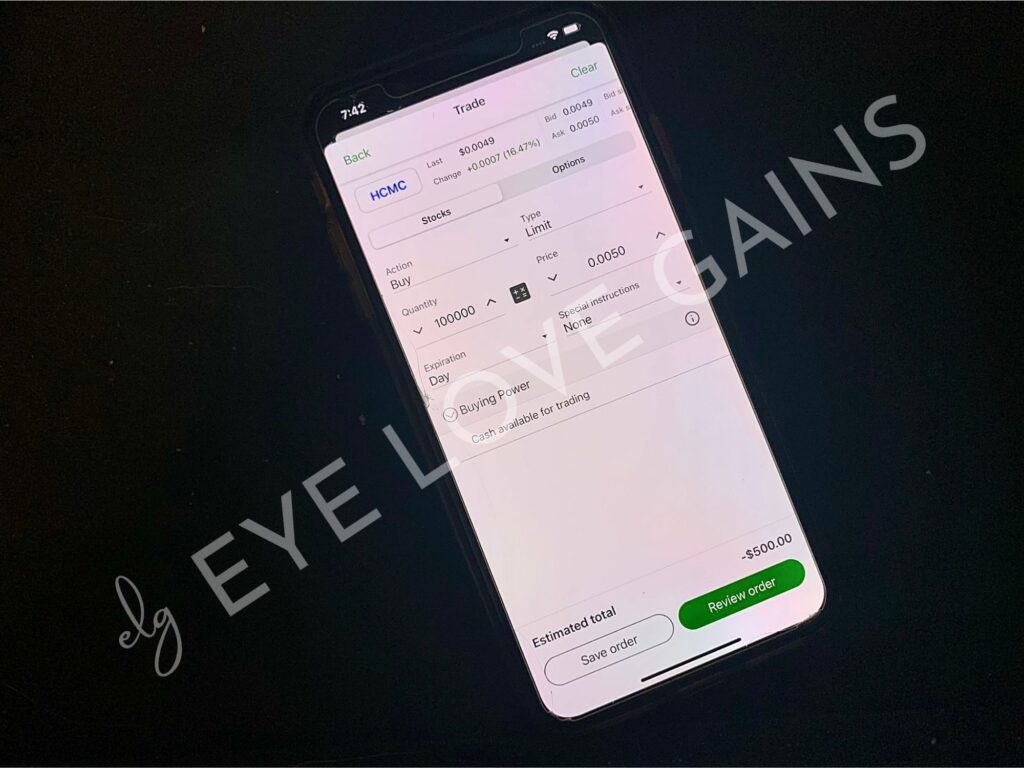

- When purchasing, place a limit order and Buy the Ask.

- Set your GTC Sell limits.

My Rules For Choosing OTC Stocks

Day Trades:

- Choose Market Movers

- Learn the chart patterns over the last few years

- Scale into full position

- Have a mental stop loss

- Exit position by market close

Swing Trades/Investments:

- Do thorough research on the company

- Learn the chart patterns over the last few years

- Set up early – week(s) to a month in advance

- Search for triple zero OTC stock first and then double zero

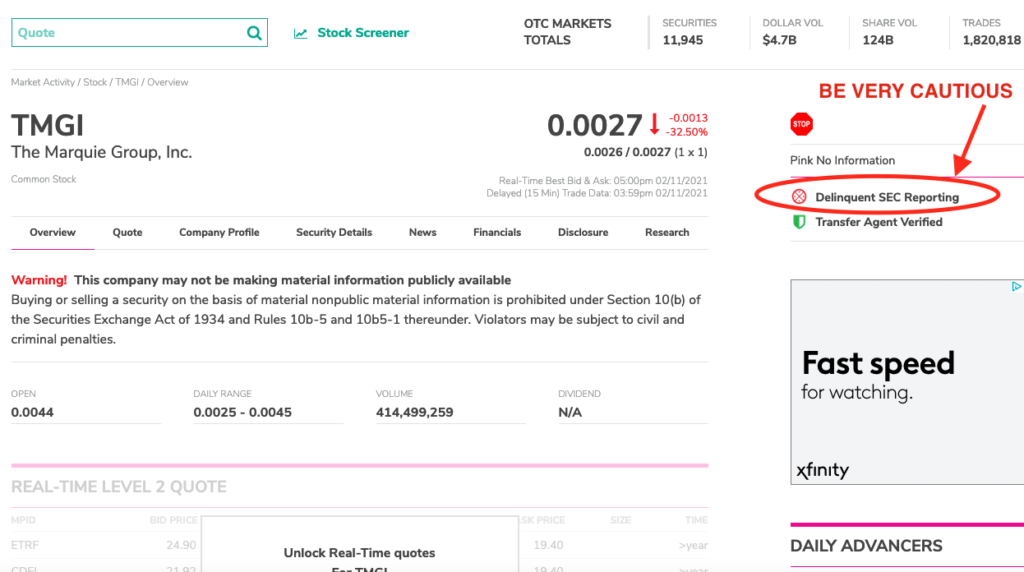

- Avoid OTC Stocks with a Delinquent SEC Reporting

- Scale into full position over week(s)

- Set GTC Sell limits with initial sell to get back initial investment + some profits, leave the remainder to ride out as ‘free shares’ as an investment (if investing) or sell all (if closing out a swing)

My Current OTC Positions:

- Healthier Choices Management Corp (HCMC) View Company Website | Health

- Santo Mining Corp (SANP) View Company Website | Blockchain

- Ecosciences, Inc (ECEZ) View Company Website |Environment/Tech

- DarkPulse, Inc (DPLS) View Company Website | Tech

- For the Earth Corporation (FTEG) View LinkedIn | CBD

- Fernhill Beverage, Inc. (FHBC) View Website | CBD/Beverage

- Amazonas Florestal Ltd (AZFL) View Facebook | Cannabis

- Therapeutic Solutions International (TSOI) View Company Website | Biotech

- FutureLand Corp (FUTL) View Twitter | Cannabis

- GenTech Holdings, Inc (GTEH) View Company Website | Food/Beverage

- Sunstock Inc (SSOK) View Company Website | Metals

- Halitron, Inc (HAON) View Company Website | Holding Company

- Chromocure, Inc. (KKUR) | Cancer

- HQ Global Education Inc. (HQGE) | View Company Website | CBD

- Sun Pacific Holding Corp (SNPW) | View Company Website | Solar

- Trans-Pacific Aerospace Company, Inc. (TPAC) | Manufacturing and aerospace

- BB Liquidating Inc. (BLIAQ) | Retail

- Digital Locations, Inc. (DLOC) | View Company Website | 5G

- Galaxy Next Generation, Inc (GAXY) | View Company Website | COVID Shields/Education/Communication

Many have asked how to support me directly, so I’ve set up a PayPal for Donations to my blog below. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.

1 Response

[…] me, it’s worthwhile for me to take the risk for higher profit margins. I posted my positions here for those […]