Watchlist 5/25/22 & Recap

Happy Tuesday,

Hope you all had a good Tuesday. It was a red day in the market so it was the day to trade defensively. I am going to make this post a bit shorter because we are set back a day for the bigger move due to the red market, so I’m going to continue to swing my positions I mention. Tomorrow is another day, and we will continue to make that green regardless if the market is red or green. As always, respect your trading rules and please consider the disclosure below. Don’t try to be a hero in this market. Proper risk management will be your best friend. May all your accounts be blessed.

Manage Risks & Trading Plan Disclosure

- These are my trading plans, and many ask if I’m holding this or that. If it breaks any of the dip zones that I mention or if it breaks the trend line for a swing on the 5D/30D chart, I will respect my rules and I will respect my stop loss and wait for the setup to re-enter.

- Never bag hold, never average down on a loser UNLESS you’re confident it will reverse, and never turn a day trade into a swing if you do not have a set plan.

- For those under PDT, be careful with setting up swings too early in the day; I prefer waiting until after lunch (EST) to set my swings up (unless it hit my perfect dip zone).

- Always make sure you have a day trade available in case you need to exit and reposition.

- It’s okay to be wrong, but it’s not okay to stay wrong. Hope doesn’t make us money; proper risk management does.

- Many of these are great long term plays if one was to load up on red days while respecting the trend line for setting up swings. There’s nothing wrong with buying on green days if buying the BIG pullbacks. Best way to get burned is to chase while they’re ripping upward.

- If these don’t run yet, and are holding new support levels, especially at my dip zone, assume I’m accumulating, and holding for a bigger move. I mainly set swings up as soon as I see signs of a reversal with anticipation of catalysts. From the original alert, expect my multi-week swings to run at least 100% with pullbacks in-between.

- I provide my watchlists for all types of traders. If you’re conservative, consider anything $50 and up; if you have higher risk tolerance, consider penny stocks below $2; if you’re in the middle, consider anything between $2-$50.

- SSR triggered setups are my preferred setups for swinging. This does not mean that it cannot be shorted. If the volume is high, price action/momentum is there, with upcoming catalysts; then this is my preferred setup as someone who swings. I keep a mental stop in case I need to reposition my swing. Not every SSR trade will move up; there are many variables one must take into account when trading this type of setup.

- I do NOT hold all stocks listed below. I provide a list of top mentions/trending/abnormal volume movers/upcoming catalysts/earnings/conservative large caps. You decide what you trade based on your preference.

5/25/22 Main Watch

If the market is red, consider respecting your stop losses. Stopping out doesn’t mean you’re unable to re-enter; it’s you giving yourself the best setup while managing your risks, and maximizing profit potential. Waiting for confirmation is crucial once it hits the dip zones; I would never just jump in and buy. It’s important they hold at the dip zone levels. If it breaks below, I typically wait for it to reclaim that dip zone before scaling in.

Refer to the Setups Recap for the swing setups from previous weeks as most of the catalysts are happening this week.

- GOVX

- BTTX

- AMD

- NVDA

- GME

- AMZN

- RDBX, SSR on

- AGRI, SSR on

- AMC, SSR on

- SIGA, SSR on

- VERU, SSR on

- IGEX (OTC)

5/24/22 Setups Recap & Trading Plan

These are all swings so if 1) they do not make any significant moves, 2) news have yet to drop, or 3) they have yet to hit the price targets; that means the swing continues as long as it respects the trend line when swinging.

GOVX

GOVX pulled back -28.42% from high of day $2.85 to $2.04. Possible dip zone may be at $1.94-$2.13 levels. SSR will trigger at $2.08, so this will be an SSR setup for a swing through 5/25/22. GOVX needs to reclaim $2.35 levels, then $2.75 levels, consolidate, and then climb up slowly for $3-$3.25 levels, consolidate, and then the next leg up will be $3.50-$4 until we reach Maxim Groups’ price target of $6. This is a multi-day swing.

Day’s Volume: 160,847,515

Average 10 Day Volume: 33.04M

Day’s range: $2.23-$3.38

Closing Price: $2.29

Short Interest: 3.60%

Analyst PT: $6

Catalysts:

- GeoVax Receives Notice of Allowance for Cancer Vaccine Patent in China. 5/24/22. View press release here.

- Maxim Group announced a $6 price target for GeoVax. 5/23/22

- “Monkeypox outbreak is primarily spreading through sex, WHO officials say” – CNBC

- GeoVax Announces Upcoming Presentations at Scientific Conferences. 5/4/22. View press release here.

- Pipeline. 5/12/22. View pipeline here.

- 8-K Sec-Filing Current Report. 5/2/22. View filing here.

GOVX hit high of day (HOD) $17.50 premarket, then broke below my dip zone ($1.94-$2.13) but was able to reclaim it at $1.94 (✓), moving up +$1.44 (+74.23%) to high of day (HOD) $3.38. It pulled back -33.73% to my previous dip zone, therefore, we are sitting at the new dip zone level ($2.13-$2.30). If we are able to trigger SSR at $2.06, that price will need to have heavy buying volume pour in for a bullish move up. Once $2.74 levels are reclaimed, and $3 levels are reclaimed, once there is consolidation about $3-$3.25 levels, the move above $4 will come quickly. This is still a multi-day swing to get to the $6 Analyst price target.

VERU

VERU hit low of day $12.35 intraday, and towards the end of day, right before the close, volume poured in, allowing VERU to reclaim $14 levels. If there is a pullback, watch for a possible dip zone to be at $13.80-$14.20. VERU needs to reclaim $15.50 levels, consolidate for a bullish move up to $16-$17, consolidate, upward, and break above $20+. Veru is presenting at the H.C. Wainwright Global Investment Conference tomorrow, May 24th 2022. 5/17/22. View the full press release here.

Veru is consistent with their PRs as you’ll see below. A company that has consistent PRs is one that I keep an eye on because you can depend on them to have strong catalysts when swinging long.

If shorts try to scare you about offerings, you should consider looking at a company’s history and patterns. I’ll look at the chart and line it up with offering dates. Every company has a pattern, and in the past Veru has only dropped offerings approximately 1-2 weeks after hitting Analyst PTs. Unlike other companies in need of cash quickly, who drop offerings at the bottom, Veru Inc. has recognized there’s a lot to be made by allowing investors and traders build up their stock price so they can raise money towards growing their company and to continue giving their shareholders results. As you’ll see from the last 3 months of press releases, their 2022 pipeline is strong.

Catalysts:

- Veru Announces Appointment of Joel Batten to Lead U.S. Infectious Disease Franchise to Focus on Hospitalized COVID-19 Patients. 5/18/22 View the full press release here.

- Veru to Present at the H.C. Wainwright Global Investment Conference on May 24th 2022. 5/17/22. View the full press release here.

- Veru Reports Second Quarter Fiscal 2022 Results and Progress of Sabizabulin for COVID-19 Toward a Request for Emergency Use Authorization. 5/12/22. View the full press release here.

- FDA States that Veru Should Submit Request for Emergency Use Authorization (EUA) Based on Positive Efficacy and Safety Data from the Phase 3 Clinical Study of Sabizabulin in Hospitalized COVID-19 Patients. 5/11/22. View the full press release here.

- FDA Has Granted Veru a Pre-Emergency Use Authorization (EUA) Meeting Date for Positive Sabizabulin Phase 3 COVID-19 Study. 5/2/22. View the full press release here.

- Veru Announces Oral Late-Breaking Presentation of Phase 2 Data of Sabizabulin for the Treatment of Hospitalized Severe COVID-19 Patients at High Risk for Acute Respiratory Distress Syndrome at the 32nd European Congress of Clinical Microbiology & Infectious Diseases. 4/25/22. View the full press release here.

- Veru’s Novel COVID-19 Drug Candidate Reduces Deaths by 55% in Hospitalized Patients in Interim Analysis of Phase 3 Study; Independent Data Monitoring Committee Halts Study Early for Overwhelming Efficacy. 4/11/22. View the full press release here.

Day’s Volume: 9,694,313

Average 10 Day Volume: 30.19M

Day’s range: $11.80-$14.00

Closing price: $12.21

Short Interest: 24.06%

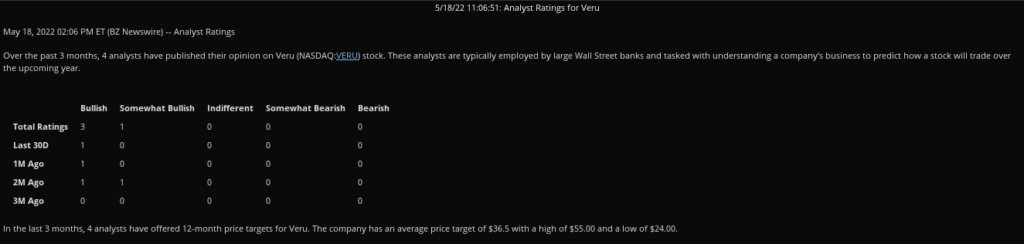

Analyst PT: $24-$55, Average PT: $36.50

VERU broke well below my dip zone ($13.80-$14.20) and faded to a low of day (LOD) $11.80. It will need to reclaim $13 levels for the move back up. We are sitting at the dip zone ($11.59-$11.95). SSR is on 5/25/22.

RDBX

RDBX was a swing from friday and dip zone, and opened up at low of day $4.85, $0.07 above my dip zone ($4.52-$4.78) (✓), and from there, it moved $2.32 (47.84%) and hit high of day (HOD) $7.17 intraday. If there is another pullback, possible dip zone ($5.19-$5.37).

Day’s Volume: 41,464,714

Average 10 Day Volume: 17.85M

Day’s range: $3.78-$5.73

Closing Price: $5.32

Short Interest: 23.78%

Catalysts:

- Redbox Entertainment Acquires North American Rights to WWII Action-Drama Come Out Fighting. 5/24/22. View press release here.

- DEFA14A Sec-Filing Additional proxy soliciting materials – definitive. 5/13/22. View filing here.

- 10-Q Quarterly report which provides a continuing view of a company’s financial position. 5/13/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- DEFA14A Additional proxy soliciting materials – definitive. 5/12/22. View filing here.

- 8-K Report of unscheduled material events or corporate event. 5/11/22. View filing here.

- 425 Filing of certain prospectuses and communications in connection with business combination transactions. 5/11/22. View filing here.

- Chicken Soup for the Soul Entertainment to Acquire Redbox, Creating Premier Independent Entertainment Company. 5/11/22. View press release here.

RDBX fell $0.29 below my dip zone but was able to reclaim my dip zone ($5.19-$5.37) (✓), and from there, it moved $0.36 (6.94%) after dropping news after hours (see above catalysts) and hit high of day (HOD) $5.55 after hours. We are currently sitting at the dip zone, ($5.30-$5.55). SSR is on for Wednesday, 5/25/22.

AGRI

AGRI hit $0.05 above my dip zone ($2.64-$2.72) at $2.77 (✓), moving +$0.61 (22.02%), then fading into the close, closing at $3.06. If there is another pullback, watch for a possible dip zone to be at $2.70-$2.85. AGRI needs to reclaim $3.50 levels, consolidate, reclaim $4, and consolidate again, for the next leg to $5.

Day’s Volume: 4,914,843

Average 10 Day Volume: 19.83M

Day’s range: $2.65-$3.05

Closing Price: $2.81

Short Interest: 0.46%

Analyst PT: $5

Catalysts:

- “AgriFORCE Growing Systems Completes Acquisition of Food Production & Processing IP from Manna Nutritional Group (MNG)” 5/18/22 View full press release here.

- Quarterly report pursuant to Section 13 or 15(d) (10-Q). 5/16/22/ View sec-filing here.

- “AgriFORCE Growing Systems Provides Update on Acquisition of Delphy, a Leading European Agriculture/Horticulture and AgTech Consulting Firm. 5/12/22. View the full press release here.

- AgriFORCE is presenting at “Microcap Rodeo’s Spring into Action Best Ideas Virtual Conference on May 17th.” Management is scheduled to present on Tuesday, May 17, 2022 at 3:00 p.m. ET. The presentation will be webcast live and available for replay https://www.webcaster4.com/Webcast/Page/2882/45580. 5/11/22. View the full press release here.

- Agriculture stocks are a very hot sector due to food shortage, food inflation, and plant/farm explosions. Agriforce is one of the main leaders according to what’s trending across discords and most mentions.

AGRI hit $0.05 below my dip zone ($2.70-$2.85) at $2.65 (✓), moving +$0.16 (+5.93% after hours, but did not make any significant moves, therefore, the swing continues. We are sitting at the dip zone ($2.70-$2.85). SSR will be on Wednesday, 5/25/22. AGRI needs to reclaim $3.25 levels, consolidate, reclaim $4, and consolidate again, for the next leg to $5.

AMD

AMD hit my dip zone ($88-$92) $90.92 (✓) and moved +$4.27 (+4.70%) to high of day $95.19. I’ve mentioned I’ll be swinging this over and over, taking it day by day, until I can long it once we hit the bottom. If there is another pullback, possible dip zone ($91.25-$93.50).

Day’s Volume: 123,341,410

Average 10 Day Volume: 139.66M

Day’s range: $89.62-$93.42

Closing Price: $91.16

Short Interest: 0.46%

Analyst PT: High PT: $200, Low PT: $97, Average PT: $137.91

Catalysts:

- AMD Chair and CEO Dr. Lisa Su to Keynote at COMPUTEX 2022. 5/20/22. View press release here.

- Statement of changes in beneficial ownership of securities. 5/19/22 View press release here.

- AMD Robotics Starter Kit Kick-Starts the Intelligent Factory of the Future. 5/17/22. View press release here.

- AMD and Qualcomm Collaborate to Optimize FastConnect Connectivity Solutions for AMD Ryzen Processors. 5/17/22. View press release here.

- AMD Enables 4G/5G Radio Access Network Solutions to Support Meta Connectivity Evenstar Program. 5/11/22. View press release here.

- AMD Announces Three New Radeon RX 6000 Series Graphics Cards and First Games Adding Support for AMD FidelityFX Super Resolution 2.0. 5/10/22. View press release here.

- New AMD Ryzen 5000 C-Series Processors Bring Leadership Performance and All-Day Battery Life to Chrome OS. 5/5/22. View press release here.

- AMD Reports First Quarter 2022 Financial Results. 5/3/22. View press release here.

AMD fell below my dip zone ($91.25-$93.50) to a low of day (LOD) $89.62, but was able to reclaim my dip zone at $91.25 (✓) moving up +$1.93 (+2.13%) to $93.18. This was also a result of SPY reversing back up. I’ve mentioned I’ll be swinging this over and over, taking it day by day, until I can long it once we hit the bottom. If there is another pullback, possible dip zone ($90.25-$91.50).

SIGA

SIGA hit premarket highs at $17.50, pulling back -40.69%. If there is another pullback, watch for a possible dip zone to be at $11.06-$11.38. SSR was triggered and will be on 5/24/22. Watch for $13 levels to be reclaimed, consolidation, then $14 levels to be reclaimed, and then $15-$17. Watch for the move to occur one leg at a time.

Day’s Volume: 26,130,117

Average 10 Day Volume: 20.22M

Day’s range: $8.47-$10.48

Closing Price: $9.15

Short Interest: 3.16%

Catalysts:

- SIGA Receives Approval from the FDA for Intravenous (IV) Formulation of TPOXX® (tecovirimat). 5/19/22. View press release here.

- New Contract Awarded by U.S. Department of Defense for the Procurement of up to Approximately $7.5 Million of Oral TPOXX®. 5/12/22. View press release here.

- SIGA Reports Financial Results for Three Months Ended March 31, 2022. 5/5/22. View press release here.

- SIGA Declares Special Dividend of $0.45 Per Share. 5/5/22. View press release here.

SIGA broke well below my dip zone ($11.06-$11.38) and faded to a low of day (LOD) $8.47, closing at $9.15. It will need to reclaim $10.25 levels for a bullish move back up. We are sitting at the dip zone ($8.85-$9.05). SSR is on 5/25/22.

Others to Watch/Trending

- SBFM

- OCGN

- GFAI

- IMMX

- SKYH

- IDRA

- USWS

- DIDI

- CBIO

- XELA

- AEMD

- MNKD

- SOPA

- SNMP

- HLVX

- PTGX

- NILE

- TSLA

Oil/Gas Stocks to Watch for a Reversal

If trading oil, make sure you’re monitoring crude oil prices. Load up on red days. If you chase the day it runs, be careful as they’re more volatile. Be careful swinging anything that’s been trading under $1 for greater than 30 days due to delisting/delinquency requirements or reverse splits; I’d keep them as day trades if uncertain.

- INDO – 9.11% SI

- HUSA – 6.32% SI

- ENSV – 3.43% SI

- CEI – 9.59% SI

- USWS – 11.58% SI

- MXC – 4.74% SI

- MARPS – 3.20% SI

- IMPP – unknown SI

Earnings

5/25/22

- DKS

- EXPR

- NVDA

- SNOW

- DXC

- ENS

5/26/22

- BABA

- M

- JACK

- COST

- ULTA

- DELL

5/27/22

- BIG

- CGC

- SAFM

- HIBB

- VIOT

- PDD

Many have asked how to support me directly, you can open up a Webull Account with my referral link that’s on the sidebar & homepage or you can donate to my blog below via PayPal. Every bit helps to keep my blogging dream alive. I truly appreciate you taking the time to read.

-Cheers

Disclaimer : This should not be considered investment advice, and should not be used to make investment decisions. Do not buy or sell any stock without conducting your own due diligence. Information on eyelovegains.com is opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts and data provided here are not meant for investment purposes and only serve as examples. We are not liable for any losses you may endure from the buying and selling of stocks or securities within your accounts.